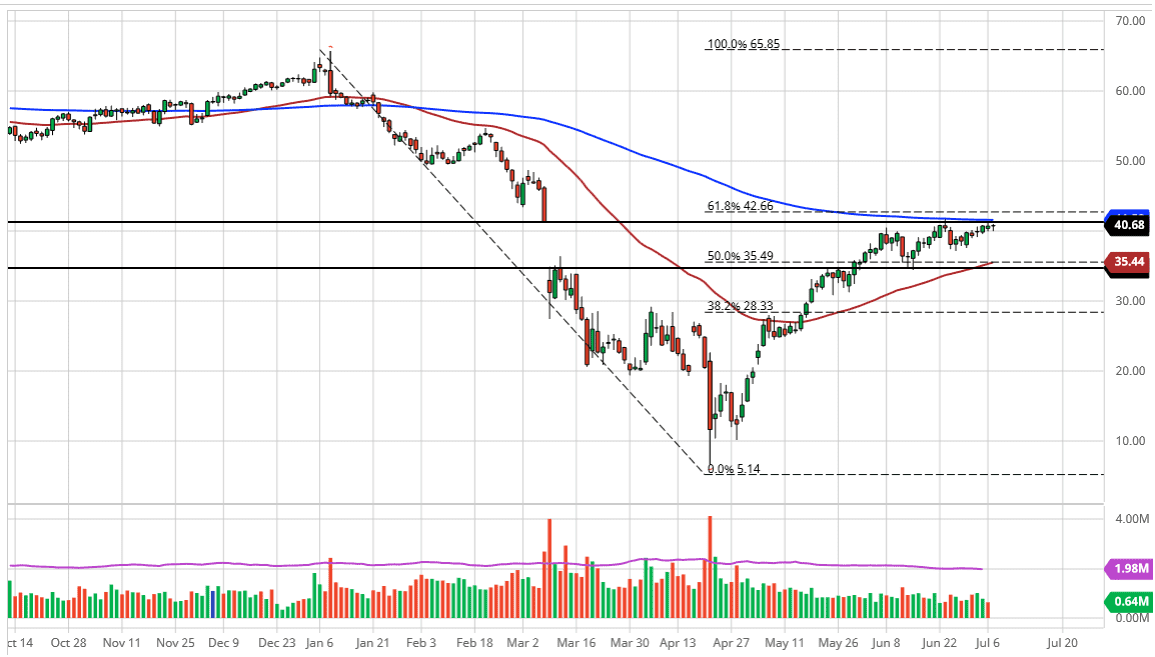

The West Texas Intermediate Crude Oil market has rallied a bit again during the trading session on Wednesday as we continue to see a lot of resistance just above. Eventually, it will try to break above this area, but do not be surprised at all to see some type of pullback. That pullback should end up being an opportunity to pick up oil “on the cheap” because there are plenty of other grades of oil that need to catch up to fill the gap as this market has. The most obvious one is the Brent market, which is a major benchmark. It has not filled the gap and has not reached the 200 day EMA. Ultimately, I do think it is only a matter of time before we do it over there as well. If that happens, then it is likely that we will see this market break above this resistance barrier.

In the meantime, I fully anticipate that we will get a short-term pullback to give us an opportunity to take advantage of lower pricing, with the 50 day EMA underneath offering significant support. The crude oil inventory numbers out of the United States added 5.7 million barrels, much worse than the expected withdrawal of 3.7 million barrels. This continues to keep crude oil markets somewhat muted, and as a result, I would not be surprised at all to see this market try to reach towards the $38 level. Underneath there, the 50 day EMA should offer a bit of a floor, and at this point, it looks like we are essentially stuck between the 50 day EMA and the 200 day EMA, and when that happens it is likely that we would see a lot of choppy behavior as is the norm in financial markets. Both short and longer-term traders are arguing over the position. Beyond that, crude oil is paying attention to the US dollar, and OPEC production cuts and whether or not countries are sticking to those production cuts, which so far, they are. However, there is not much in the way of demand as per historic numbers, so I think we still have quite a bit of “push-pull” in the markets out there and therefore range-bound trading makes quite a bit of sense in general. We just have to find the range that we are going to work with.