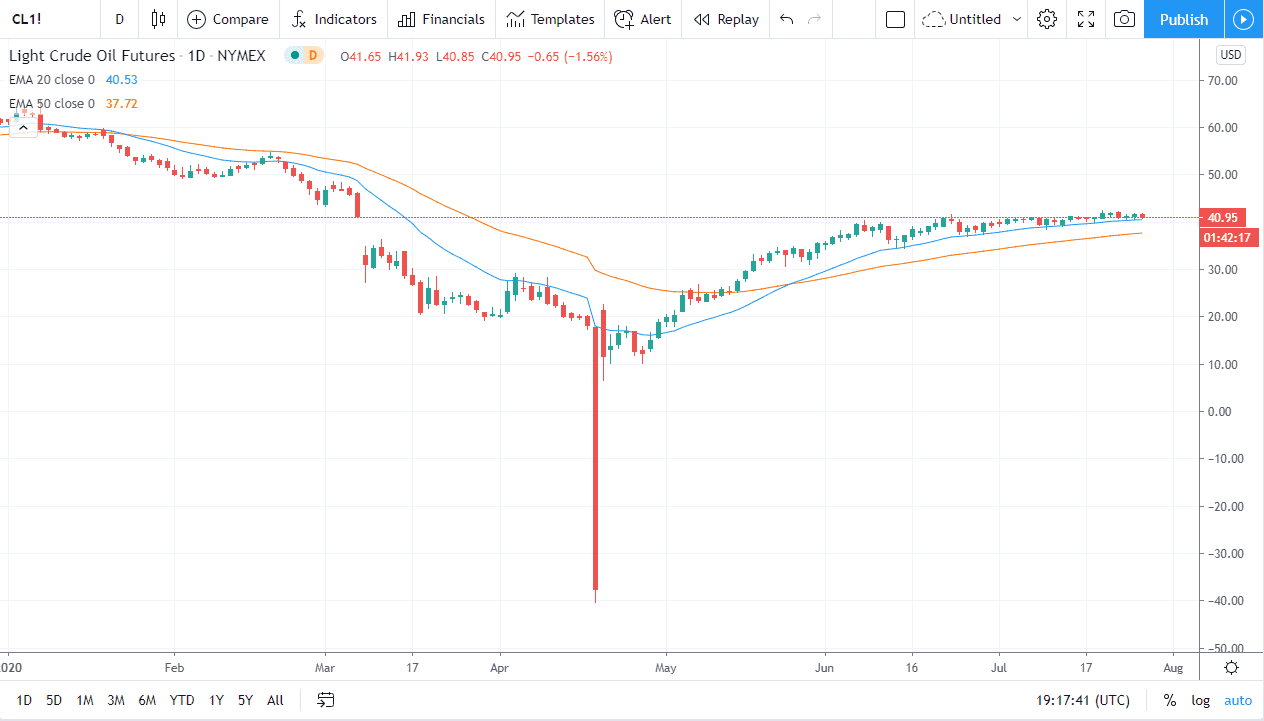

The West Texas Intermediate Crude Oil market dropped a bit during the trading session on Tuesday, as the $41 level has offered a bit of resistance, and the 20 day EMA underneath continues to offer support. At this point in time, the market looks like it is ready to continue to go higher, but we need some type of catalyst. Currently, the biggest catalyst would be the falling US dollar, which in and of itself can be rather helpful when it comes to commodities. Having said that, it is probably not enough for a bigger move to the upside.

One of the biggest hurdles for higher pricing is going to be the fact that the demand for crude oil has fallen quite a bit as the global economy continues to slip. All things being equal, this is going to continue to cause major problems and continues to keep a bit of a weight around the neck of the market. Having said that, the US dollar looks like it is ready to fall apart, and therefore I think that might be the catalyst, but there is also hope out there that perhaps the global economies will strengthen a bit.

On the other hand, there is now the concern of the US/China trade war getting even worse. It is an election year, and that play as well to the electorate, being tough on China. Furthermore, it is all but assured that this will continue to go further, thereby causing issues for demand. On the negative sign also is the fact that air travel has collapsed, which drives down demand for crude oil as well.

At the end of the day, it only matters what price does. It looks as if we are ready to go higher, but I think it will take some type of catalyst or “thing” to happen. We need some type of impulsive candlestick to the upside to show that it is time to start buying again. On the other hand, if we get an impulsive candlestick to the downside, we may see this market drop a bit, perhaps down to $35. Maybe even $30 could be possible, but that obviously would take some type of extreme negativity. The fact that the market has been so resilient tells me that we are more than likely going to go higher before we go lower, with an eye on the $49 handle.