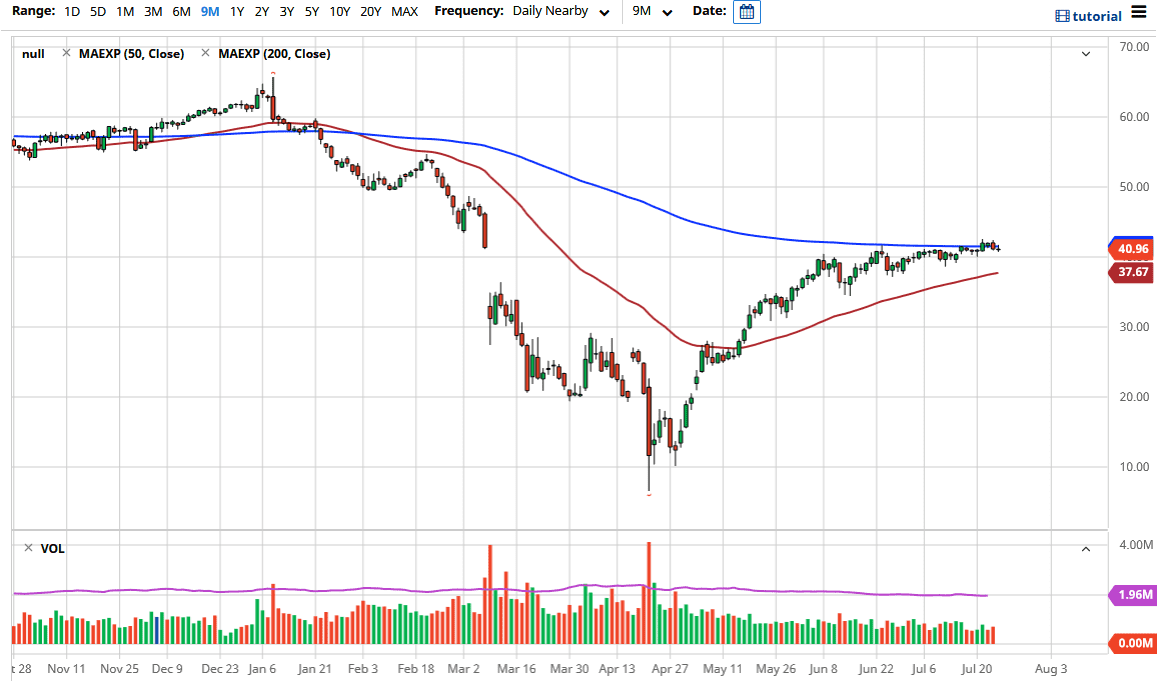

The West Texas Intermediate Crude Oil market has initially tried to rally during the day but fell a bit during the trading session on Friday, as the market seems to have a little bit of a magnet attached to the $41 level. The 200 day EMA above should continue to offer resistance, and therefore I think we could see a little bit of a short-term pullback. However, the key phrase there is “short term.” After all, there are a lot of different forces being played out in the crude oil markets right now, so it makes sense that we chop more than anything else.

OPEC has been very stringent with its quotas when it comes to production cuts, and unlike many of the other times in the past, it was relatively well followed. This brings down supply but at the same time, we have to worry about demand coming out of the United States. This has now been exacerbated by the fact that the United States and China are heating up the Cold War again, and that could cause serious demand issues also. With that being the case, crude oil has quite a bit of bearish pressure on top of it. However, you can also make an argument that the US dollar falling helps the idea of crude oil going higher, so with just those issues alone, you can see why the market simply has not found itself bullish enough or bearish enough to make a significant move over the last couple of months.

That being said, markets do not sit still forever, so it is only a matter of time before we get a break higher or lower. If we can get a significant daily close above the 200 day EMA, some type of impulsive green candlestick, then I think this market goes looking towards the $49 level. To the downside, if we break down below the 50 day EMA, the market is likely to go looking towards the $32 level. As long as we are between the 200 day EMA and the 50 day EMA, I think we just have range-bound trading and therefore if you are a short-term scalper, this is going to be a great market to employ your trading systems. This is one of those scenarios that once the market makes up its mind, it will be obvious as to where we go next.