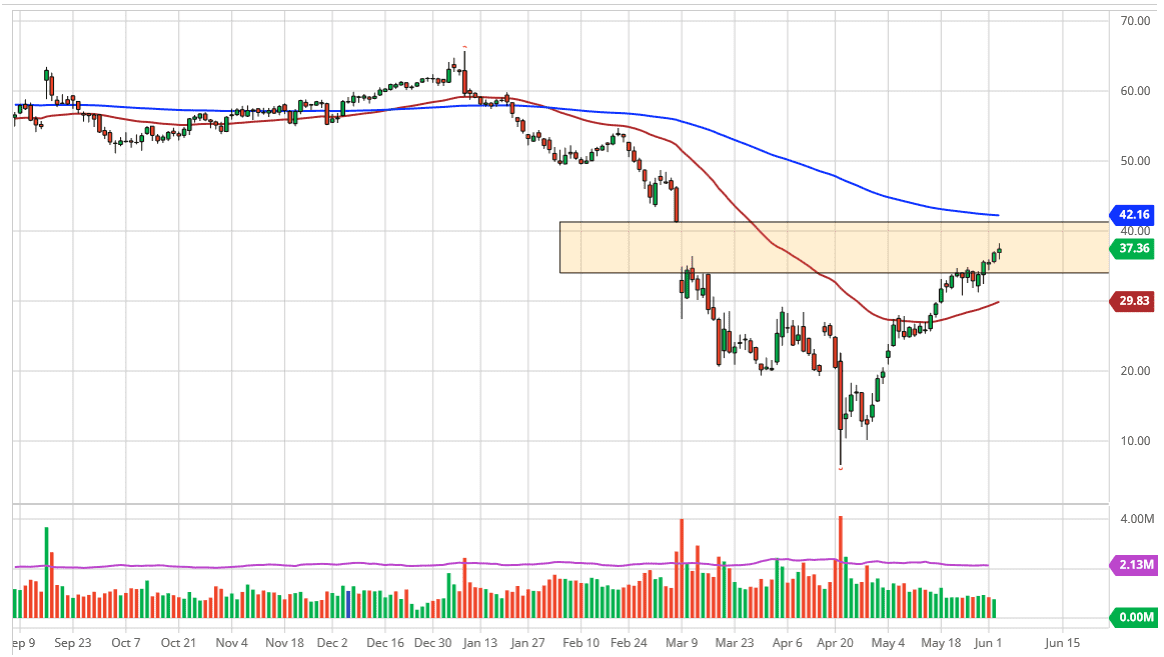

The West Texas Intermediate Crude Oil market has gone back and forth during the trading session on Wednesday, as we await some type of decision by OPEC as to whether or not the production cuts get extended. There have been multiple news headlines going back and forth during the day, and it suggests that perhaps OPEC may or may not follow through. Obviously, this is a huge effect on supply and demand, which by extension will have a huge effect on price. I think the next couple of days could be rather dramatic and volatile, but at the end of the day, we have a technical signal to fill the gap above.

I cannot give you any fundamental reason other than some type of massive production cut that crude oil should continue to go higher, but ultimately it looks as if the market needs to fill this gap above, which is quite common. The $41 level above is the top of the gap, and therefore the top of the range. I believe that the 200 day EMA in that area also provides quite a bit of resistance so I think that crude oil is going to go looking for that level, only to turn around and pullback. In fact, I think the market is a short-term buying opportunity, only to turn around and start selling again.

To the downside, the market breaking down below the $30 level would of course in this market much lower, but we are $6.59 above that level at the close, so it is difficult to imagine that happens anytime soon. I believe that it is much easier to simply buy this market and hang on until we get to the top of the range, filling the gap, and then breaking down. Longer-term, this is still a negative market, and even though we have formed a shooting star, which of course is a negative technical sign, but I think there is plenty of buyers underneath near the $35 level. If we break the top of the shooting star, that should bring in even more buyers, continuing the cycle of the “melt up” in this market. Having said all of that, if we do somehow break above the 200 day EMA it is likely that the market then goes looking towards the $47 level, although I do not think there is a huge likelihood of that without some type of massive production cut.