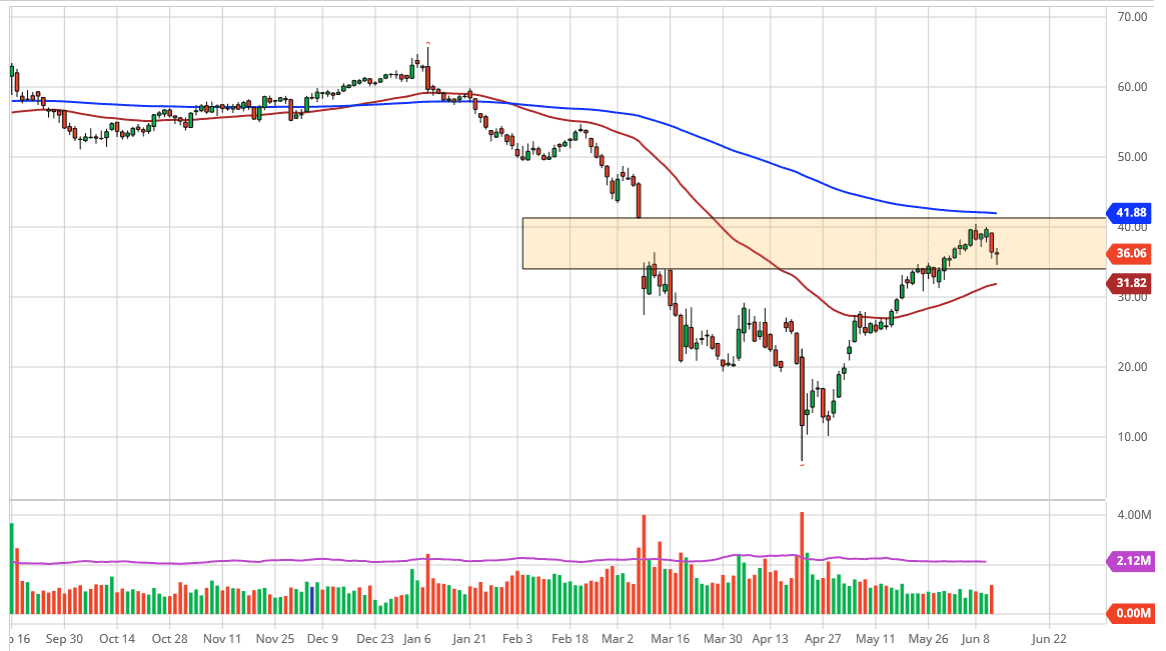

The West Texas Intermediate Crude Oil market has broken down a bit during the trading session on Friday, reaching down towards the $35 level. This is an area that attracts a lot of attention because it was previous resistant and now is a large, round, psychologically significant figure. By bouncing this way, we have ended up forming a bit of a hammer, and that suggests that we are ready to continue going higher. After all, we have yet to find the top of the gap, so I think we probably still need to make an attempt to get to the $41 level.

The 50 day EMA is sitting just below the $32 level, which is right in the middle of the consolidation area previously, so there should be a lot of order flow there as well. Ultimately, I think that buyers will continue to take advantage of value, at least until we get that gap filled. Because of this, I think that we have another shot higher, especially as we have seen quite a bit of turnaround in risk appetite during the day. Although it must be said that we could hang on to some of it. With that in mind, I believe that the market has stabilized quite nicely, so it is a good sign that we could get another leg higher. After all, traders are starting to price in the idea of the Federal Reserve liquefying everything, and therefore bring money into risk appetite assets. The stock market, commodities, is all the same as the US dollar floods the system.

On the downside, if the market breaks down below the 50 day EMA, it is likely that the $30 level gets tested. The $41 level above is significant resistance, which sits just below the 200 day EMA as well, so there are plenty of reasons to suspect that it will be difficult to break above there.

Ultimately, if we were to break above there that would be an extraordinarily bullish sign but right now filling the gap is probably going to be the default story, at least until we get some type of massive selloff. The crude oil market has been extraordinarily resilient, regardless of how many negative headwinds there are out there. With that, I suspect that short-term buyers are going to come in and try to pick up on this hammer.