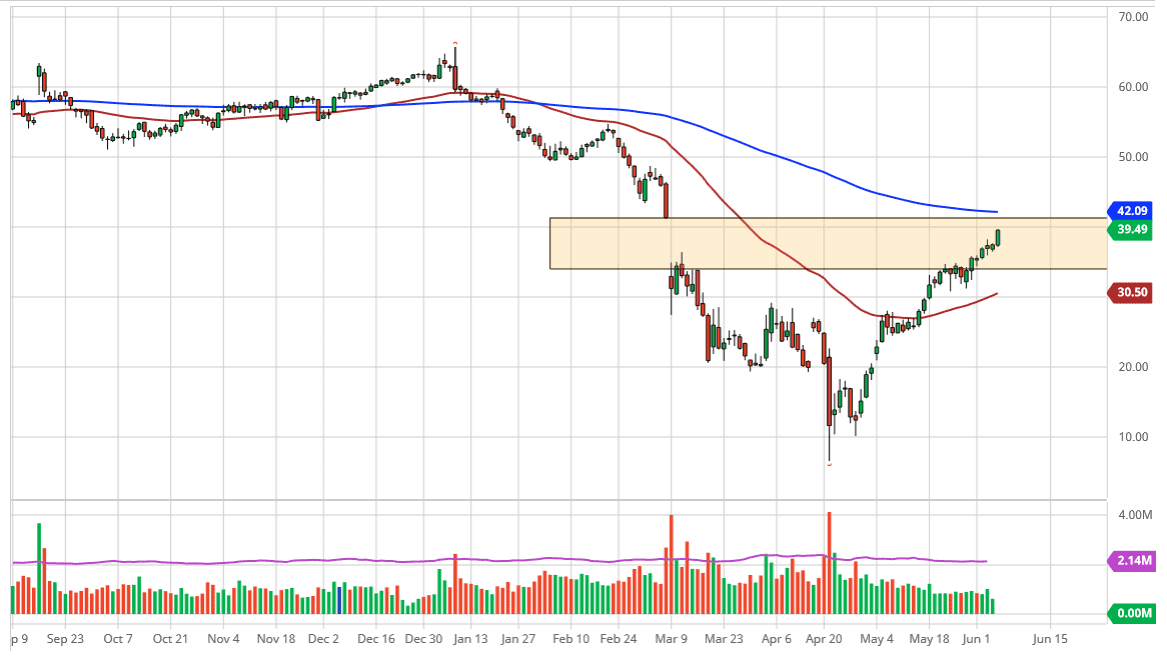

The West Texas Intermediate Crude Oil market rallied significantly during the trading session on Friday again as the job numbers came out stronger than anticipated. This is a sign that perhaps the market is going to try to continue to go higher, reaching towards the top of the overall gap that we are in. The $41 level would be the short-term target, as not only is it at the top of the gap, it is also where the 200 day EMA is currently sitting.

The candlestick closing towards the top of the range of the day does in fact suggest that the market is going to go higher. The market closing as high as it did suggest that there are plenty of buyers out there ready to pounce upon this market going forward. Overall, it is not until the market breaks above the 200 day EMA that I would be convinced that we can go much further. That being said, this is a technical move that people would expect, as gaps do get filled over time. Beyond that, with the job numbers showing the strength that it did during the day, it brings the idea of demand picking up. After all, if there are more people out there working, the idea is that there will be more demand for crude oil and gasoline, etc.

To the downside, the $35 level would be an area that traders will be looking towards, if we do of course break down significantly from here. As even if we break below the $35 level it is likely that the market will then move towards the 50 day EMA.

The crude oil market is getting a bit of a boost from OPEC suggesting that there are going to be more cuts, and that means that there is going to be a dip in supply. Having said that, the market is very confused right now, because we are in a massive argument between supply and demand. This is quite usual, however, we have a lot of extra negative factors going on at the same time as well.

With that, I think the one thing you can count on is a lot of volatility, and if we can get some type of clarity, then we could get a bigger move. I think we are trying to carve out a larger range at the moment, so therefore we have to define the boundaries. Which is essentially what driving the market right now.