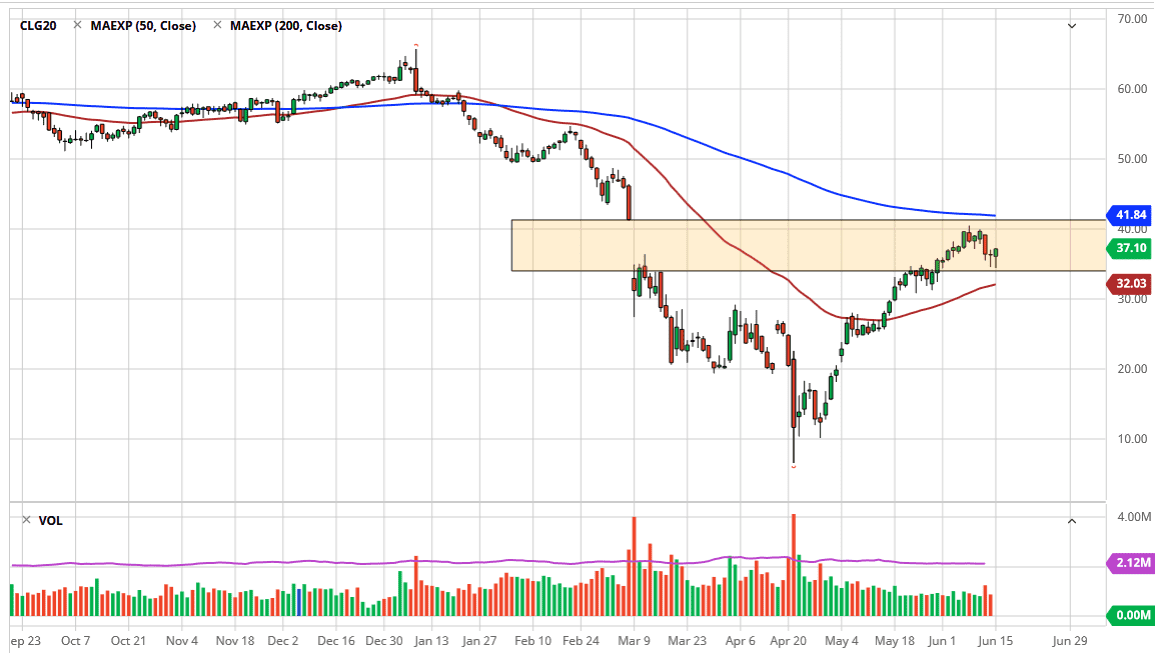

The West Texas Intermediate Crude Oil market continues to find buyers on dips, with the $35 level offering a significant amount of support. Ultimately, I think that the market will continue to grind higher in order to build the range that the market desperately needs. The gap above at the $41 level has not quite been filled, so I do think that we need to get there in order to do the technical move that most people were paying attention to.

I do not think there is necessarily a strong amount of demand out there, but the reality is that the market likes to fill these gaps, so therefore I think that a lot of traders will push that envelope. I do not necessarily think that we break above there, but if we did do that then it would obviously be an extraordinarily strong sign and send this market way to the upside.

A pullback from here could send the market down to the $35 level again, and then eventually the 50 day EMA. If the market breaks down below there, then we will go looking towards the $30 level. The $30 level would be a large, round, psychologically significant figure that will attract a lot of attention, but I do think that there would be buyers in that general vicinity and that would push the market to the upside as it was with previous resistance, and market memory comes into play.

I think it is highly likely that we could see the market try to form some type of range between $30 and $40 before it is all done said. Expect plenty of volatility, because that is basically what we have seen in every other market. On the downside, if we break down below there then it is likely that we could go to the $20 level, and that is an area that is massive support. With this, I think that we will more than likely find buyers on dips going forward, but I do not necessarily think that we are going to break out massively to the upside, at least not unless we get some type of massive recovery in the global economy, something that seems very unlikely to happen as we are worried about reinfection. Because of this, and the fact that we have far too much in the way of supply, I just do not see how the market will rocket straight up in the air.