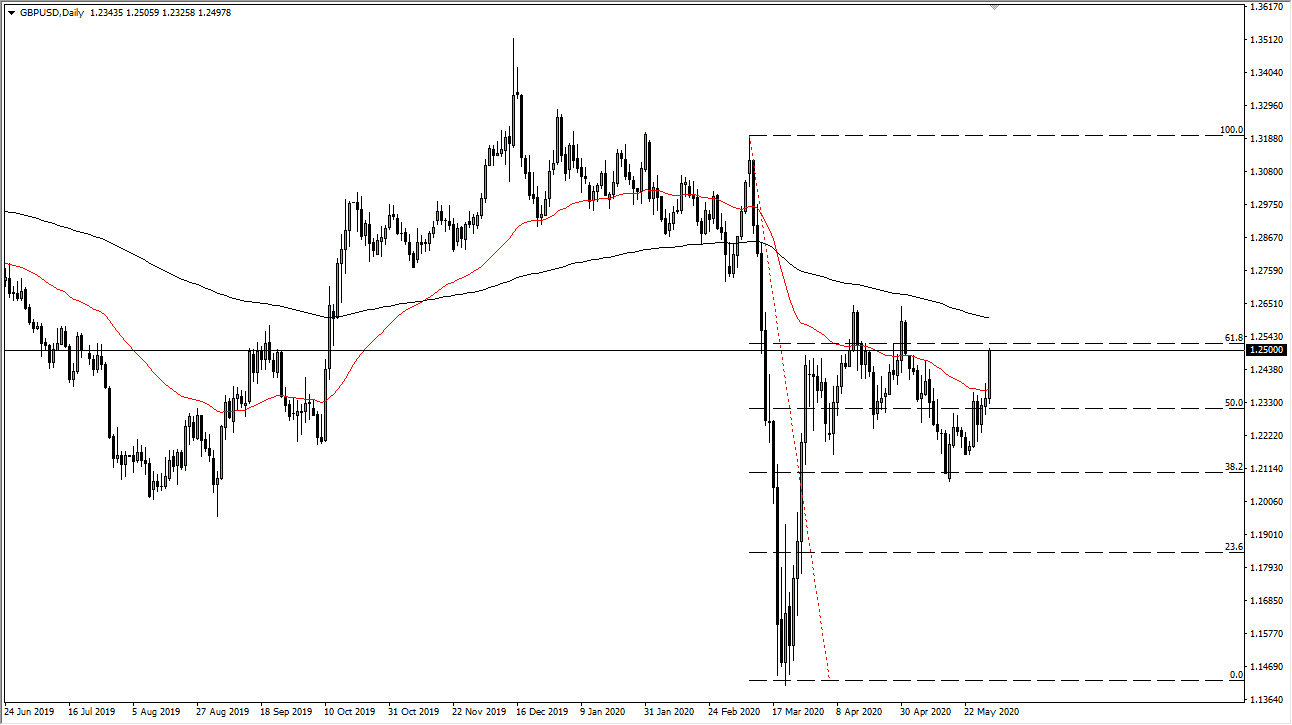

The British pound exploded to the upside, reaching towards 1.25 handle above, and as a result it is likely that we are going to see a little bit of a pushback due to the fact that it is a large, round, psychologically significant figure. Furthermore, the market is racing towards the 200 day EMA, which of course is an area that people play as support and resistance quite a bit. Beyond that, the 61.8% Fibonacci retracement level sits just above, and therefore I think that we will probably see selling.

To the downside, the red 50 day EMA could offer support, and I am the first person to admit that the bullish candlestick for the session on Monday is quite impressive, but I think it is also overdone. You can see clearly that the next 100 pips above have been resistive more than once, so therefore I think we probably get a bit of a push lower. As you can see by this chart, the currency markets are all over the place and have no idea what to do with themselves.

In a sense, it does make sense that the British pound will go higher against the US dollar due to the fact that the Federal Reserve cannot stop printing, but at the same time it does not make any sense that the British pound is one of the main beneficiaries, as the Bank of England is still very likely to go negative with interest rates. Yes, the United Kingdom is starting to open up its economy, but at the end of the day there has been an enormous economic damage done to the United Kingdom, and of course they still have to get through the Brexit situation which is only getting worse as far as a negotiating situation is concerned.

I believe at this point we are at the very least going to see a bit of a pullback, but right now it is difficult it is obvious that traders are simply going straight up in the air. The question is how long can they continue to do so? I would be on the sidelines when it comes to the British pound, and of course the Australian dollar which looks remarkably similar. Do I expect a pullback? Of course, I do, but I think we probably still have some “blow off potential” ahead of us at this point in time.