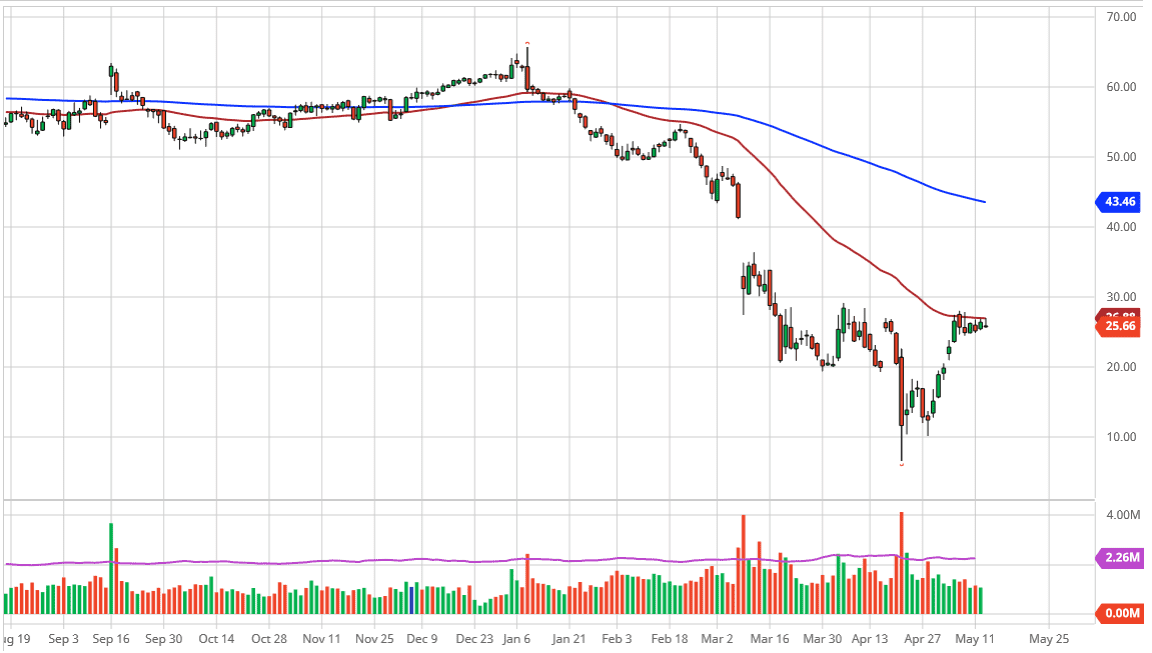

The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Wednesday, but as you can see the market has failed again at the 50 day EMA. What is even more impressive is that the market got a very bullish inventory figure but could not keep the short-term gains that occurred. At this point, I believe that if the WTI Crude Oil market breaks down below the $25 level, it will more than likely open up a move down to the $20.00 level given enough time. Ultimately, this is a market that has a multitude of issues to deal with, not the least of which will be the lack of demand. Quite frankly, if the entire world is locked down, there cannot be much in the way of demand.

Furthermore, even when we do open up the world’s economy, it appears that it is going to be increasingly slow down, and therefore it is hard to imagine a scenario where demand will be as strong as it once was. At this point in time, it looks as if the 50 day EMA is a decent proxy for resistance, but ultimately the $30 level is even more resistive, so it is not until we break above there that I would consider that this market is going to be running higher. At that point, we could go looking to fill the gap at the $42 level, but it seems very unlikely to happen at this point.

To the downside, the $20 being broken would clearly open up the floodgates to much lower pricing. At that point in time, the market could very well go down to the $17.50 level, possibly even the $15 level after that. A move to the $20 level is probably the most likely of outcomes, especially as there is far too much in the way of crude oil, despite the fact that several Middle Eastern countries have cut back significant amount of production. With that in mind, market participants continue to sell short-term rallies and I do believe that will probably be the best way going forward. Ultimately, this is a market that I think will continue to be extraordinarily volatile, but clearly the downside is easier route for most traders. What I do find interesting is that the 200 day EMA is starting to come towards the top of the gap, so that is something to keep an eye on as well.