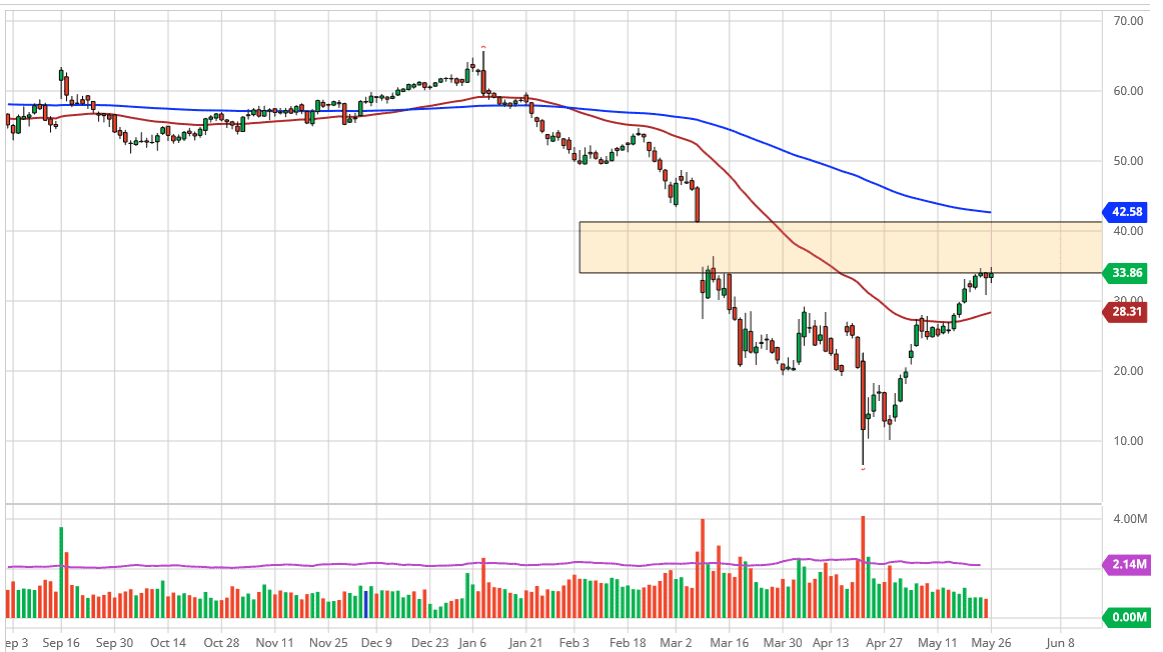

The West Texas Intermediate Crude Oil market continues to see a lot of resistance near the $34 level as it is the beginning of the gap higher. The gap extends all the way to the $41 level so now it comes down to whether or not we can break higher and continue to go towards that level. Ultimately, this is a market that is going to pay attention to a lot of foam well, which seems to be the main driver.

If the market breaks above the $35 level, then I think that it is only a matter of time before we fill that gap, and therefore it is likely that the momentum will take over again. While there seems to be plenty of reasons to think that perhaps the oil market is overdone, the reality is that momentum is starting to take over everything, if that happens, then the filling of the gap makes quite a bit of sense as it is a technical trade that a lot of people like to deal with.

On the other hand, if we break down below the hammer from the Monday session, and perhaps even the $30 level, then it is likely to see more of a breakdown. The crude oil market wells oversold, and now it is starting to get into a potential overbought situation. After all, while we have seen a lot of production cuts, the reality is that we are starting to get close to running out of storage again. A lot of this has been based upon the idea of China getting back to work, but we are starting to learn that a lot of Asian buying is simply put into storage. In other words, it becomes even more overdone if we are not careful.

A move to the $41 could send this market to the top of the gap and also to the 200 day EMA which is right at the same place. In other words, if we do fill the gap, I figure that is about as good as this gets, which is quite common for a gap that is getting filled. At this point, I think it is all about technical trading more than anything else, nothing to do with fundamentals as nobody really knows what is going to happen as far as demand is concerned going forward, but the one thing that you can probably count on is the fact that it will not be as strong as it was six months ago.