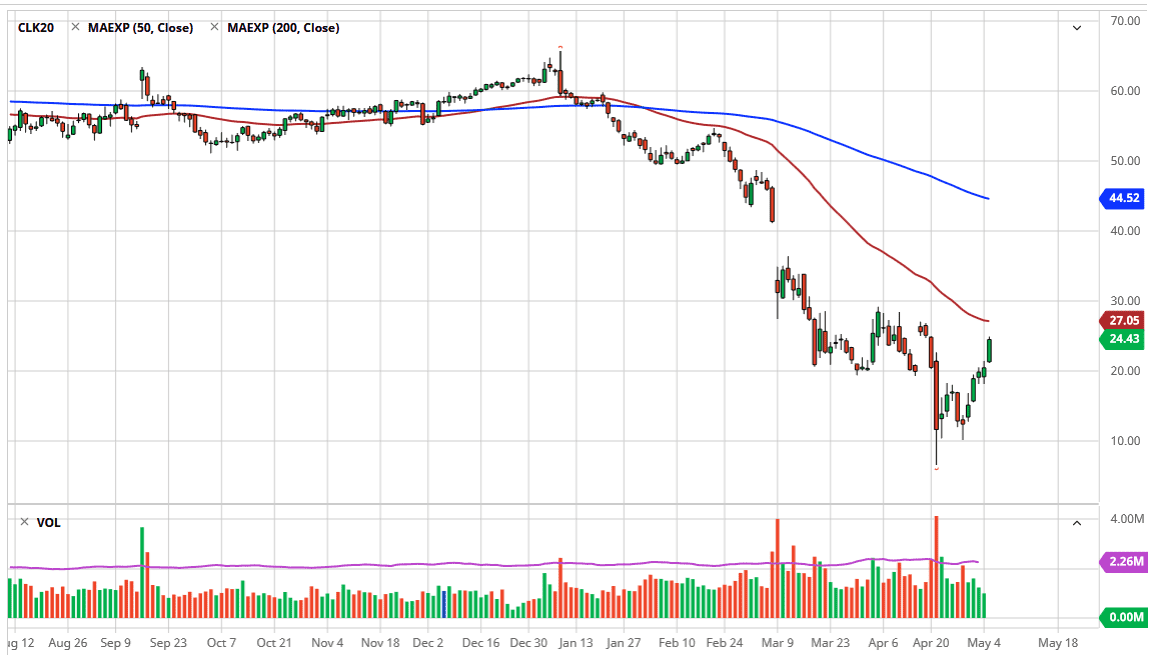

The West Texas Intermediate Crude Oil market has rallied yet again during the day on Tuesday but looks like it is heading towards a resistance barrier that should be paid quite a bit of attention to. The 50 day EMA above at the $27 level should offer a significant amount of resistance, so I think at that point anybody who has already bought this commodity should be thinking about getting out. Ultimately, this is a market that has rallied quite significantly over the last several sessions but had been oversold.

The market has a lot of noise in this general vicinity, so I think it is easier to simply wait for signs of exhaustion that we can start selling. I would be stunned if we broke above the $30 level, and at that point I would have to assume that we are going to go ahead and fill the gap. I think it is far too bullish to think that is going to happen in the short term, and therefore I do think it is only a matter of time before oil rolls over. That being said, I am not willing to put that short position on until I get some type of exhaustive daily candlestick. At this point, the 50 day EMA comes into play rather quickly, so I think we only have another day or two of bullish pressure before the sellers will come in and try to squash this rally.

Part of the rally has been predicated upon US companies cutting back on production, but we have nothing in the way of demand either so although perhaps price needed to be a bit higher, there is only so far it can go before we find it to be far too extended. I think at this point we are getting relatively close to that environment, as the rally has been so brutal. Whether or not we go back to negative prices as the contract is would be a completely different question, but I do think it is only a matter of time before we go lower and get a couple of brutal negative days. Because of this, I am overly cautious at this point and am simply going to have to wait and be very patient as there should be a nice selling set up as the fundamentals do not justify oil rally in the way it has.