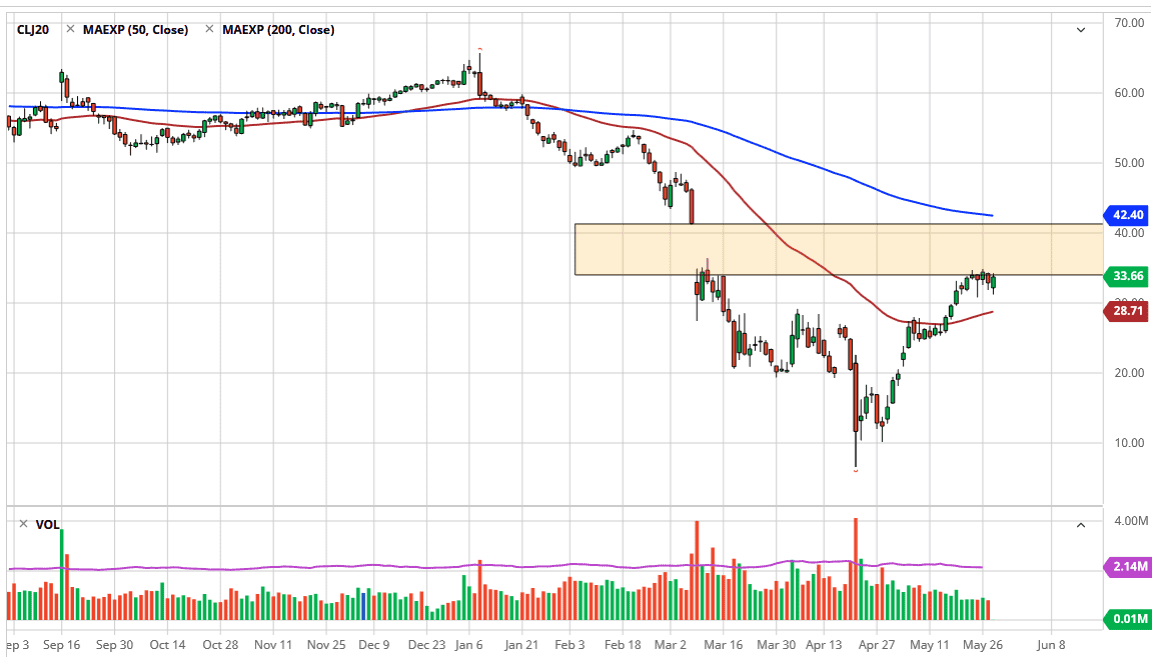

The West Texas Intermediate Crude Oil market has initially fallen during the trading session, as there was a lot of concern when it comes to the oversupply and the surprise build with inventory figures. In all of that being said it looks as if the market is turning around and trying to fill that technical gap above as markets quite often do. With that in mind I believe that we will continue to see buyers on dips, perhaps with an eye towards the $41 level. This does not mean that we get there overnight, that I think it is likely that there is at least going to be an attempt to make this happen.

I think it is fair to say that markets have become completely disconnected from the economy, and oil markets will be different because of this expect to see more bullish pressure, at least in the short term as traders begin to price in the idea of economies opening up. However, I would be stunned to see this market break above the $41 level because eventually reality comes back into play. There is not going to be enough demand to continue the upward pressure for the long term, as eventually start to focus on the fact that there has been an ominous amount of damage done to the global economy, which I would point out was already slowing down before the pandemic it. Because of this I cannot in good conscience think that buying oil would be anything more than a short-term trade. I do think that happening traders know that gaps do tend to get filled. Beyond that, there have been oil rigs shut down and that of course helps the situation as well. It is not enough to get rid of the excess, but it at least health. Ultimately, I think that this is a market that continues to see a lot of volatility and is support underneath at the $30 level. I think we essentially go back and forth until we get some type of catalyst to go higher. However, if we were to break down below the 50 day EMA I would have to reassess everything, as this is a market that seems hell-bent on destroying as many accounts as possible. Remember, oil is not actually a retail xv retail traders.