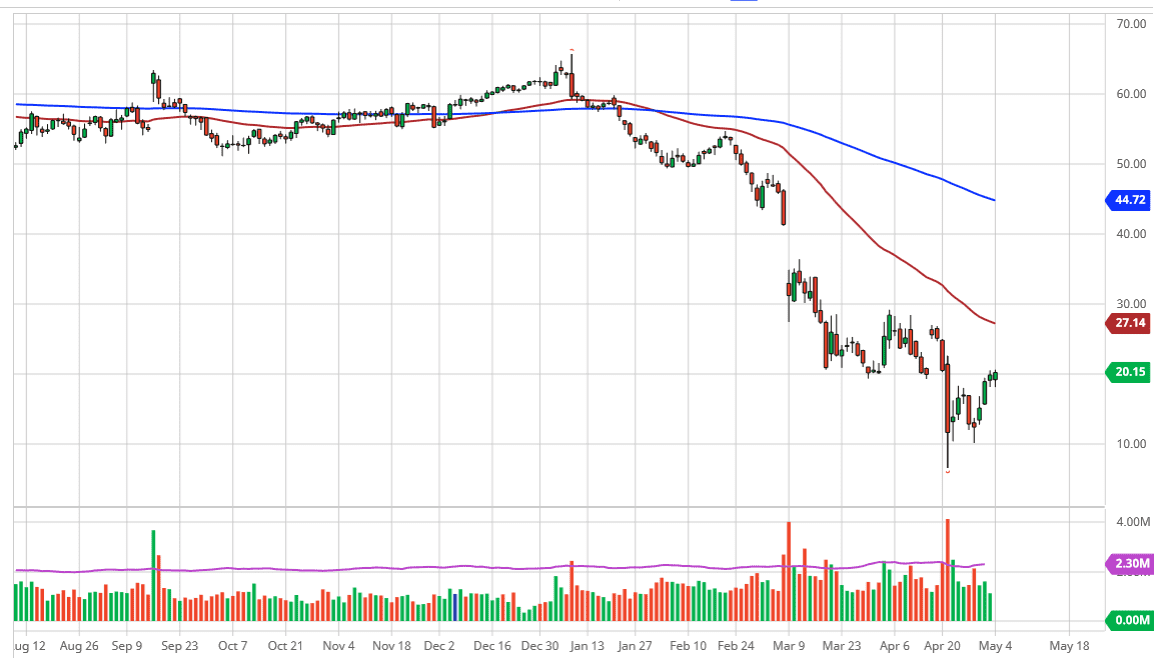

The West Texas Intermediate Crude Oil market initially pulled back during the trading session on Monday to kick off the week but found support at the same place it had on Friday. By doing so, it managed to challenge the $20 level, an area that of course attracts a lot of attention due to the fact that it is a large, round, psychologically significant figure. Furthermore, this is an area that had previously been support, so it makes quite a bit of sense that the market would show resistance in this vicinity.

When you look at this chart, you can see that there is a lot of previous trading extending all the way to at least the $27.50 level, and now we see the 50 day EMA dropping below that level to show signs of weakness. Ultimately, the market will eventually see plenty of exhaustion in that region, assuming that we even get to that point. The crude oil market still has to worry about the possibility of lack of demand continuing for much longer than anticipated, and quite frankly that is the most likely scenario. With this being the case, it is only a matter of time before we see the exhaustive move that we could start shorting.

If we were to break down below the lows on both Monday and Friday, then the market will break down as well, because that would break down 48 hours’ worth of support. By breaking down through that level, the market would show a significant amount of negativity that will push this market towards the $10 level. At this point, the market will test major support, and I do not know that we break through the $10 level right away. In fact, we cannot necessarily guarantee that prices will go negative again this contract, but it certainly is a possibility as we still have to worry about storage. With that being said, the one thing I do not want to do is buy the oil market, because there are far too many issues out there for crude oil to simply take off to the upside. With that in mind, I am waiting for an exhaustive candle to start selling, and then as the market breaks down, I am more than willing to add to their position and become much more aggressive as we see a continuation of the longer term downtrend.