South Africa is in discussions to lower its Covid-19 pandemic alert level to three by the end of May, according to its risk-adjusted reopening of the economy. While the nationwide lockdown curbed the spread of the virus and allowed its healthcare system to prepare for the potential of more cases, especially of another infection wave occurs, the costs to the economy are massive. The government implemented an R500 billion stimulus, but lobby group Business for South Africa warned of a GDP contraction exceeding 16% in 2020 and four million job losses unless rules are relaxed quicker. Despite tremendous challenges, the South African Rand maintained its resilience to weaken more excessively, granting the USD/ZAR a distinct bearish driver below its short-term resistance zone.

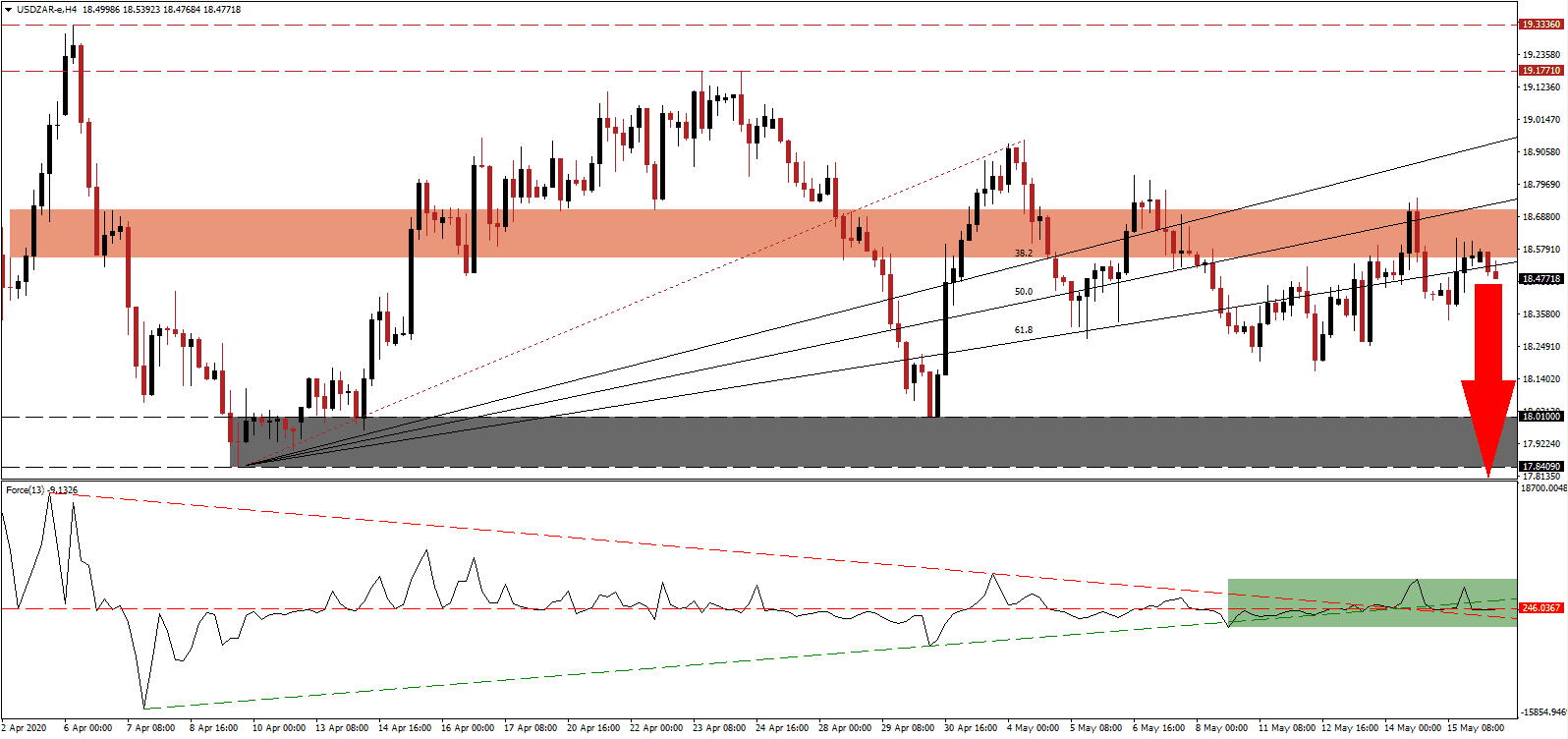

The Force Index, a next-generation technical indicator, formed a series of lower highs and confirmed the rise in bearish momentum. It contracted below its ascending support level and is now positioned below its horizontal resistance level, as marked by the green rectangle. More downside is favored to push the Force Index below its descending resistance level, serving as a temporary support. Bears wait for a crossover below the 0 center-line in this technical indicator before resuming complete control of the USD/ZAR.

One of the most significant challenges facing the South African economy is high unemployment, which stood at 29% before the Covid-19 pandemic. The main opposition party in the government has warned that the lockdown needs to be lifted altogether to preserve lives and livelihood from all threats. More details on President Ramaphosa’s plan are scheduled for announcement on Wednesday. US concerns outweigh the challenges dominating South Africa, and the breakdown in the USD/ZAR below its ascending 61.8 Fibonacci Retracement Fan Support Level added to downside pressures. It joined bearish developments after price action moved below its short-term resistance zone located between 18.5467 and 18.7111, as marked by the red rectangle.

US Democrats narrowly passed a bill for an additional $3 trillion in economic assistance, favored to be blocked by Republicans in the Senate. The bill passed the House of Representatives with a vote of 208 against 199, 14 Democrats opposed the measure, and one New York Republican approved it. The US strategy to the virus followed the preferred approach of increasing debt and hoping it will have a positive economic impact without a clear plan forward. It intensifies long-term bearish pressures on the USD/ZAR, which is anticipated to descend into its revised support zone located between 17.8409 and 18.0100, as identified by the grey rectangle. A breakdown extension is likely to materialize.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 18.4500

Take Profit @ 17.8500

Stop Loss @ 18.6500

Downside Potential: 6,000 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 3.00

In case the Force Index accelerates above its ascending support level, the USD/ZAR may attempt a breakout. The upside potential is limited to its ascending 38.2 Fibonacci Retracement Fan Resistance Level. With an unsustainable debt load pressuring the US Dollar to the downside, aided by complacency over the requirement to introduce necessary economic reforms, any breakout attempt will offer Forex traders a second short-selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 18.7500

Take Profit @ 18.9500

Stop Loss @ 18.6500

Upside Potential: 2,000 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.00