South Africa's leadership has repeatedly communicated, to the businesses and consumers alike, that it took a risk-adjusted approach to reopen the economy gradually. The nationwide lockdown was successful in containing the infection rate of Covid-19, but the government has come under intense pressure to speed up the process. It remains unclear if the business community is ready to resume operations, as numerous companies had to shut down for deep cleaning and disinfections after employees tested positive. The South African Rand remains resilient, allowing the USD/ZAR to maintain its holding pattern inside of its short-term resistance zone. It is partially assisted by direr developments out of the US.

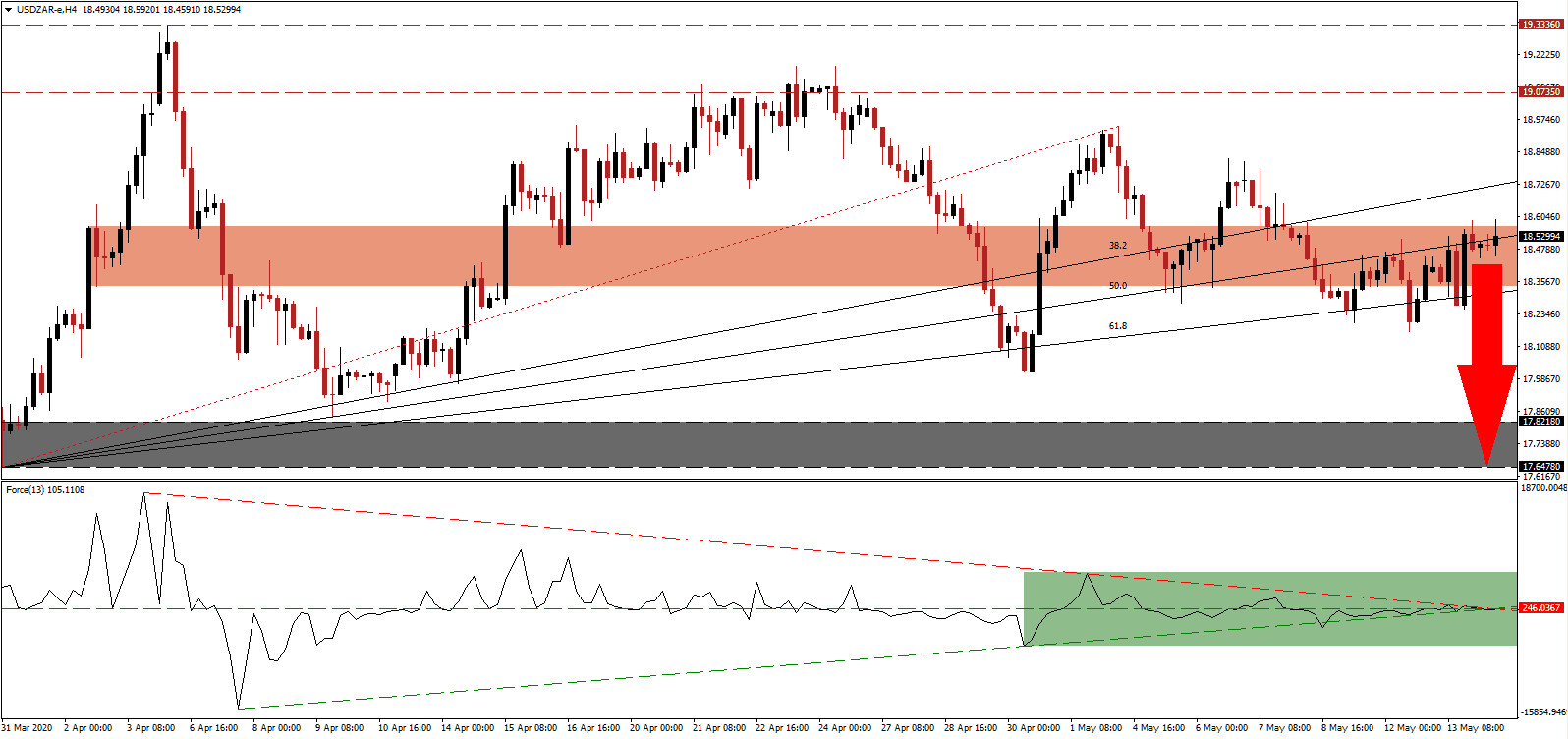

The Force Index, a next-generation technical indicator, is challenged with a role-reversal of the ascending support level and the descending resistance level. It emerges while both have crossed the horizontal resistance level, as marked by the green rectangle. Bullish momentum remains absent, suggesting breakdown pressures are on the rise. This technical indicator crossed above the 0 center-line with bears waiting for a reversal to regain full control of the USD/ZAR.

While criticism and pressure on the government are rising, the South African Chamber of Commerce and Industry does not believe the response to the Covid-19 pandemic was slow or insufficient, but rather the management of the R500 billion stimulus requires optimization. Volatility in this currency pair is anticipated to increase, with temporary breakouts in the USD/ZAR above the short-term resistance zone located between 18.3390 and 18.5678, as identified by the red rectangle, followed by swift reversals, leading to a breakdown extension in price action.

US President Trump has labeled warnings by Doctor Fauci, the Director of the National Institute of Allergy and Infectious Diseases since 1984, regarding a rushed reopening of the economy in the absence of treatment for the virus and a functioning TTI (test, trace, and isolate) infrastructure, as unacceptable. It confirms the divide between reality and the president’s desire to secure votes ahead of the November election. It positions the USD/ZAR for rejection by its ascending 50.0 Fibonacci Retracement Fan Resistance Level, sparking an accelerated correction into its support zone located between 17.6478 and 17.8218, as marked by the grey rectangle. More selling is likely, pending backed by the US considering more debt-funded assistance, deteriorating recovery potential for the economy.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 18.5000

Take Profit @ 17.6500

Stop Loss @ 18.7000

Downside Potential: 8,500 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 4.25

Should the Force Index accelerate to the upside and away from its ascending support level, the USD/ZAR may be pressured higher. While South Africa is faced with a multitude of challenges, the willingness to implement necessary reforms provides a bullish catalyst for the South African Rand. The US remains complacent and favors a debt-fueled short-term approach, adding to an unsustainable model. Forex traders are advised to take advantage of a breakout with new short positions. The upside is reduced to an area between the intra-day high of 18.9463 and the bottom range of its long-term resistance zone at 19.0735.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 18.8200

Take Profit @ 19.0700

Stop Loss @ 18.7000

Upside Potential: 2,500 pips

Downside Risk: 1,200 pips

Risk/Reward Ratio: 2.08