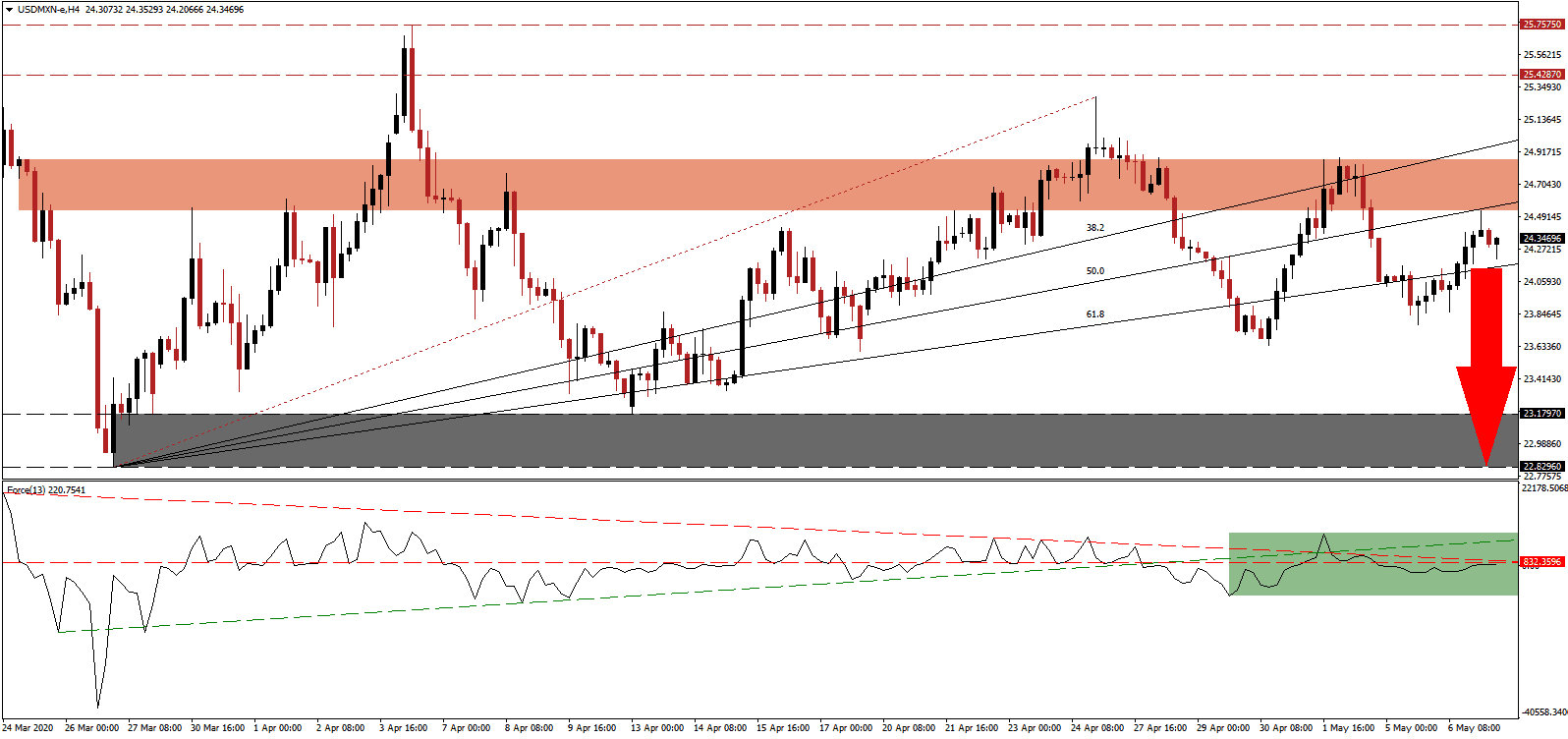

Yesterday’s US ADP report showed the most massive job losses in its history, with over 20.2 million lost private-sector jobs. Initial jobless claims total over 30 million, and today’s report is forecast to add 3 million to the total. Therefore, tomorrow’s NFP report is likely to be dismal. Mexico’s first-quarter GDP posted a marginally lower contraction than expected, while mining, farming, and fishing expanding. The Mexican economy remains on track for a second-quarter collapse of 12%, and the potential of a downward revised first-quarter report. Despite the risks, the USD/MXN maintains its bearish stance between the ascending 61.8 Fibonacci Retracement Fan Support Level and the 50.0 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, remains below the horizontal resistance level and is faced with more downside pressure by its descending resistance level. Following the breakdown in the Force Index below its ascending support level, bearish momentum is dominant. This technical indicator is well-positioned to correct below the 0 center-line and grant control of the USD/MXN to bears.

Mexico’s President Lopez Obrador did not follow the destructive decision making to bail out corporations. While he faces criticism by those concerned over the short-term impact, it allows the economy to embark on a healthy recovery with sound fiscal conditions. The US favored extending its unsustainable debt load, adding a long-term bearish fundamental catalyst to the USD/MXN. After being rejected by its short-term resistance zone located between 24.5283 and 24.8690, as marked by the red rectangle, the rise in bearish pressures is anticipated to reignite the corrective phase in this currency pair.

One essential level to monitor is the intra-day low of 23.7766, the base of the most recent move below the 61.8 Fibonacci Retracement Fan Support Level. A breakdown will initiate the next wave of sell orders and add volume for an accelerated correction. The USD/MXN is likely to test its support zone located between 22.8296 and 23.1797, as identified by the grey rectangle. Markets slowly shift their attention to the cost of bailouts and lockdowns, where Mexico remains in a superior position over the US.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 24.3500

Take Profit @ 22.8500

Stop Loss @ 24.8500

Downside Potential: 15,000 pips

Upside Risk: 5,000 pips

Risk/Reward Ratio: 3.00

A breakout in the Force Index above its ascending support level, serving as temporary resistance, may inspire more upside in the USD/MXN. Any advance from current levels should be taken advantage of with new net short positions, due to the deteriorating outlook for the US economy in conjunction with a rising deficit. Price action will face its next resistance zone between 25.4287 and 25.7575.

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 25.0000

Take Profit @ 25.7500

Stop Loss @ 24.6500

Upside Potential: 7,500 pips

Downside Risk: 3,500 pips

Risk/Reward Ratio: 2.14