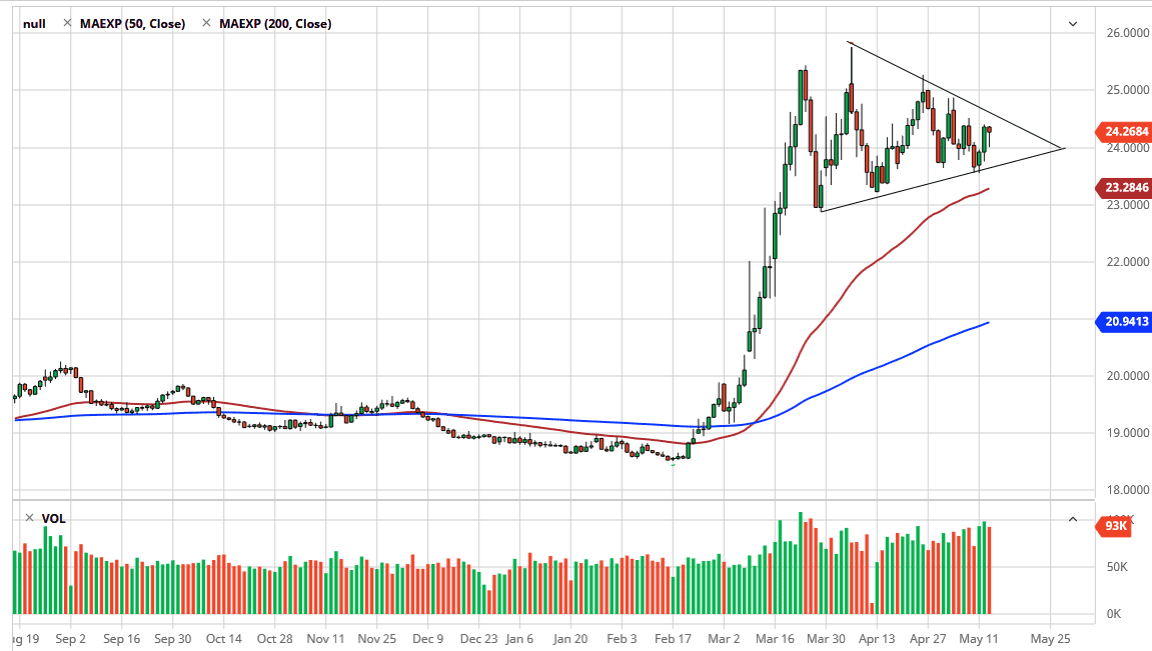

The US dollar has pulled back a bit against the Mexican peso during the trading session on Wednesday, only to turn around and show strength that the 24 level. That is an area that will attract a certain amount of attention due to the fact that it is a large, round, psychologically significant figure. Furthermore, the market is in a bit of a triangle, after shooting straight up in the air. This has been a massive move until the last couple of months, and now it looks as if the US dollar is going to offer a bit of digestion when it comes to the gains.

We are in a very tenuous point, because the market breaking out to the upside would open up the possibility of a move towards the 26 peso level again, perhaps even a bigger move. When you look at this chart, you can make a real argument for a bullish pennant that could kick off a move all the way to the 32 pesos region. Granted, that is an extraordinarily strong move from here but there are a lot of charts out there that look extraordinarily pro US dollar, especially when it comes to emerging markets. The Mexican peso will not be any different therefore this should not be a huge surprise.

Underneath the triangle is the massive 50 day EMA, which of course will offer plenty of support as well. Given enough time I believe that the market will probably continue to find buyers on dips, and therefore looking for “cheap US dollars.” I have no interest in shorting this pair, at least not until the environment around the world changes which quite frankly will not happen anytime soon. Even though Mexico is opening up its economy on Monday, the reality is that the Mexican economy was in serious trouble long before the virus hit. As things get back to work, the first place people will put money is in the United States, as we are a long way away from emerging markets picking up traction the way they did previously. In fact, it is not until we break down below the 200 day EMA, which is at roughly 21 pesos that I would consider a pullback something to be worried about as far as the bullish trend is concerned. The US dollar is by far the most favored currency out there.