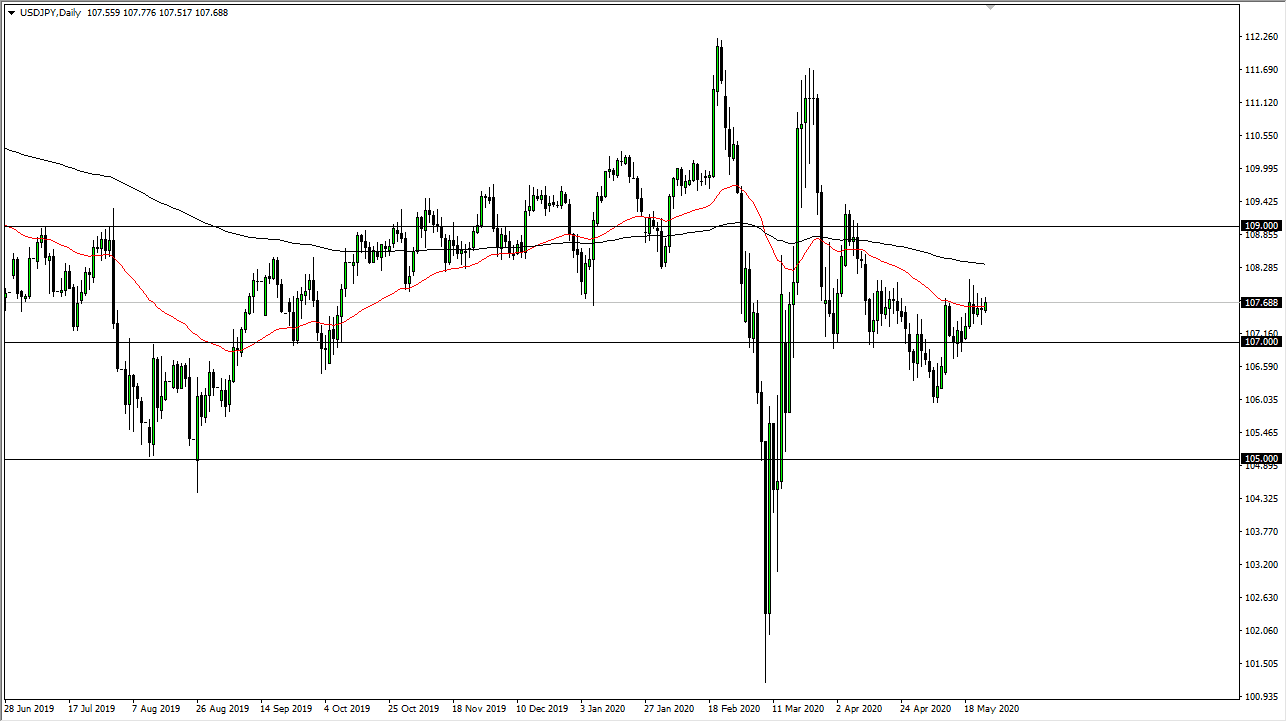

The US dollar went sideways against the Japanese yen during the trading session on Monday, which of course was Memorial Day in the United States so therefore it is a bit difficult to imagine a scenario where we see a lot of momentum one way or another. What you can notice on this chart though is that there are a lot of exhaustive wicks from the previous several candlesticks. Because of this, it is highly likely that we will see sellers come back in given enough time. I would not be overly concerned with the fact that the market rallied a bit during the trading session, because quite frankly the liquidity just is not there.

I believe that the ¥108 level continues offer a significant amount of resistance, and I think it will be difficult to break above there. This is further exacerbated by the 200 day EMA sitting just above that level, so I think there will be plenty of sellers given enough time. That being said, it is not as if we can break down significantly to the downside either, because there are plenty of supportive areas that could come into play.

When you look to the downside, the ¥107 level is an area that has been supportive several times, so do not be surprised at all to see this market see buyers in that area as well. At this point, it looks like simple chop back and forth type of trading is what we are going to see. This makes sense because both of these currencies are considered to be “safety currency.” Will to be honest here: markets are all over the place and they really do not know what to do with the risk parameters as central banks around the world continue to flood markets, but at the same time economies have stagnated to say the least.

This is a market that is been very noisy for some time and I do not see that changing anytime soon. Because of this, we will continue to see a lot of back and forth noise that could offer nice trading opportunities for short-term traders, but if you are looking to hang onto a trade, you are probably going to need to find another pair for bigger moves. At this point, I expect more the same and would be surprised to see some type of impulsive candle. As soon as we get one though, that could be something worth following.