After Indian Prime Minister Modi’s government gave in to pressures for a massive stimulus, ignoring fiscal stability, a ₹20 trillion spending package, including previously announced measures, was delivered. It represents approximately 10% of GDP in Asia’s third-largest economy measured by GDP. Complementing the announcement are proposed tax breaks for new plants and incentives for foreign companies to locate to India. Not all items are new spending proposals but represent already approved projects in the budget, which are being expedited. The Indian Rupee faced mild selling pressure, but bearish momentum in the USD/INR is increasing, anticipated to restart the breakdown sequence.

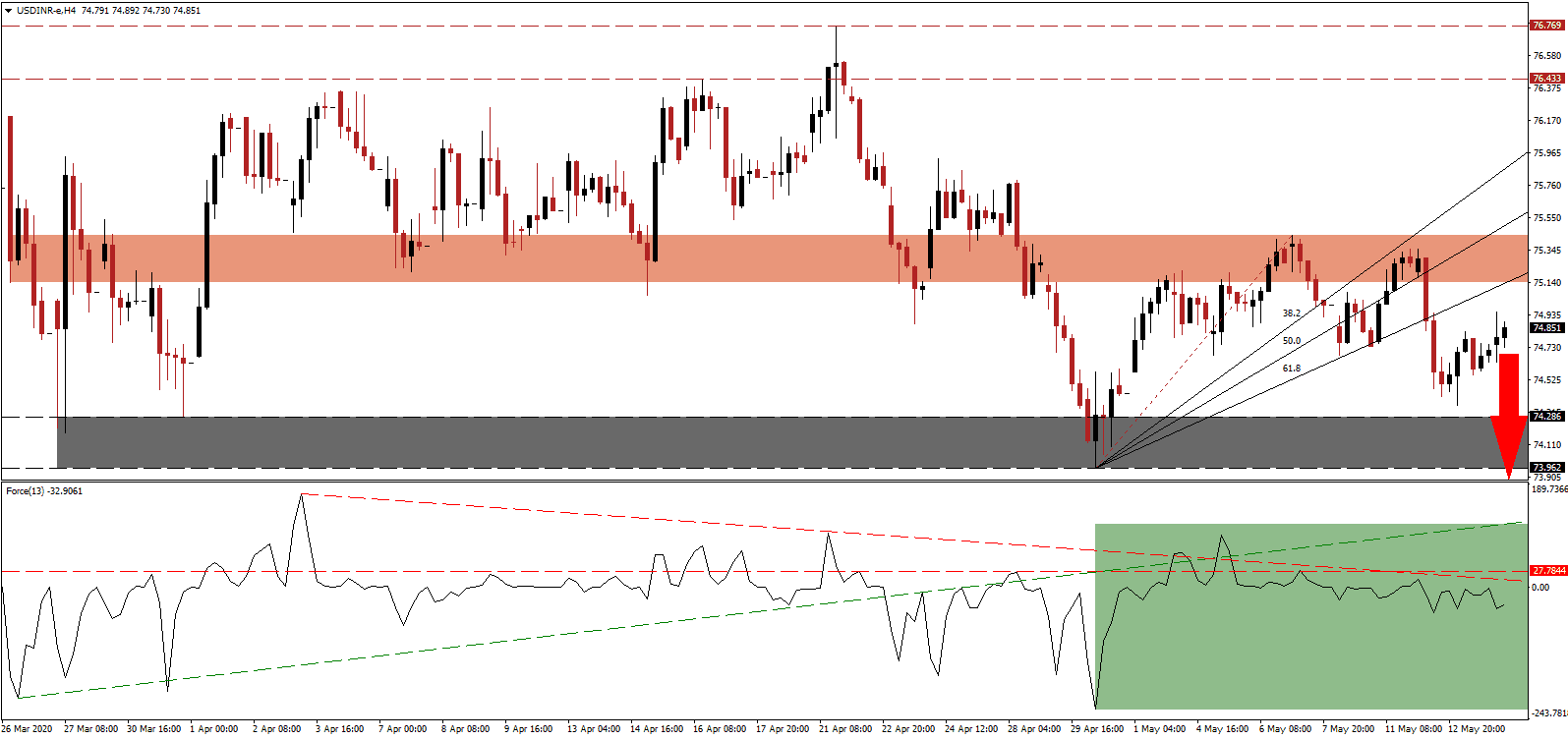

The Force Index, a next-generation technical indicator, is being pressured to the downside by its descending resistance level after crossing below its horizontal resistance level, as marked by the green rectangle. Bears have taken control of the USD/INR following the breakdown in this technical indicator below its ascending support level, now converted into resistance. An accelerated collapse is likely to drag price action lower. You can learn more about the Force Index here.

Indian job losses for April alone total an estimated 122 million, resulting in the collapse of consumer demand. While the announced stimulus is more massive than economists expected, it is short of what Associated Chambers of Commerce and Industry of India lobbied. The government attempts to juggle stimulating the economy without sacrificing financial stability. A downward adjustment in the short-term resistance zone located between 75.138 and 75.443, as marked by the red rectangle, is pending, reflecting the rise in bearish progress in the USD/INR.

Plans by US Democrats to add another $3 trillion stimuli, including a second $1,200 direct payment to consumers, is adding to breakdown pressures in this currency pair. Criticism by US President Trump over the White House Covid-19 task force, led by Vice President Pence and Doctor Fauci, regarding caution over a rushed reopening of the economy, further complicates the US scenario. After the breakdown in the USD/INR below its ascending 61.8 Fibonacci Retracement Fan Support Level, a push into its support zone located between 73.962 and 74.286, as identified by the grey rectangle, is favored. Collapse into the next support zone located between 72.348 and 72.702 is probable, driven by an increasingly bearish outlook for the US Dollar.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 74.850

Take Profit @ 72.350

Stop Loss @ 75.550

Downside Potential: 25,000 pips

Upside Risk: 7,000 pips

Risk/Reward Ratio: 3.57

In the event the Force Index reverses above its ascending support level, the USD/INR could extend its temporary counter-trend reversal. Any breakout in this currency pair will present Forex traders a secondary short-selling opportunity, on the back of mounting US economic pressured and missteps by leaders, threatening a spike in infections over the summer. The next resistance zone awaits price action between 76.433 and 76.769.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 75.950

Take Profit @ 76.550

Stop Loss @ 75.650

Upside Potential: 6,000 pips

Downside Risk: 3,000 pips

Risk/Reward Ratio: 2.00