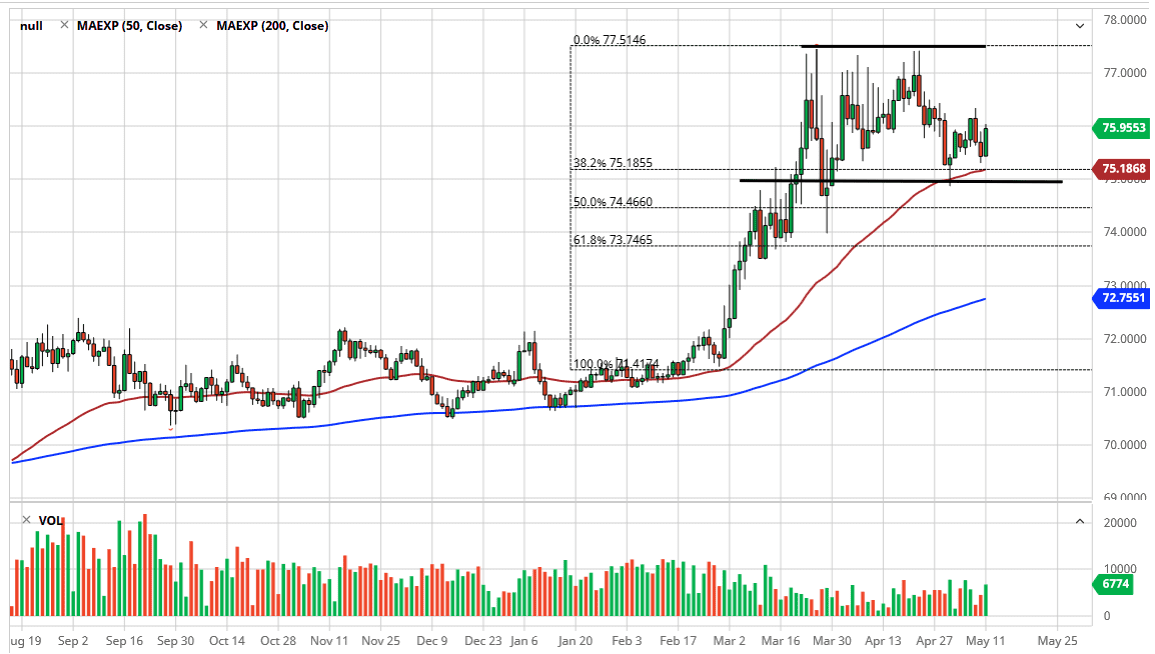

The US dollar has rallied significantly during the trading session on Monday against most currencies, including the Indian rupee. The market is closing out the session at the ₹76 level, an area that has been important from both sides of the equation as of late. At this point, the ₹75 level underneath has marked the support, while the ₹77.50 level above has offered resistance. The 50 day EMA sits just below current trading, so therefore we should see a certain amount of support in this area as well.

The market bouncing around has been the issue for some time, as the market is trying to figure out what to do with the idea of a very uneven recovery. India is in the midst of suffering a massive blow to its economy while the population is essentially locked down. The US economy is starting to open up and therefore people are starting to look towards the US dollar again. That being said though, even if the situation crumbles, the US dollar will be looked towards for safety.

Otherwise, the market breaks down below the ₹75 level, then it is possible we will go looking towards the ₹74 level. I believe there is a massive support barrier between ₹75 and ₹74, so it is simply a matter of picking up value if you get an opportunity to. Ultimately, this is a decent looking candle for the trading session, and I do believe that if we are going to close at the top of the range then it is likely that the market will try to get to the ₹77 level. I believe that this is a market that will continue the uptrend, but if we were to break down below the ₹74 level then you have to start thinking about the opposite. That would be a very bullish sign as it would be emerging market starting to pick up against the US dollar but quite frankly that seems to be very unlikely this point due to debt market concerns and of course global issues in general. Expect a lot of choppiness and noisy trading, but I still believe in the upward momentum overall. Obviously, things change then I will let you know but ultimately the US dollar is the favorite currency around the world against most currencies. If we can break above the ₹77.50 level, then this market is more than likely going to go looking towards ₹80 over the longer term.