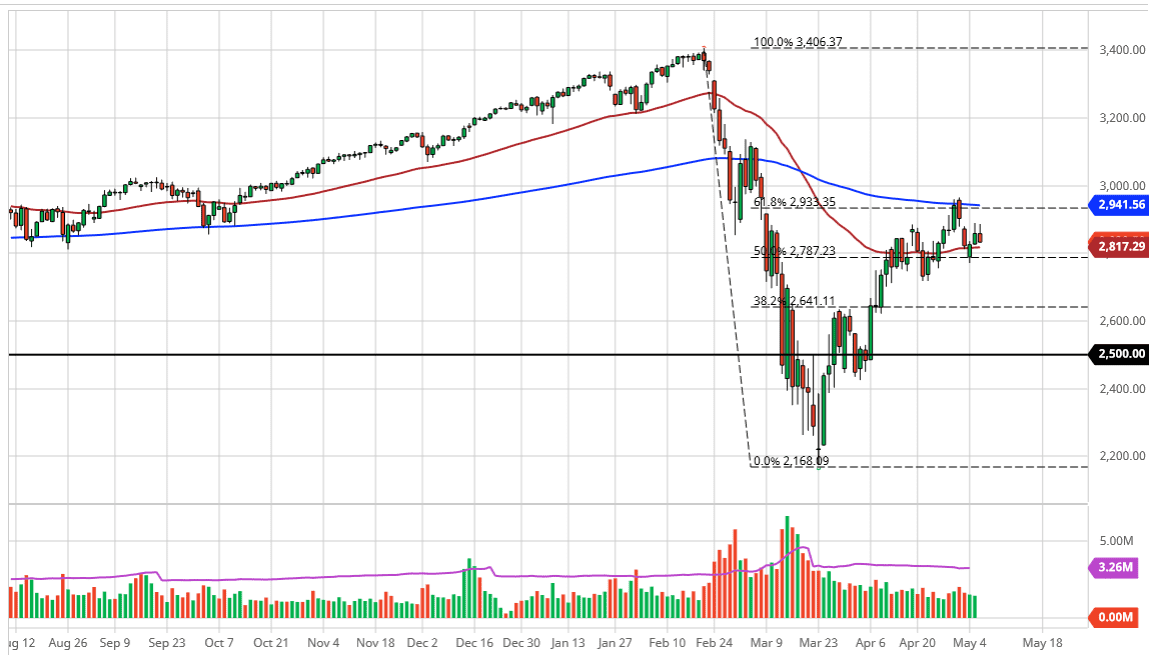

The S&P 500 has tried to rally during the trading session on Wednesday but has turned back around to show signs of exhaustion near the same gap that it had on Tuesday. The 200 day EMA is sitting at the 2940 level, and so far, has been enough to keep the market a bit sluggish. Furthermore, the 61.8% Fibonacci retracement level is right there as well, so there are a couple of reasons to think that perhaps this market is going to struggle in general.

Furthermore, the jobs number comes out on Friday, so that of course has a major influence on the Thursday session, as it is likely that traders will be putting a lot of money to work between now and then. I anticipate that Thursday is going to be of relatively quiet situation in the markets, barring some type of headline which of course can always come out.

Overall, the market looks as if it is trying to figure out where it is going to go next for a larger move, and perhaps the jobs number might be the main reason to push this market around. Furthermore, there are a multitude of other things that could be working against the bullish pressure, not the least of which will be Trump and China arguing back and forth about the coronavirus situation in the news. There is a lot of talk about China not working with the trade deal, and therefore one would think that tariffs are probably coming down the road. Furthermore, it makes quite a bit of sense that the anti-China rhetoric will continue to come out of the United States, not only for obvious reasons, but for the fact that we are getting close to the election cycle, and it is a popular sentiment in the United States on both sides of the aisle. In other words, the Chinese can probably expect some type of retribution for the entire virus situation and lack of living up to the agreement.

The S&P 500 and stocks in general do not like that, so it is yet another reason to think that we could roll over. That being said though, the bullish argument would be that the market simply goes higher regardless of what happens with the economy in the Federal Reserve is giving out free money to everybody who wants it. Because of this, I am bearish but still need to see a significant candlestick to put serious money to work.