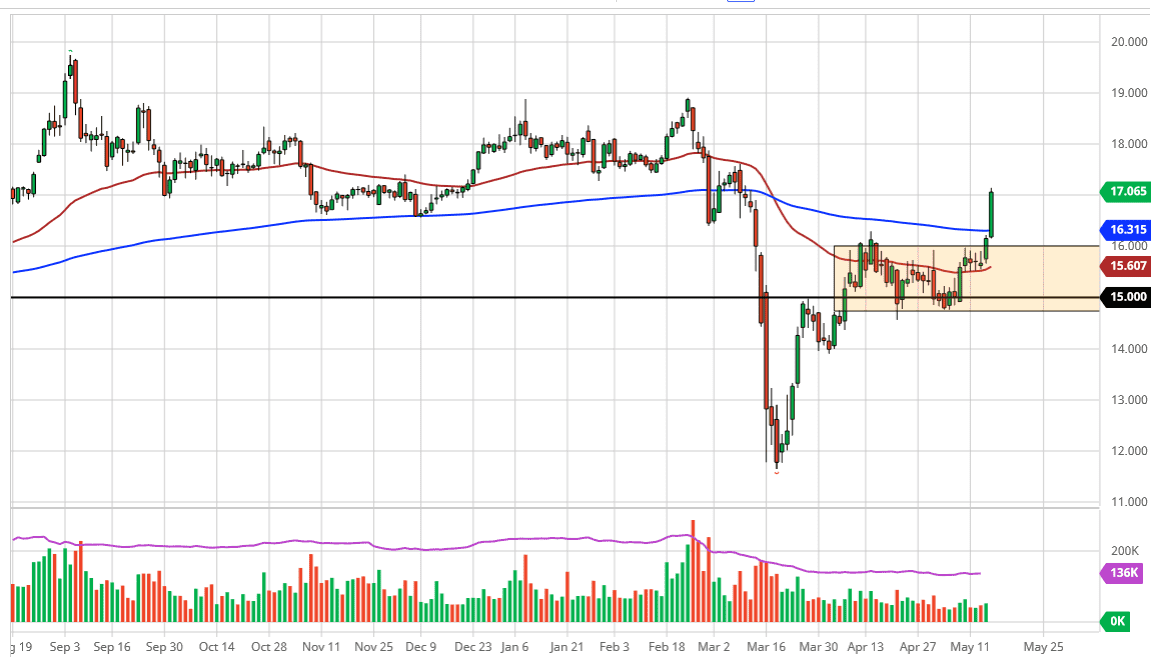

Silver markets have broken higher during the trading session on Friday, slicing through the 200 day EMA like it was not even there. What is interesting about this is that the market not only slice through there but then reached towards the $17 level. By the time the futures market opened up in Chicago, silver was up over 4% already. In other words, this is a market that is extraordinarily bullish based upon the last couple of candlesticks.

The $17 level of course offers a significant amount of interest as far as a psychological standpoint is concerned, and it is also where the market had broken down previously. The fact that we have reached that level suggests that the market is likely to see a lot of pressure in this region. The fact that the market had closed just at the $17 level on Friday suggests that we are going to continue to see a lot of bullish pressure, but at this point we may need to pull back a bit in order to build up the necessary momentum to finally break out to the upside from a longer-term move.

It should be noted that the 200 day EMA should now offer support, and most certainly the $16 level will as it is the top of the previous consolidation area, and even below there you would anticipate seeing quite a bit of support at the 50 day EMA as well. At this point in time, the market is likely to see volatility because it has gotten a bit overbought, but the overall trend most certainly has shifted to the upside, not only here but in the gold market which of course can drag silver right along with it. Having said that, silver does suffer from the fact that it is also an industrial metal and wood measured in its volatility terms, silver behaves more like a base metal that it does a currency like gold goes, so keep in mind that the quicker move to the upside is probably still going to be had in gold and not silver. Silver will get a big move to the upside, but only if it gets the help of industry demanding more of it going forward. This means that we need a bit of a recovery in the global markets overall when it comes to commodity demand. That being said, selling certainly is something you cannot do anytime soon.