The NASDAQ 100 has rallied quite significantly during the trading session on Monday, as everybody bought everything they could related to stocks. The NASDAQ 100 of course is essentially an ETF of the “Wall Street darlings”, such as Microsoft, Google, Tesla, Netflix, and of course Facebook. Ultimately, this is a bet on all of the stocks that everybody on Wall Street runs to at the first hint of bullish pressure. Because of this, you should probably never actually consider selling the NASDAQ 100 unless of course the entire market is falling apart. With that being the case, it is essentially a “one-way trade” in general, as you can see over the last couple of months. Yes, it can break down significantly but that needs to be some type of major meltdown in general.

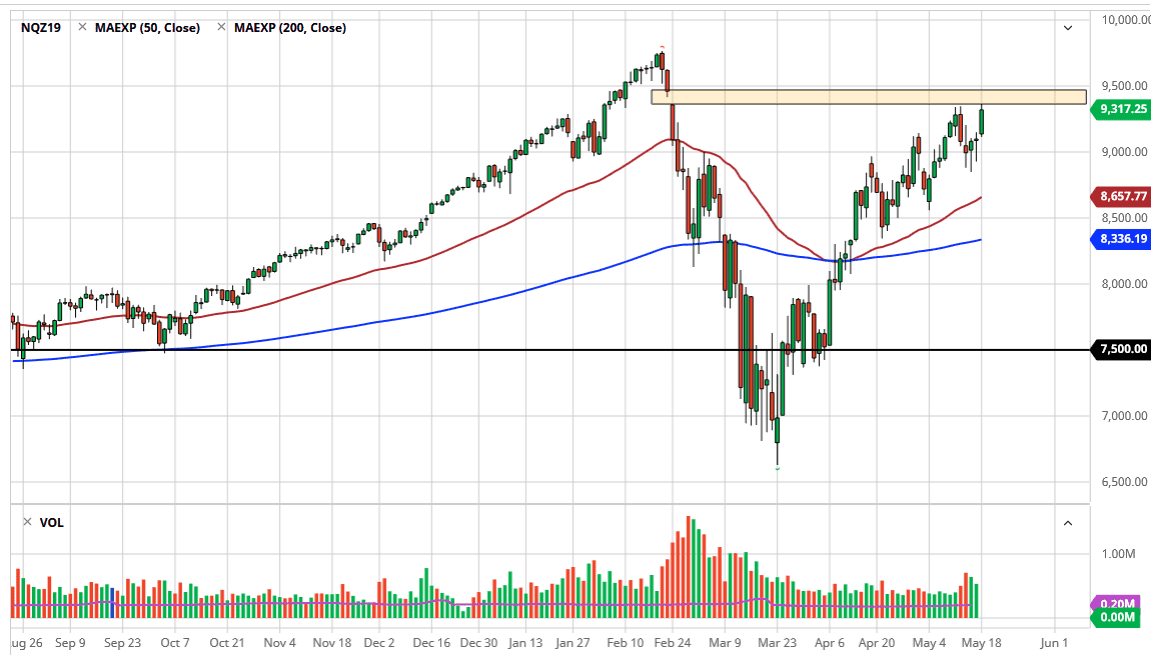

Because of this, the 9000 level underneath is an area that is relatively important, because we have formed several support of candle there, as well as seeing significant resistance there on the way down. The 50 day EMA underneath should also offer a significant amount of support, so I think all the way down to at least that figure we are probably looking at buying opportunities.

The candlestick is very bullish from the trading session on Monday, and it looks as if we are going to try to take on the gap that sits just above. At this point, the 9450 level is likely to be extraordinarily resistive, just as the 9500 level is. If we do break above the 9500 level, then it is going to continue to go much higher, perhaps reaching towards 10,000 given enough time. Ultimately, I do think that this index will find a way up there, but it is mainly because of the stocks that are involved. After all, those names that I mentioned previously make up about 40% of this index, so it is really an exercise in futility to start looking for shorting options. Buying pullbacks should continue to work, and I think a pullback is probably necessary. That pullback should be an opportunity to pick up a bit of value, so therefore it is worth being patient enough to look towards the 9000 level for a potential buying opportunity. Between now and then, it is probably best to leave this alone, unless of course we break out above the 9500 level which would take an extraordinarily strong move.