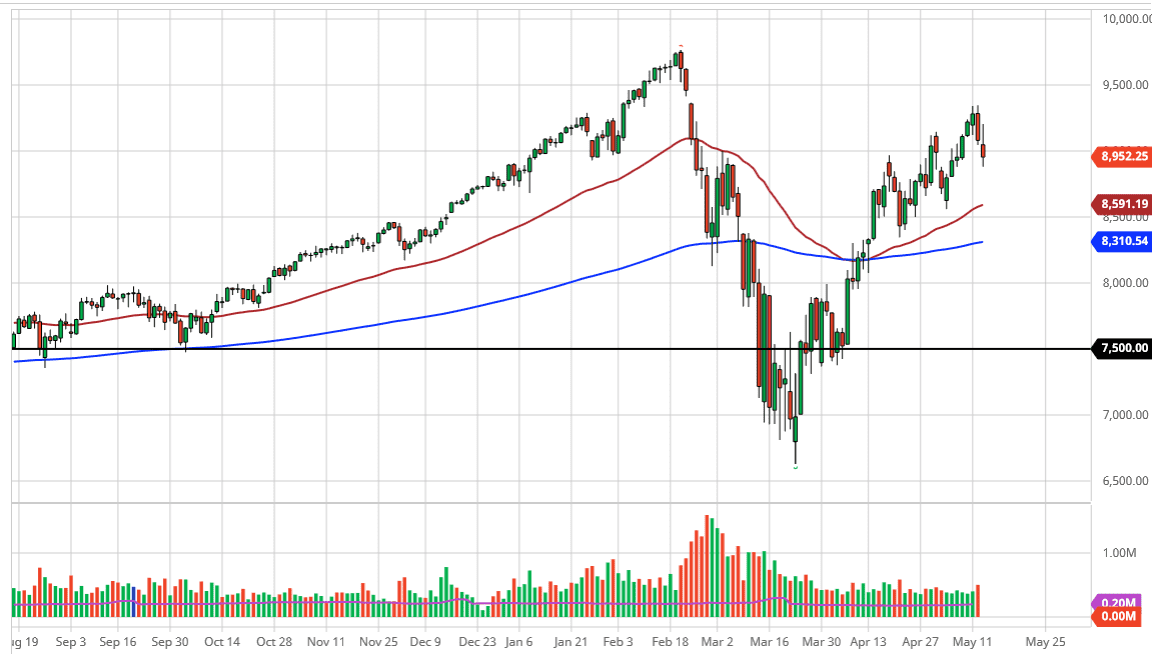

The NASDAQ 100 gapped lower to kick off the trading session but then turned around to rally quite a bit. However, the market then turned around to show signs of negative pressure. The 9000 level being broken to the downside shows that the market will continue to see quite a bit of negative pressure. The 50 day EMA underneath is sitting at the 8590 handle. At this point in time, it should show a significant amount of support and it would be the bottom of the overall uptrend channel that we are in.

Looking at this chart, I do believe it is only a matter of time before the buyers come back due to the fact that the market has shown some of choppiness on the way out. This does not matter at this point though, as the market is essentially trading on pure emotion at all times. I do think that the 50 day EMA will come in and try to support this market so I would not be selling the NASDAQ 100, rather looking for value at lower levels. After all, the NASDAQ 100 is comprised mainly of technologically favorable companies such as Amazon, Google, Tesla, and the like. The “Wall Street darlings” make up over 30% of this index, so it is difficult to imagine that this market will break down for a long timeframe, because those of the same stock that everybody goes back to time and time again.

In fact, at the very end of the session we did see some buying, showing that there is plenty of support underneath. The 9500 level above will be targeted eventually, but I do not think that is going to happen anytime soon. The market is overvalued, so this pullback is probably necessary. However, the NASDAQ 100 has shown itself to be extraordinarily resilient, so it is almost impossible to short it, as the market is now sitting on top of an area that was significant resistance from previous trading as well. All things being equal, this index will continue to outperform the S&P 500 going forward, and then I think that a lot of people who do pair trading will be long of this market, well short of the S&P 500. All things being equal, I do believe it is only a matter of time before we see some type of rebound.