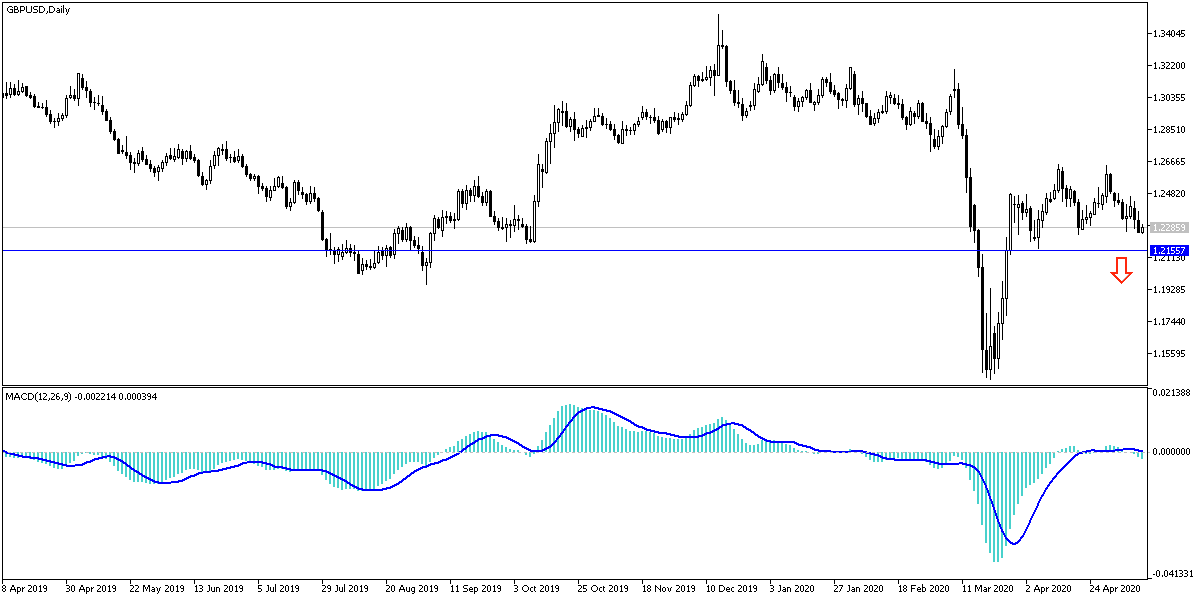

Prior to the announcement of a historical contraction of the British economy in the Corona era, the GBP/USD pair finds it difficult to make an upward correction in spite of the historically negative figures for the American economic releases, the most prominent of which were the recent employment and inflation figures for April. Yesterday's gains did not exceed the 1.2377 level, but the pair soon retreated to the 1.2255 support in the beginning of Wednesday trading. This performance confirms our permanent expectations to sell the Pound from every bullish level. After the markets absorbed the US data, investor’s attention is turning to UK first quarter GDP data on Wednesday and Thursday's update on out of EU trade talks by negotiators.

The previous losses came amid optimistic investor sentiment that lifted global stock markets, commodities and many risk currencies. The UK government has already been criticized for being slow to request a closure in March, due to lack of testing and poor handling of the purchase of PPE. For the British pound investors, the fact that no real progress has been made in the Brexit talks between the UK and the European Union, is also a source of concern given that the end of the transition is looming.

In addition, no positive headlines emerged from the trade talks between the United States and the United Kingdom as well. Whereas, the UK government urgently needs some positive signals from these talks to enhance its trade relations outside the European Union. However, the British consumer was bothered by fears suggesting that a trade deal with the United States could push the UK to lower agricultural standards and high drug prices.

The pound is facing the prospect of becoming a "sick man of Europe". Unlike global economies, the Boris Johnson government may extend the policy of national "closure" to June this weekend and said that some sectors of the economy will not be able to reopen until July, while all other major economies of Europe and North America are taking steps towards returning to normalcy.

Expectations indicate that the British economy may contract by -2.3% in the first quarter of 2020 and -7.5% in March, although the UK did not enter the closure until the last week of March. But the economy was already weak before coronavirus, and with economists’ previous optimism about the size of the U.S contraction, which was until late of the closure, the risk is that this week’s numbers are even worse than what many had imagined.

According to technical analysis of the pair: the recent GBP/USD bearish momentum may pave the way to the 1.2000 psychological support at the earliest time, especially with investors and markets interacting with sharp contraction of the British economy, expected to be announced today. According to the performance on the daily chart, the 1.2600 resistance will remain the strongest opportunity for bulls to control the performance. This would not happen without the positive features of the post-Brexit talks and the drop in U.K new Coronavirus cases and deaths.

As for the economic calendar data today: From Britain, the GDP growth rate, industrial production index, the investment rate in assets and the trade balance of goods will be announced. From the United States, Producer Price Index and upcoming statements by Federal Reserve Governor Jerome Powell.