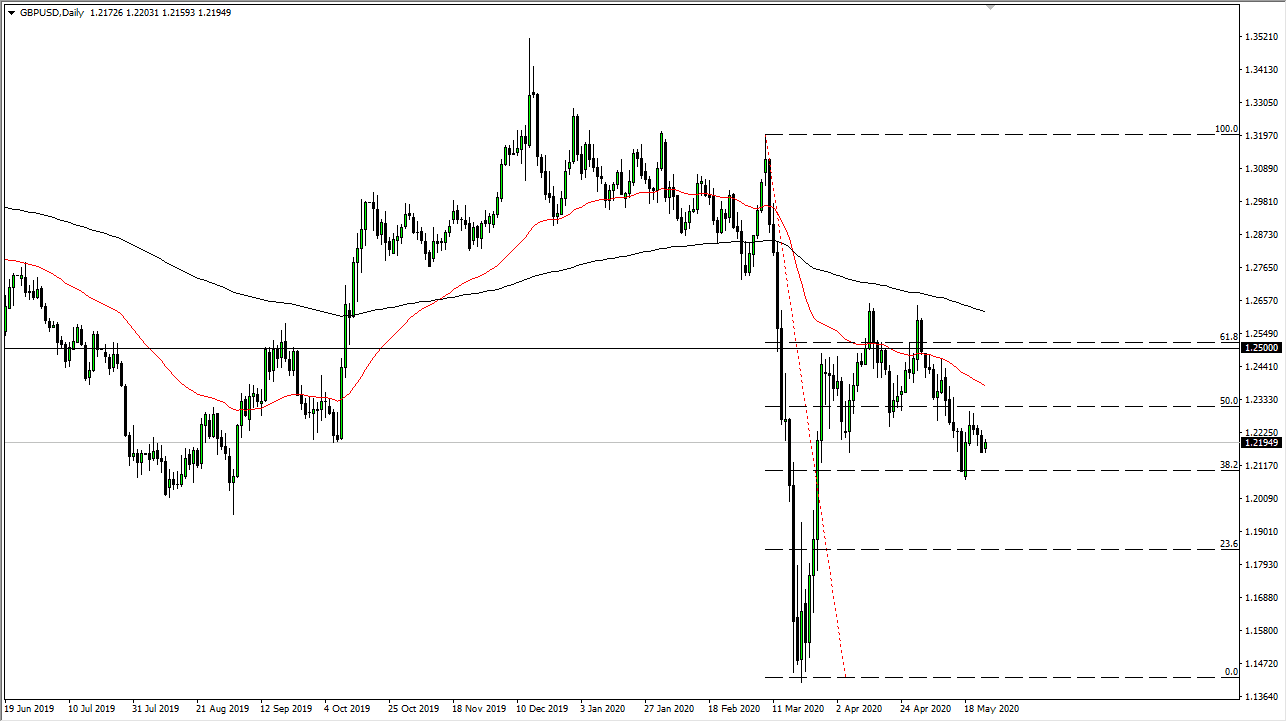

The British pound has rallied slightly during the trading session on Monday, as banks in both countries were closed. Because of this, I would not get too excited about this candlestick and the overall analysis still continues. When I look at this chart, I see the 1.23 level is an area that shows quite a bit of resistance so I do think that any move towards that level will probably send this market right back down.

Underneath, I see the 1.21 level as a potential target, and then possibly even a move down to the 1.20 level which of course is a large, round, psychologically significant figure that will come into play and perhaps cause a bit of attention. Below there, then it opens up the move to 1.1750 that I think is possibly the destination. I do believe that given enough time we will eventually see some type of break down, and as the British economy is struggling due to not only the coronavirus but also the lack of growth, I do believe at this point in time it is only a matter of time before this pair falls.

Looking at the pair, you should also see the US dollar as a safety currency, and therefore it makes quite a bit of sense we continue to go lower. To the downside, I think we will accelerate if we can go down below the 1.21 handle. There is an alternate scenario where the market could rally but I think the red 50 day EMA will probably offer quite a bit of resistance. I would be more than willing to short the market near the 50 day EMA, because it will offer a significant amount of psychological and technical resistance.

I really do not have a scenario in which I am willing to buy the British pound from the longer-term, at least not yet. Obviously, something changes from a fundamental standpoint then I would consider it but right now the British pound has more issues around it than it does bullish pressure. I look at rallies as an opportunity to pick up the US dollar “on the cheap”, and I do believe that most of the market feels the same way. In fact, I would not be surprised at all if we continue to see a back-and-forth type of trading scenario where sellers continue to overwhelm every opportunity that they get.