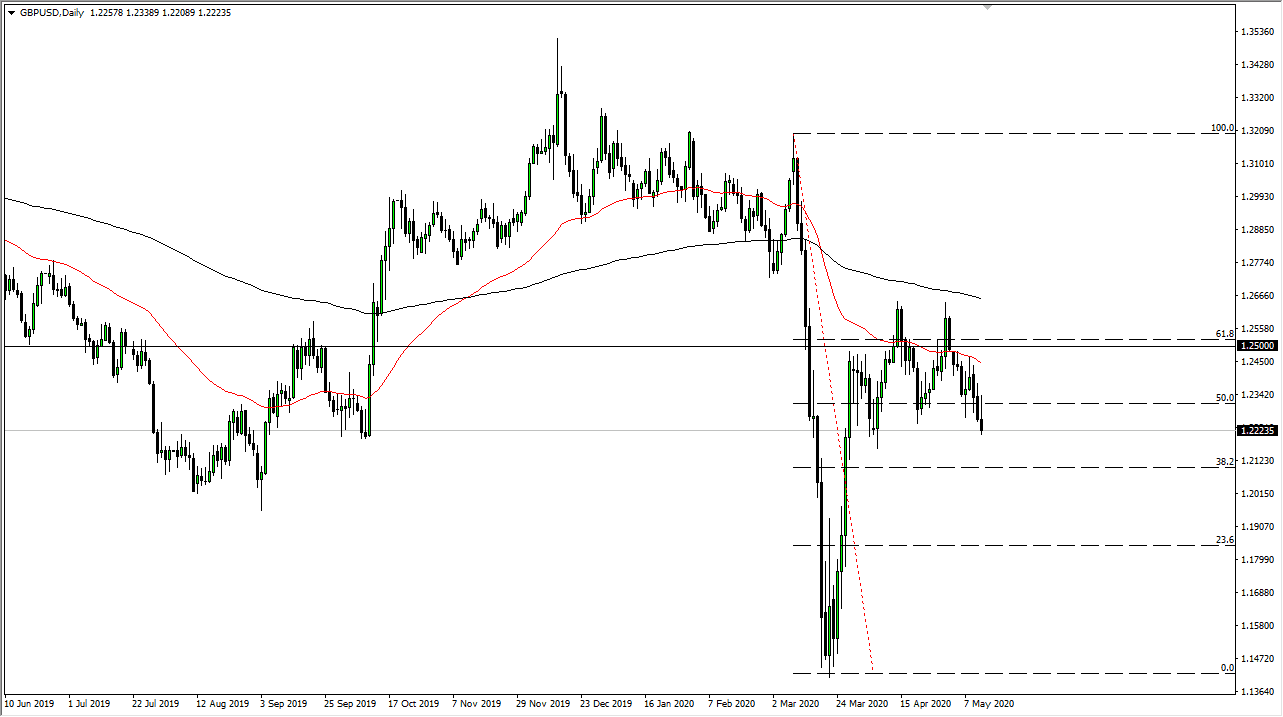

The British pound initially tried to rally during the trading session on Wednesday, reaching towards the 1.2350 level. By showing the market resistance at that level, it shows that we are ready to continue breaking down. The candlestick is an inverted hammer, and if we break down below the bottom of it, it is highly likely that the British pound will go looking towards 1.20 level, perhaps even the 1.1750 level after that.

Rallies at this point should continue to see a lot of selling pressure above, especially near the red 50 day EMA. Ultimately, this is a market that has been running out of steam for a while and it is likely that we will continue to see a lot of downward momentum as the market had gotten far too ahead of itself recently. With the United Kingdom completely locked down and the likelihood of negative interest rates all but gone in the United States according to the Chairman of the Federal Reserve. With that being the case, it is likely that we will continue to see a lot of volatility and of course people looking to the US dollar for value.

I do not see any opportunity to go long quite yet, but if we were to somehow turn around a break above the 200 day EMA, then we will go looking to the upside. Regardless though, I think there are plenty of opportunities between here and there that could offer an opportunity to start shorting. If we break down below the bottom of the candlestick for the trading session on Wednesday, I will simply short the British pound there as well. Again, I have no interest in trying to buy this pair anytime soon and I do think that the last ditch effort during the trading session on Wednesday was a very telling when it comes to the likelihood of the trend going forward.

As long as there are concerns about the global growth that has been clipped by the coronavirus, it is highly likely that the US dollar will be favored against most currencies, not just this one. With that, I like the idea of fading an economy that has the highest death rate in Europe, massive issues when it comes to the lockdown, the Brexit problems, and a whole host of other reasons. As the US treasury market continues to strengthen overall, that is the greenback’s greatest strength.