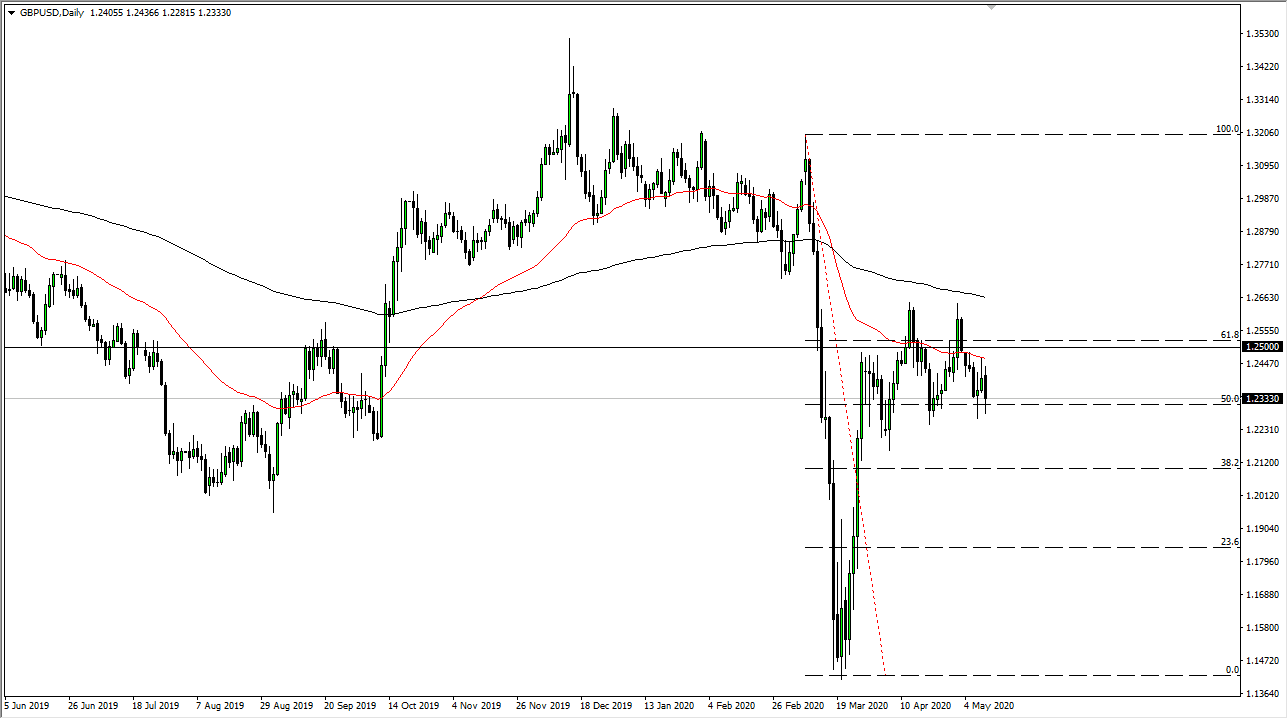

The British pound initially tried to rally during the trading session on Monday, but then broke down towards the 1.23 level yet again. Having said that, we bounced later in the day so now it looks like we are going to continue to bounce around major support. I believe that support is anchor around the 1.2250 level, an area that if broken to the downside could open up quite a bit of selling. The US dollar of course is the favorite currency around the world, and therefore it is likely that we will eventually see enough pressure to break this pair down.

To the upside, the 50 day EMA is sitting just above and it is shrinking to lower levels. That offers dynamic resistance, people should pay attention to the reaction of the market to this level. Ultimately, this is a market that should continue to run out of momentum as we have seen over the last several weeks. At one point or another, we will see the market have to make a longer-term decision, as we cannot simply go back and forth forever. It should be noted that the 68.1% Fibonacci retracement level has offered astringent resistance, and a bounce from here probably is simply going to offer another selling opportunity. This will be especially true near the 1.25 level which is of course psychologically important and is becoming more and more of a factor.

Above there we have the 200 day EMA which of course will offer certain amount of resistance as well, so it is important to pay attention to that level as well. If we were to break above that level, then obviously it is a very bullish sign in the British pound could continue to go much higher. However, I believe that if we break down below the 1.2250 level we are likely to go down towards the 1.20 level given enough time, perhaps down to the 1.15 level after that, which makes quite a bit of sense considering that the US dollar is favored overall, and of course the British economy continues to suffer under the hands of a nasty lockdown, which although loosening is going to do so at an extraordinarily slow pace. In other words, growth is light years away from showing itself in the United Kingdom, so I think it is only a matter of time before we rollover. That being said, the British pound has been amazingly stubborn.