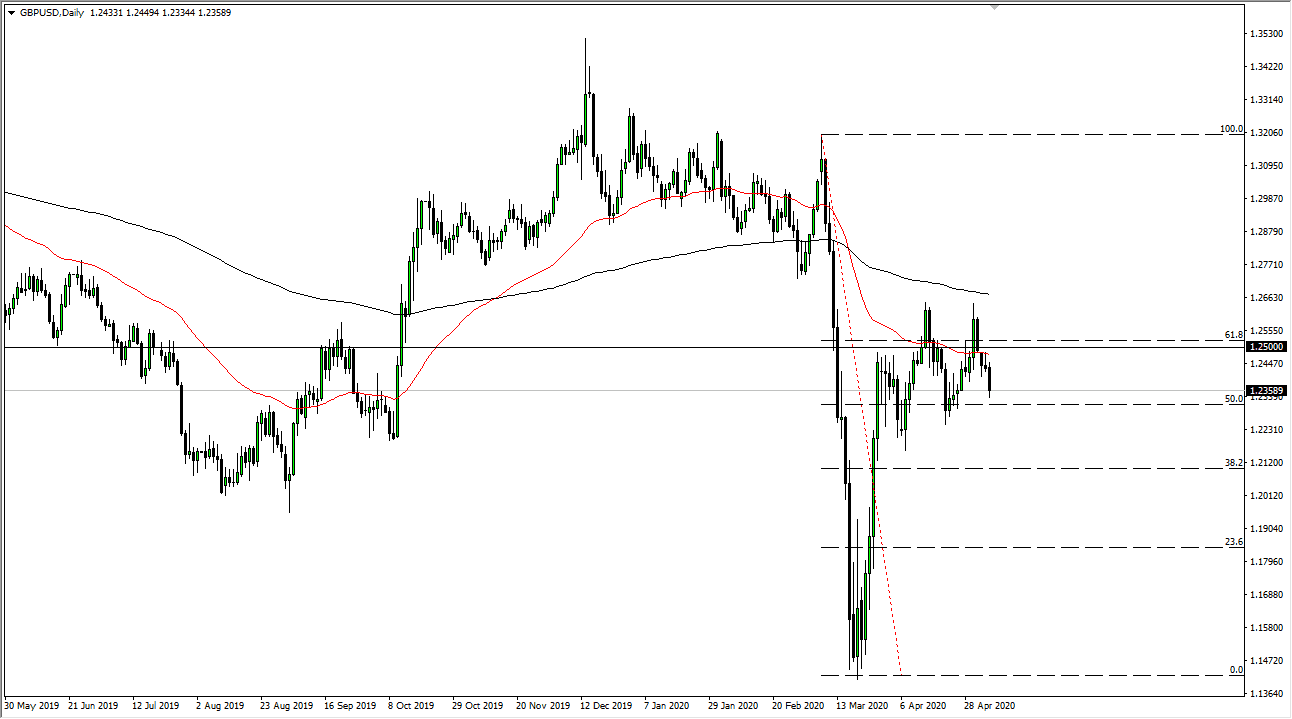

The British pound has pulled back a bit from the highs over the last couple of days, and of course Wednesday was not any different. In fact, we started to close down the US session near the 1.3250 level, and at that point it is an area where we have seen a little bit more of a support region. I do think that if we break down below the 1.23 level though, it is likely that the market continues to go lower, reaching towards the 1.22 handle, and then eventually the 1.20 level after that.

The candlestick is closing close to the overall range, which of course is a sign that there is a lot of negativity in general, as it shows real conviction to the downside. Ultimately, this is a market that I do believe that we are going to see sellers come back in on these rallies. After all, we have started to see a major breaking down of momentum, and the rate of change slowing down is typically the beginning of the end of a trend.

Rallies at this point I will continue to sell, as it looks like the 200 day EMA is of course going to continue to be something that is major. As long as we can respect that, the trend is still down, even though we have had a major bounce as of late. When you look at this chart, it is hard not to notice that the 50 day EMA is sitting at the 1.25 level, which is also backed up by the 1.25 handle. In other words, there are plenty of reasons to think that the area will hold as a negative level.

I do think that ultimately, we will probably drop pretty significantly, but it is going to be very noisy between now and then. Keep in mind that the jobs number is on Friday so it is likely that the markets will be somewhat quiet over the next 24 hours. That being said, if we get some type of “risk off” type of situation, it is likely that the US dollar will continue to pick up a bit of momentum, as it is still the favorite currency overall when it comes to global traders. With that being the case, being a bit patient in fading short-term rallies should continue to work out quite well when it comes to trading the British pound against almost everything.