The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Of course, the current market environment is one of crisis and relatively high volatility, and price movements are mostly dominated by the perceived economic impact of the coronavirus pandemic. That is the dominant factor to consider in trading any market today.

Big Picture 3rd May 2020

In my previous piece last week, I forecasted that the best trade was likely to be long of Gold in USD terms if it closed at or above $1732 at the end of Monday’s New York session. It did not close at or above that price on Monday, which was just as well as the price of Gold fell over last week.

Last week’s Forex market saw the strongest rise in the relative value of the Euro, and the strongest fall in the relative value of the U.S. Dollar.

Fundamental Analysis & Market Sentiment

The world is not coming to an end, but we are living in an extraordinary time of global health crisis, the type of which has not been seen in one hundred years. There is both fear and optimism, but it is important to remember that the evidence shows that the vast majority of people are going to survive and be healthy.

In time such as these, it is extremely difficult to make very short-term market forecasts, as the crisis can change focus day by day, strongly affecting sentiment and market movements. However, medium-term forecasts are easier to make as high levels of volatility tend to accompany see-sawing price movement.

We have seen the epicenter of the global pandemic move into the United States, especially New York, with fatalities hitting a high rate also in the U.K. However, the rolling average of deaths seems to be plateauing or even falling in both those countries, although daily new confirmed cases remain stubbornly high. Latin America is now seeing the most dramatic rises in new deaths and confirmed infections, especially Brazil. Daily deaths globally are continuing to fall. The strongest exponential growth in new confirmed cases is happening in Brazil, Russia, Turkey, India, and Singapore.

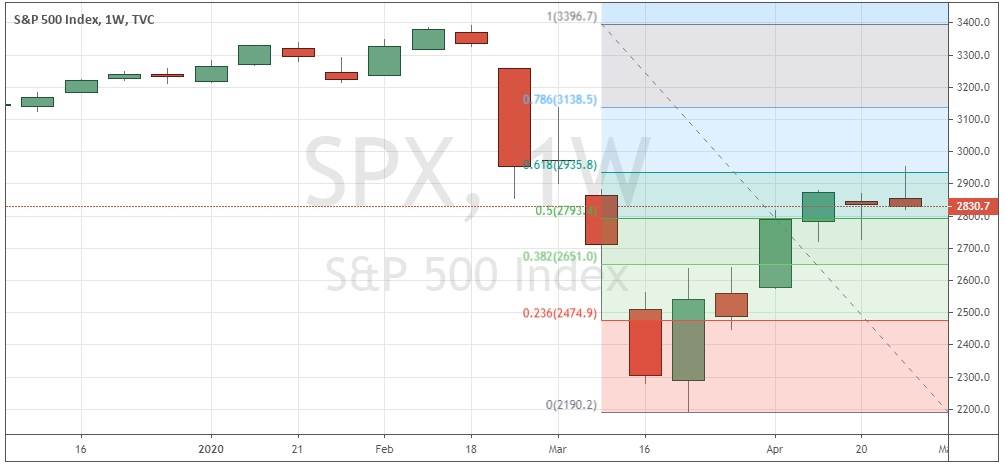

The U.S. stock market fell again last week for the second week running, rejecting the 61.8% Fibonacci retracement of its peak to trough decline. The market had been recovering very bullishly at least partly due to the $2.2 trillion emergency stimulus package a few weeks ago and ongoing buying of U.S. stocks and other market instruments on a large scale by the Federal Reserve. However, important questions remain as to the sustainability of this rally even in the face of a huge drop in GDP and employment, which the U.S. economy is certain to suffer over the near term.

U.S. GDP shrank by 4.8% in the first quarter of 2020. U.S. unemployment nationwide is currently estimated at approximately 16%. New unemployment claims in the U.S. have hit 30 million over only the past six weeks Many analysts see this ongoing stock market rise as bound to collapse, and we may be approaching a pivotal moment where bears begin to dominate again.

It is clear that this crisis will enforce severe economic restrictions in all affected countries which will need to last for several weeks or even months. The only given is that employment and GDP generally will take severe hits, with Goldman Sachs forecasting a 34% drop in U.S. GDP in the second quarter of 2020. The stock market crash we are seeing is comparable to 2008 and even 1929 so far. In fact, the speed of the initial drop of 20% from the all-time high price took only 15 market days to happen, compared to 30 days in 1929.

It seems clear that we will see a continued though maybe reduced level of high market volatility, at least in the stock market.

We are also starting to see a few countries that have had relatively successful lockdown measures begin to relax restrictions on the belief they have successfully dealt with a first wave of infections. These are smaller nations such as Denmark, Norway, Austria, Israel and the Czech Republic.

The U.S. is in a strange situation, with the virus running rampant, yet we see increasing demands mostly from the political right to “reopen the economy”, despite the fact that 0.22% of the entire population of New York City has died from the virus in recent weeks, suggesting that the infection fatality rate truly is not far from 1% - although this is hotly disputed by many. The federal government is now encouraging states to reopen as individual conditions allow. One state in focus is Georgia, where the curve is still rising yet the state government has allowed many businesses, including hairdressers, to reopen.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows last week printed what is technically a semi-bullish semi-pin candlestick, and which is still holding up above the support level shown at the blue horizontal line at 12470 which I have had to adjust downwards slightly. There is a bullish trend reflected in the fact that the price is higher over both 3 and 6 months and the holding of support is also a bullish sign, but we are seeing a decline in volatility accompanied by a consolidation after very high volatility, so direction is extremely difficult to predict. Overall, next week’s price movement in the U.S. Dollar looks somewhat unpredictable but more likely to be up than down.

S&P 500 Index

The major U.S. stock market index – the biggest market index in the world closed down slightly this week for the second week running since it made its major low six weeks ago. The candlestick is a bearish pin candlestick, and another bearish indicator is that the upper wick of the candlestick has rejected the 61.8% Fibonacci retracement level of the market’s recent peak to trough move. This price area between about 2900 and 3000 is highly likely to be pivotal, and we may have just seen a decisive bearish turn.

USD/JPY

The USD/JPY weekly chart printed a bearish candlestick last week. The action is not especially bearish or dramatic, but we do see a long-term bearish trend, albeit a weak one. The Japanese Yen is a relatively strong currency, so there may be opportunities for conservative short trades here but be careful not to stay too long in any such trade.

Conclusion

This week I forecast the best trade is likely to be short of the S&P 500 Index.