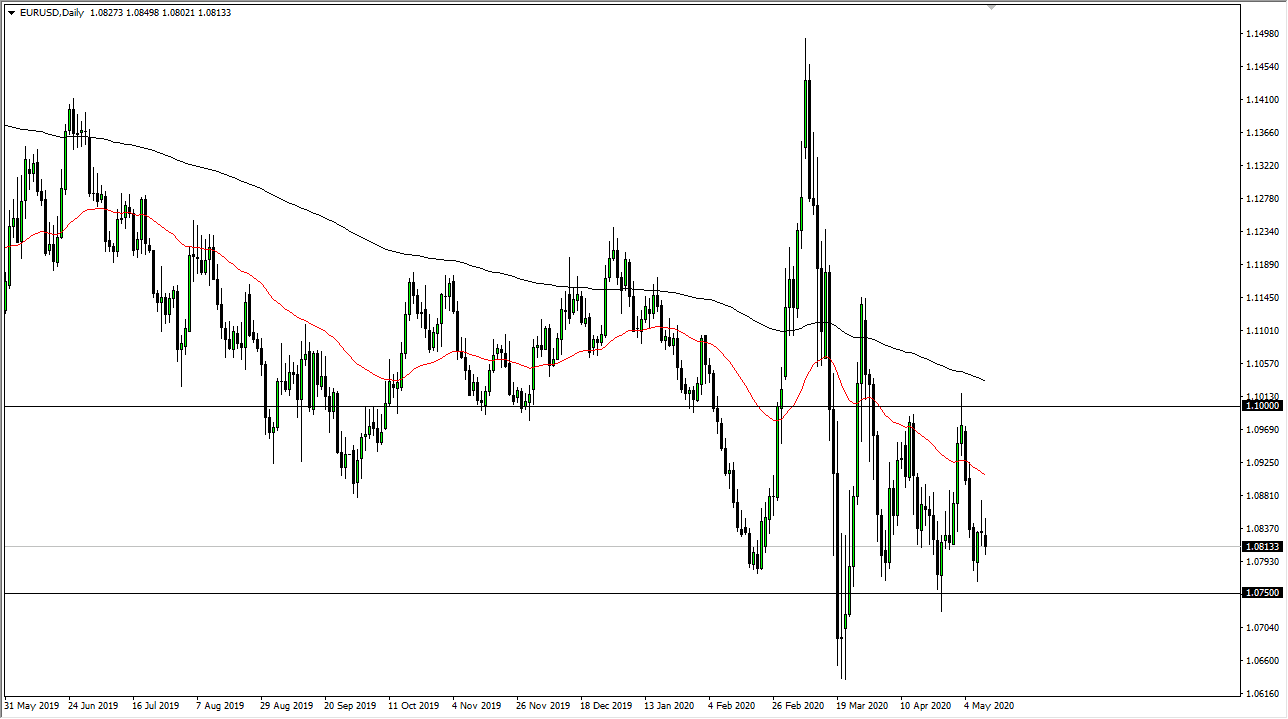

The Euro initially tried to rally during the trading session on Monday but gave back quite a bit of the gains as we broke above the 1.08 level. By showing signs of exhaustion, the market looks as if it is ready to rollover still, perhaps reaching down towards the 1.0750 level. That area is significant support, but if it gets broken to the downside it is likely that we could drop another 100 points. With the Germans ruling that the corporate bond buying of the ECB is illegal under German law, it does cause some significant issues when it comes to this currency. Furthermore, the US dollar is favored against most currencies in general, so it does make quite a bit of sense that we would see the Euro fall.

This does not necessarily mean that we are going to fall apart right away, and it does not mean that we cannot rally a bit. Nonetheless, this is a market that you should be selling, and I have had no interest whatsoever in trying to buy this pair, even though a bounce certainly is well within the possibility of the next few moves.

If we do rally a bit from here, I would anticipate that the 1.0950 level would be targeted, which signifies a resistance barrier that extends to at least the 1.10 level. All things being equal, I believe that this market as a “sell the rallies” type of situation. A break down below the 1.0650 level could open up the door to the 1.06 handle, followed very quickly by the 1.05 level. If that level gets broken to the downside, it is going to open a massive trapdoor for this pair and based upon longer-term charts could see this market as low as the 0.80 level, although that would be a longer-term call more than anything else.

Expect a lot of choppy behavior and volatility, so keep in mind that the market is going to continue to demand that you pay close attention to the latest moves, so with the choppy behavior, it is probably best to trade in small positions as the market continues to see a lot of headline risks, as the noise between Germany and the EU will continue to be a major problem, not to mention the fact that the European Union is in serious dire financial straits.