The Euro has broken down during the trading session on Wednesday, reaching down towards the 1.0750 level. At this point, the market is highly likely to continue to see a lot of negativity going forward, and as a result it is obvious that the Euro continues to face a lot of problems. This makes quite a bit of sense considering that the European Union is basically a basket case, and as a result it makes sense that we would see the Euro getting hammered every time it tries to rally.

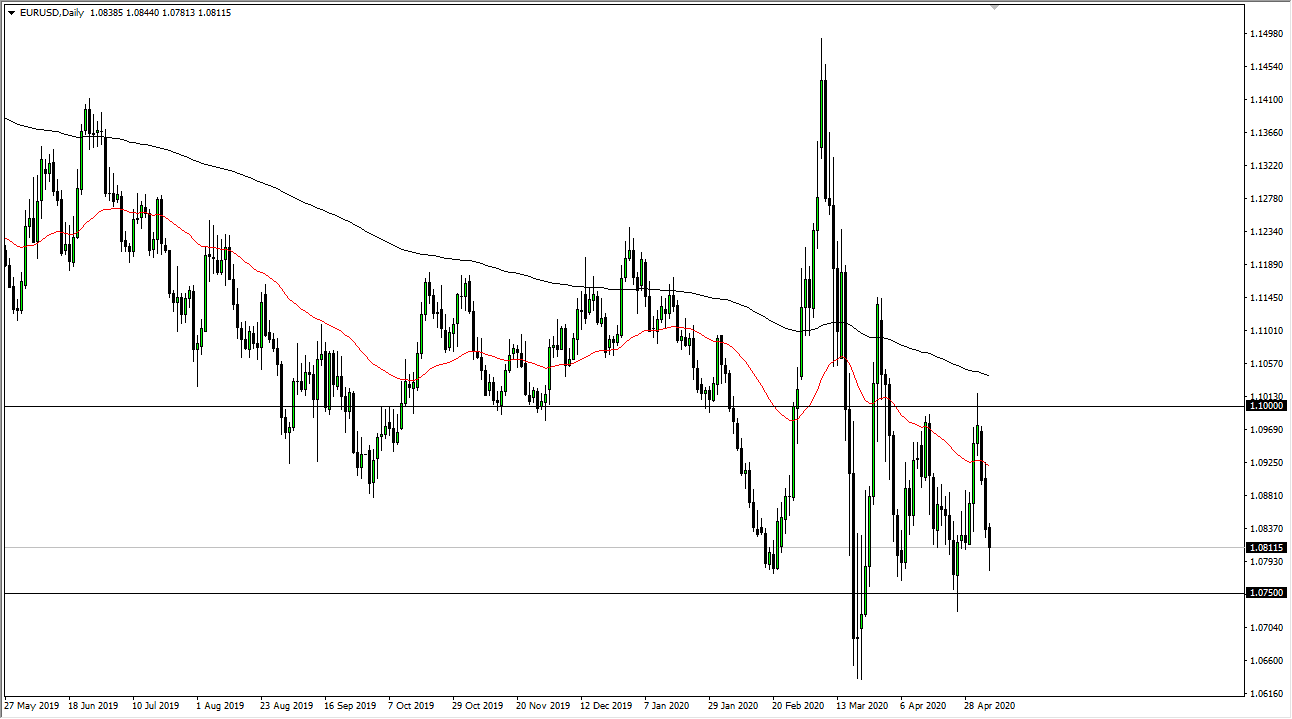

When you look at the chart, it is obvious to see that we have a nice range between 1.10 level on the top and the 1.0750 level on the bottom. At this point, it is obvious that the market is in a well-defined range that we should be paying attention to and as a result it looks as if the market is waiting for the next catalyst to go into the market in one direction or the other. If we do break down below the 1.0750 level, then it is likely that we drop another hundred points to the 1.0650 level. After that, the 1.05 level comes into focus and then eventually the market break down below there could open up a longer-term move to the 0.80 level based upon historical charts.

On the other hand, if we bounce from here, and that is probably the most likely scenario, we will try to go back towards the top of the range. At that point, I would be more than willing to start selling this market once we get to the 1.0950 level, but I think of it as a general “range” so a little bit of patience may be needed in order to short this market in that vicinity. I am not looking to buy this pair right now, even though a bounce does make quite a bit of sense. This is because from the fundamental standpoint it is very unlikely that the Euro takes out to the upside. In fact, if we break above the 200 day EMA which is sitting at the 1.1050 level, then I would have to rethink the entire situation, but at this point that is simply something that could happen, not something that I expect to happen. If things change, I will let you know but, in the meantime, it is a simple matter of fading rallies as they occur.