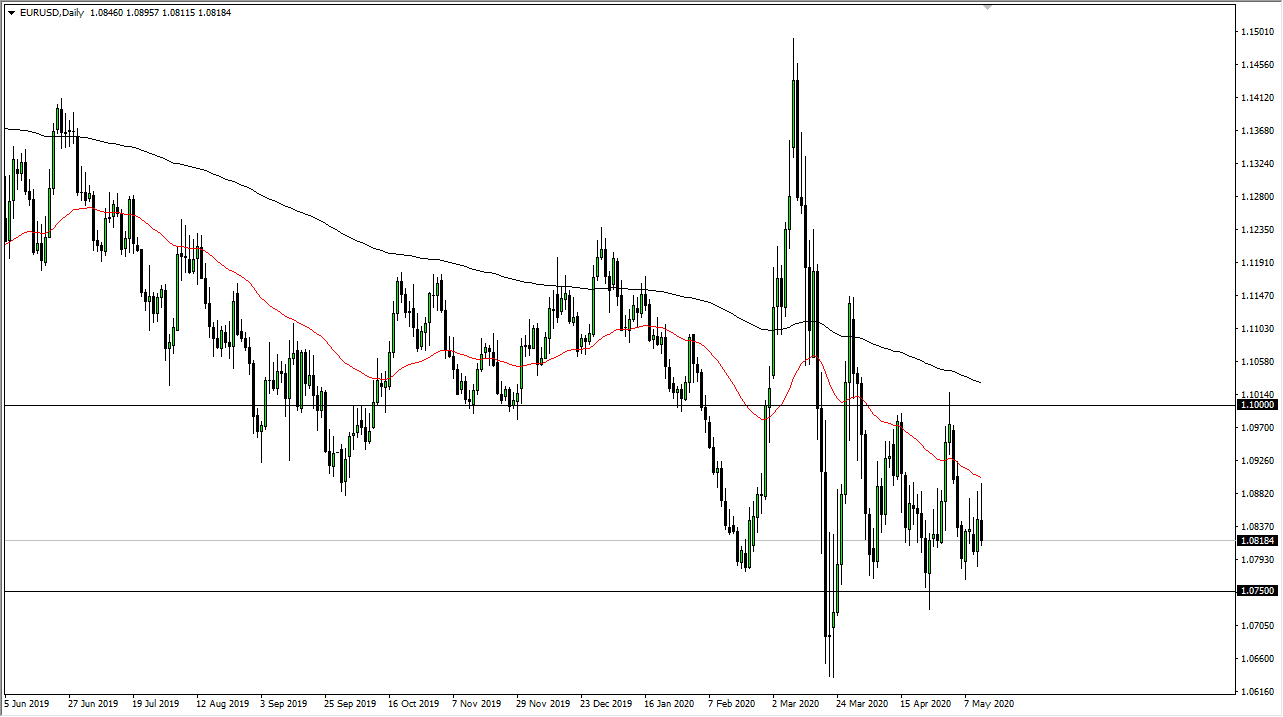

The Euro has rallied a bit during the trading session on Wednesday, reaching towards the 1.09 level before rolling over. By rolling over the way the market has, it shows that the Euro cannot be trusted at this point. We are getting close to the bottom of the overall range, so one would think that there is a potential for a bit of a bounce. The 1.0750 level underneath could offer a bit of buying pressure, but if we were to break down below there, that opens up a move to much lower levels.

The candlestick of course is very bearish, but we have seen a lot of back and forth at this point, and the volatility should continue to be a major issue. The US dollar will be favored over the Euro in general, as the market continues to worry about the fundamentals when it comes down to the European Union. At this point in time, the market has a lot more faith in the US than the European Union, and that will more than likely continue to be the case. Looking at this chart, it is obvious that the 1.09 level continues offer issues, so as long as we see the 50 day EMA in that range, it is more than likely going to continue to offer resistance as well.

If we were to break down below the 1.0750 level, it is likely that the market will find a move down to the 1.0650 level likely. Below there, then it opens up the move to the 1.05 handle after that. That is a major support level based upon longer-term charts, going back so far that you would not only have the EUR/USD chart, but you would also have a basket of European currencies going back to the Deutschmark against the US dollar. Ultimately, I will be fading this market every time it rallies as I did do early in the session on Wednesday. This is a short-term type of market, and not one that you can play for longer-term moves anytime soon. Taking advantage of “cheap US dollars” will probably be the best way going forward. I do not like the idea of trying to get too cute and buy this market, as the downtrend is firmly ensconced and nowhere near breaking down. I do not have any interest in trying to fight what has been the trend for the last several years.