A new economic assessment announced by EU Economy Commissioner Gentiloni puts the 2020 GDP recession in the Eurozone at 7.75% and for the European Union at 7.50%. It will be the most severe downturn in the history of both, while recovery prospects remain dim. Debt is ballooning across the union, with Greece, Italy, and Spain especially hard-hit. France, the second-largest economy in the bloc, is forecast to collapse by over 8%. The overall condition is notably more complex than during the 2008 global financial crisis, where GDP contracted by 4.5% or the 2015 Eurozone debt crisis. Therefore, the Euro is expected to extend its structural weakness, granting the EUR/TRY a bearish catalyst to accelerate its breakdown.

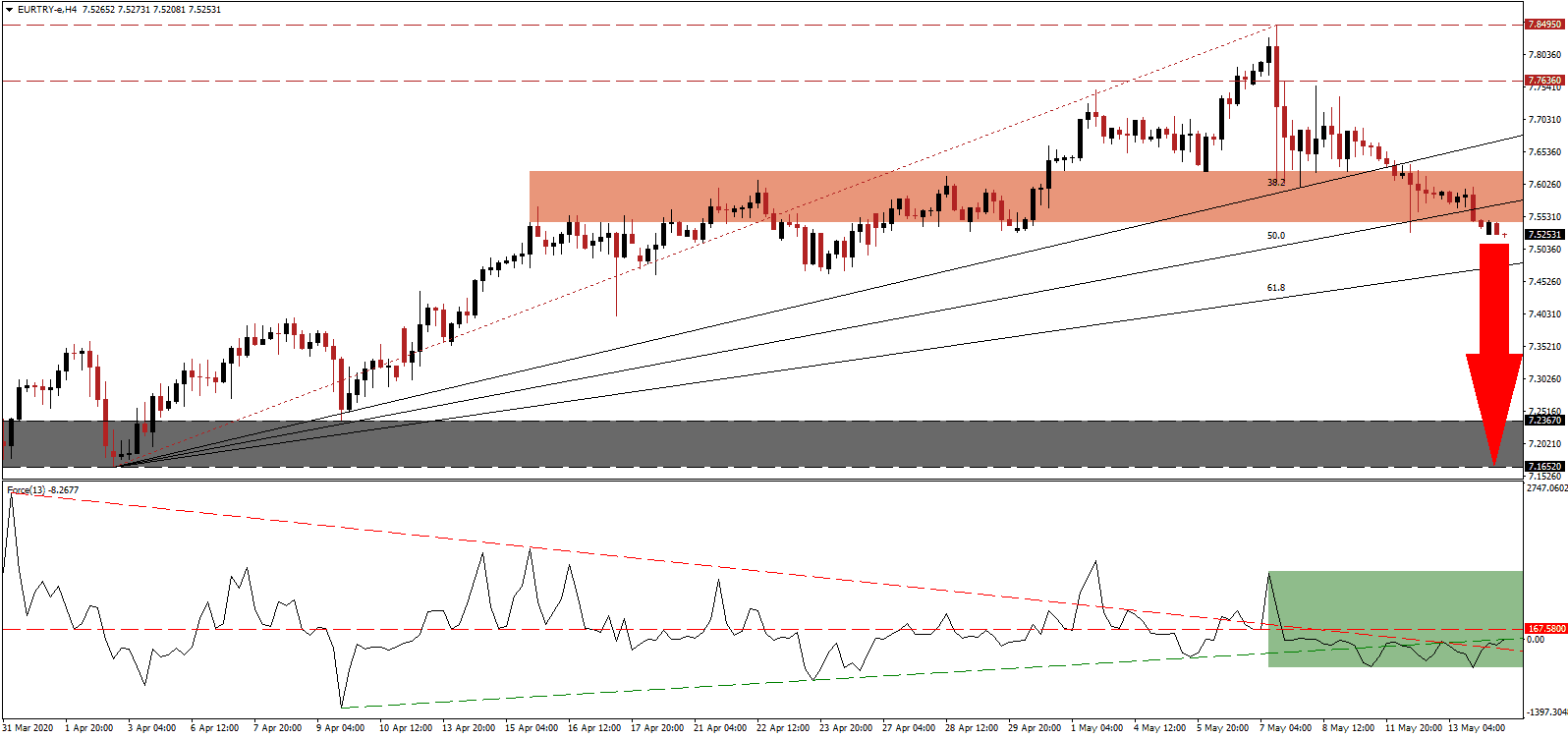

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level but was able to drift higher from its recent low. With the ascending support level and the descending resistance level reversing roles, as marked by the green rectangle, bearish momentum remains dominant. A breakdown from current levels will lead this technical indicator deeper into negative territory, strengthening the influence of bears on the EUR/TRY.

Unlike many other politicians, the Eurozone leadership is more realistic on recovery prospects once the Covid-19 pandemic is under control. Estimates call for a 2021 expansion of 6.3% in the Eurozone and 6.1% in the EU. Given the lack of unity, highlighted by the reluctance of Germany and the Netherlands to be dragged into debt by its southern neighbors, the outlook is overly optimistic. The EUR/TRY completed a breakdown below its short-term resistance zone located between 7.5436 and 7.6236, as identified by the red rectangle.

Adding to bearish drivers in this currency pairs is the conversion of the ascending 50.0 Fibonacci Retracement Fan Support Level into resistance, following the collapse below it. From a fundamental perspective, prospects for the Turkish economy are more upbeat, forecast to contract by 3.5% in 2020 with a 6.0% recovery in 2021, per the latest analysis by the European Bank for Reconstruction and Development (EBRD). Turkish President Erdogan vowed the economy will withstand foreign plots against it and has shown signs of resilience. The country is also home to vast amounts of gold reserves in private homes, increasing recovery potential. Price action is well-positioned to extend its correction, taking the EUR/TRY into its next support zone located between 7.1652 and 7.2367, as marked by the grey rectangle. A breakdown extension is probable, pending another catalyst.

EUR/TRY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 7.5250

Take Profit @ 7.1650

Stop Loss @ 7.6450

Downside Potential: 3,600 pips

Upside Risk: 1,200 pips

Risk/Reward Ratio: 3.00

In case the Force Index spikes above its ascending support level, acting as resistance, the EUR/TRY is likely to attempt a short-term reversal. Given the mounting negative progress across the Eurozone, as evident by worse than forecast economic data, Forex traders are recommended to view any advance as an excellent selling opportunity. The next resistance zone awaits price action between 7.7636 and 7.8495.

EUR/TRY Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 7.7050

Take Profit @ 7.8250

Stop Loss @ 7.6450

Upside Potential: 1,200 pips

Downside Risk: 600 pips

Risk/Reward Ratio: 2.00