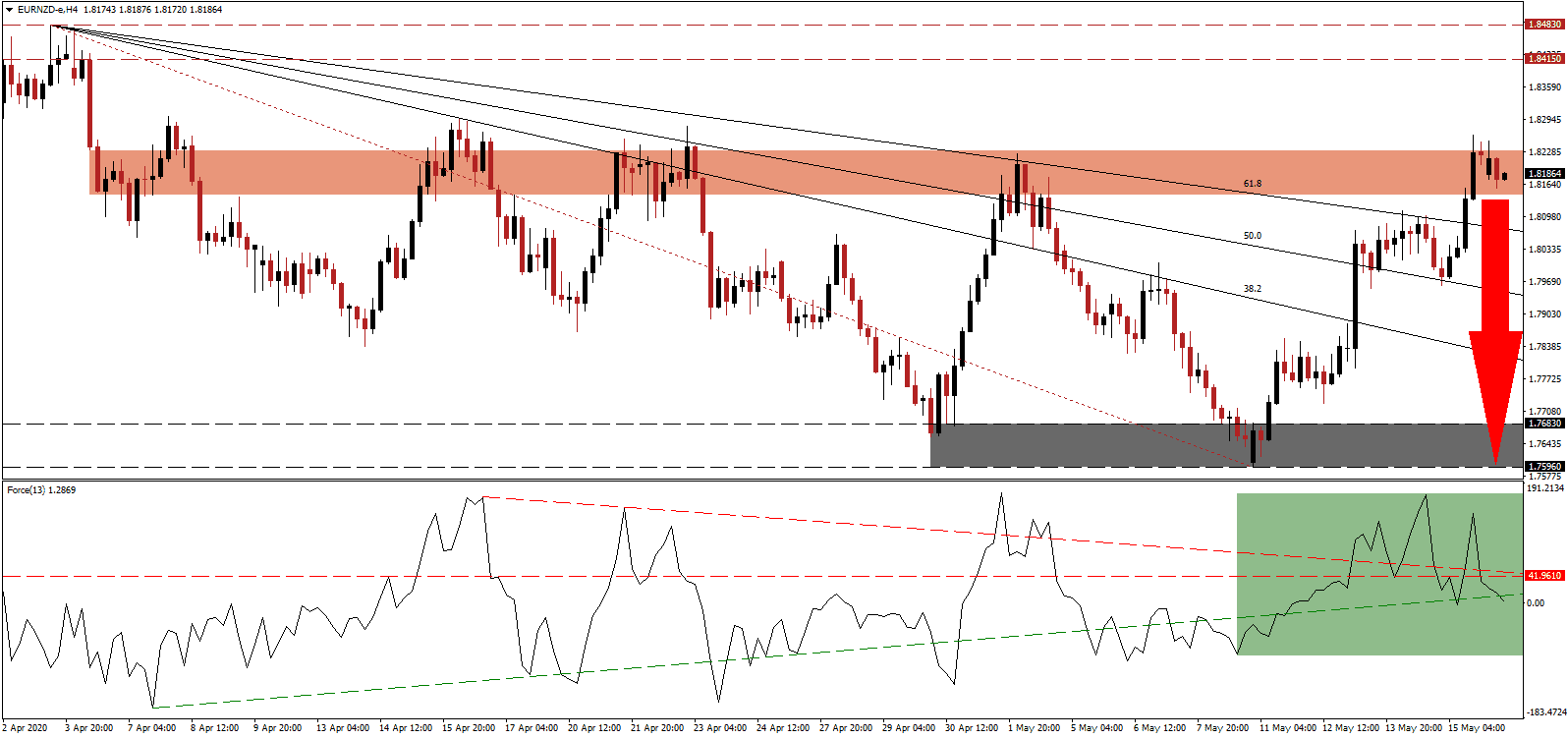

With the Eurozone in a recession, Germany entered one before the rest of the bloc after fourth-quarter data was revised lower. Before the Covid-19 pandemic resulted in nationwide lockdowns, economic data pointed towards a manufacturing recession, which emerged during the US-China trade war, while the global output was naturally falling. Germany, the export engine, and economic leader of the Eurozone reported a contraction less severe than that of France and Italy. Markets are now focused on second-quarter data to assess the situation more accurately. Bullish momentum in the EUR/NZD collapses after this currency pair reached its short-term resistance zone from where a breakdown is favored.

The Force Index, a next-generation technical indicator, initially accelerated above its horizontal resistance level, followed by a spike above its descending resistance level. It swiftly collapsed below both, as marked by the green rectangle, and has now corrected below its ascending support level. This technical indicator is on the verge of moving below the 0 center-line and into negative territory, ceding control of the EUR/NZD to bears.

Existential pressures across the Eurozone, in its third substantial crisis in twelve years, are dominant. After 2008 and 2015, the global financial and sovereign debt crisis, respectively, the single-currency bloc failed to adapt and implement positive structural changes. Divisions between member countries are widening, and the Covid-19 pandemic may result in a costly breakout, a risk that cannot be ignored. After the EUR/NZD temporarily pierced its short-term resistance zone located between 1.8142 and 1.8232, as identified by the red rectangle, bearish momentum started to accumulate.

New Zealand is faced with a potential leadership change this year, as the criticism of Prime Minister Ardern and her handling of the economy is rising. She received international praise for containing the spread of the virus, but her neglect of long-term economic stability is equally apparent. The new budget saw an unprecedented NZ$50 billion allocated to restore employment to pre-Covid-19 levels within two years, in a sign that any economic recovery will be government-led. While this presents a significant bearish development, concerns out of the Eurozone are more severe. The EUR/NZD is, therefore, expected to collapse below its entire Fibonacci Retracement Fan sequence and into its support zone. This zone is located between 1.7596 and 1.7683, as marked by the grey rectangle.

EUR/NZD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.8185

Take Profit @ 1.7600

Stop Loss @ 1.8315

Downside Potential: 585 pips

Upside Risk: 130 pips

Risk/Reward Ratio: 4.50

A reversal in the Force Index above its descending resistance level can temporarily extend the EUR/NZD. Given the mounting uncertainty inside the Eurozone, which just reported the steepest quarterly GDP contraction in its history at 3.8%, the upside potential remains confined to its resistance zone located between 1.8415 and 1.8483. Forex traders are advised to take advantage of any push higher with new net short positions.

EUR/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.8380

Take Profit @ 1.8480

Stop Loss @ 1.8330

Upside Potential: 100 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.00