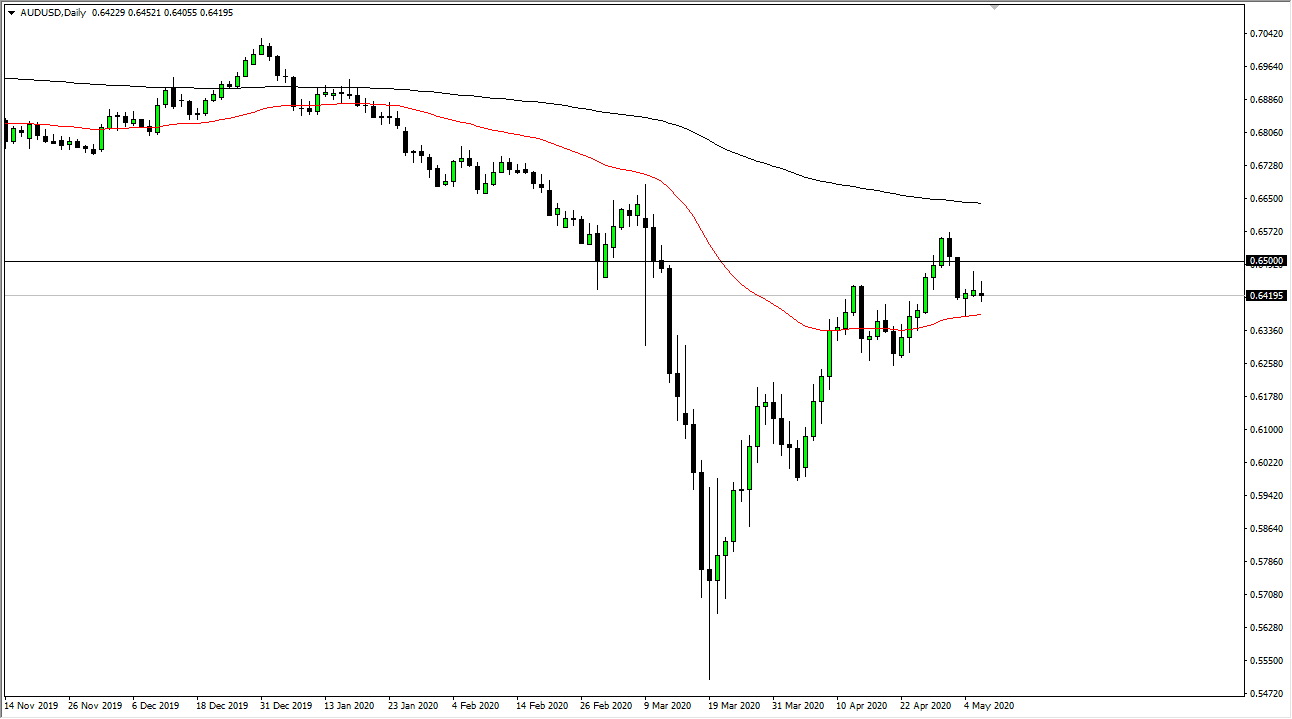

The Australian dollar has initially tried to rally during the trading session on Wednesday but gave back the gains to form a bit of a shooting star. This matches the shooting star from the previous session but is countered by the hammer that formed during the Monday session. Furthermore, the 50 day EMA is just below, and that of course will attract a certain amount of attention. At this point, it looks as if the 0.65 level continues to be a major problem, and with that in mind it makes quite a bit of sense that we perhaps pullback from here. However, the market is going to have to focus on the jobs number at the end of the week, I suspect that the Thursday session will possibly be somewhat quiet with a little bit of a negative bias.

If we do break down below the 50 day EMA, it is likely that the market goes down to the 0.6250 level, which was the previous low. If we break down below there, then it is likely that the market goes much lower, perhaps down to the 0.62 level, and then eventually the 0.60 level. The Australian dollar is of course going to be sensitive to the overall economic condition around the world, as we have to wonder whether or not there is going to be enough demand for products from China. After all, Australia is essentially the “general store” for China, providing things such as copper, silver, gold, and aluminum. Ultimately, if there is a lack of demand for commodities out of Australia, that will cause a certain amount of attention to be paid to this market and will probably send it much lower.

Thursday does feature the Trade Balance figures out of Australia, which could give us an idea as to how much demand there has been for Aussie commodities, but at the end of the day it all comes down to China and of course the expectations of global growth or shrinkage. The market has been a bit overextended for a while, so it makes quite a bit of sense that we get a pullback at the very least, if not some type of major pullback from the large round figure. I believe that the economic conditions continue to warrant caution, and with the jobs number coming out on Friday it is likely that we will see more safety trading again.