The West Texas Intermediate Crude market has been relatively choppy during the trading session on Wednesday, as the market is trying to decide what’s going to happen next. With the OPEC members meeting during the trading session on Thursday via teleconference, and some of the other major players in the world joining that conference, people will be paying close attention to any production cuts that come out of that meeting. This of course would have a massive influence on the market, so it’s not a huge surprise to think that Wednesday will have been a relatively quiet day.

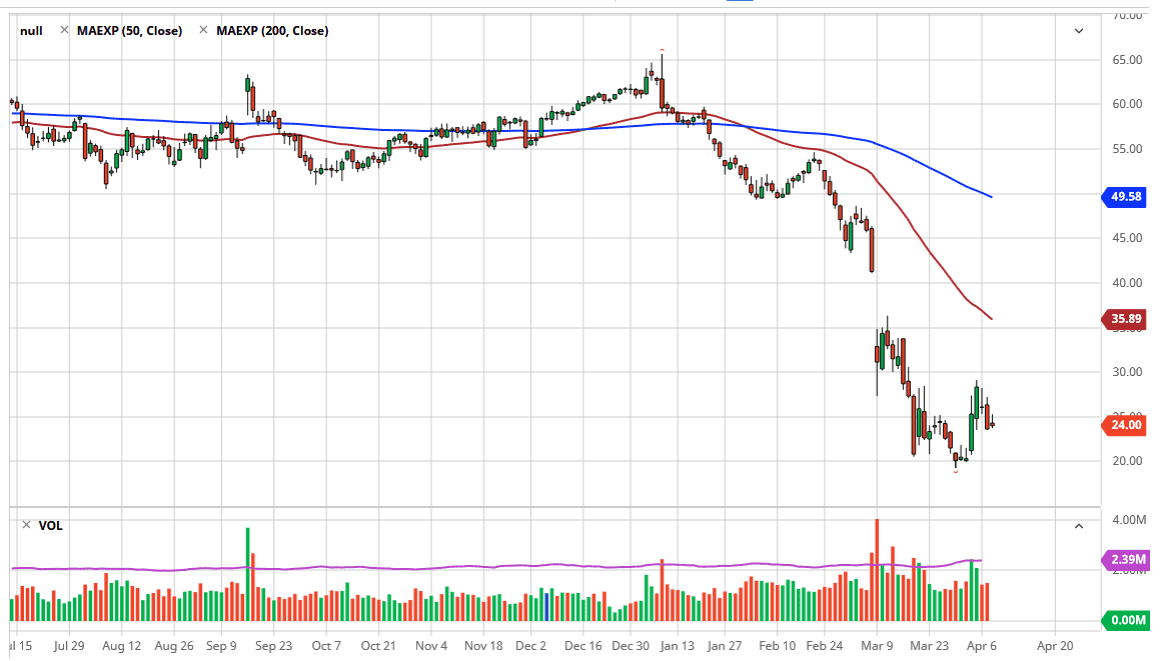

Looking at the candlestick, you can see that the range was relatively small, as traders were willing to take too much risk on and one direction or the other. The $25 level looked to be important, because we could not break above there. That being said, we were above there just a couple of days ago, so I don’t think it is a “brick wall”, just that people are using it as a psychological barrier to define the market. At this point, if the market were to break above there it’s likely that the WTI market could go to the $27.50 level. On the other hand, if we were to break down below the candlestick from the Tuesday session, it opens up the door to the $22.50 level.

That being said, it’s not until the results of that meeting our release that one can see the true reaction to the marketplace. Regardless, any rally based upon a production cut is probably somewhat limited in the sense that there is a huge drag on demand for crude oil. Because of this, I look at rallies with suspicion unless of course there is an announcement of something in the order of a 10 million barrel cut. We are more than likely never going to see that, so although we may get a little bit of a bounce from a significant production cut, it’s going to take several months to work through the excess. On the other hand, if the meeting doesn’t produce any type of cut, oil will almost certainly break down significantly, perhaps reaching down towards the $20.00 level or even lower than that. That of course would be a major breakdown, and as a result there would be even more selling coming into the market at this juncture, it’s not until we get a move after the announcement that we can put serious money to work.