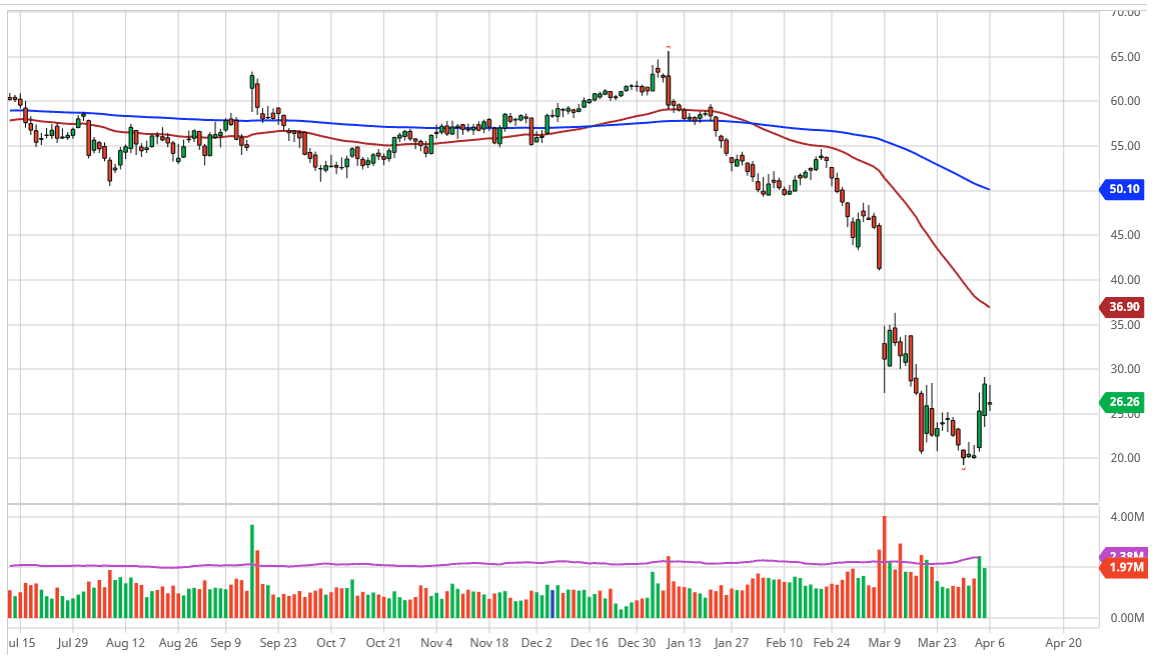

The West Texas Intermediate Crude Oil market has gone back and forth significantly during the trading session on Monday to open up the week, as we initially gapped lower. At one point early in Asian trading, the West Texas Intermediate Crude Oil market was down 12%. We have rallied significantly, and even almost got back to breakeven during the day before falling yet again. This insane amount of volatility shows just how much trouble there is, and as a result it’s very likely that we will continue to see rally sold into. After all, a market that is this volatile doesn’t necessarily suggest that people will be comfortable buying, so at this point it’s very likely that the rallies will continue to look a bit suspicious.

The candlestick is very neutral, but it is down near the gap. By losing almost 8% during the day, the market shows just how concerned people are about the potential of OPEC meeting that initially was supposed to be over teleconference during the day on Monday but was pushed back to Thursday. There seems to be a lot of back and forth between Russia and Saudi Arabia as to whether or not there will be production cuts. There does seem to be signs of a bit of progress, but it’s obvious just how skittish this market is going to be.

Regardless of what OPEC or Russia does, the reality is that demand is still going to be almost 0, so therefore it’s likely that the oil markets will continue to struggle to hang on to gains. At this point, it’s very unlikely that the market can break to significantly to the upside, but at this point I think any time there is a rally it’s likely that we will start to short at the first signs of exhaustion. The gap above could be a target if there was a sudden bullish move, but at this point it’s very unlikely that we get that filled anytime soon. I believe that the $20 level underneath would be a massive support level, so if we were to break down below there the market could completely unravel. In the short term though, I think simply fading short-term rallies is the best way to go going forward as the demand picture for crude oil is going to continue to be very soft going forward. Keep your position size small though, because if you are in the market, sudden headlines could cause major headaches.