The USD/JPY fell by more than 100 points during Monday's trading session, to the 107.50 support, before settling around the 107.75 level in the beginning of Tuesday’s trading. Yesterday's session is an extension of trading sessions last week which witnessed a downward correction as investors abandoned the US dollar as a safe haven. The closing of companies and keeping people at home has forced a record number of Americans to leave work, and raised expectations that many companies will end up in bankruptcy. Many investors expect what could be the worst recession since the Great Depression.

Investors are focusing on the pathway of the coronavirus to obtain clues as to how the economic consequences will emerge. Last week, signs that the epidemic reached its climax in New York and other parts of the world helped to abandon the US dollar as a safe haven. Despite optimism in the markets, the overall data show that the number of new cases is still increasing. As there are more than 1.86 million confirmed cases of the deadly epidemic around the world, led by the United States with more than 557,000 people infected, more than 22,000 Americans have died, according to Johns Hopkins University statistics.

The global economic stimulus plans are not over. Japan's budget includes 220 billion yen ($2 billion) to help its companies return to production. There were 23 billion yen to facilitate the transfer of companies and factories from other countries to the country. And before the weekend, US economic advisor Kudlow expressed interest in creating new tax incentives for American companies to do something similar. American tariffs on the bulk of imports from China have already encouraged US companies to rethink supply chains.

Reports indicate that a Covid-19 epidemic will put such a trend in consideration, but there is also a compensating force that should not be forgotten, and it stems from the size of the Chinese domestic market. For example, China is GM's largest market, and Apple's second largest market. And some foreign companies will maintain a strong presence in China to be close to a large and rapidly growing market, even if not at the previous speed.

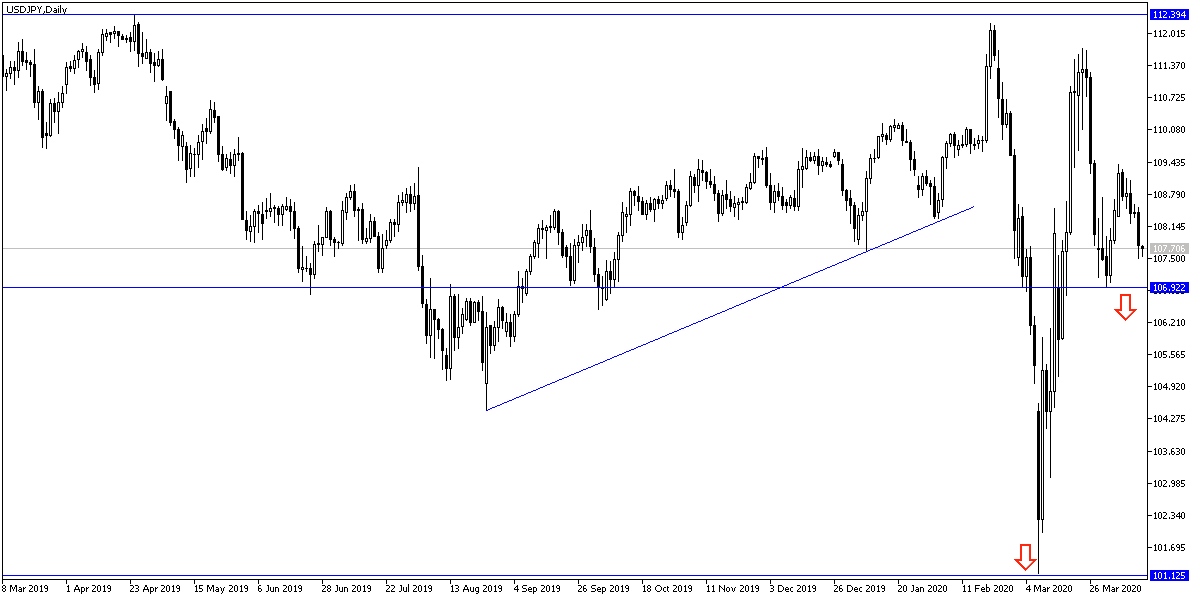

According to the technical analysis of the pair: I confirmed in the recent technical analyses of the USD/JPY that a break below the 108.00 support will increase the bear's control over the performance and therefore the pair has moved towards lower support levels, the closest ones are currently 107.60, 106.90 and 106.00, respectively. Without testing the 110.00 psychological resistance, there will be no chance of the pair's bullish momentum returning.

Today, the pair may react to the announcement of the Chinese trade balance figures and the latest figures for coronavirus infections and death.