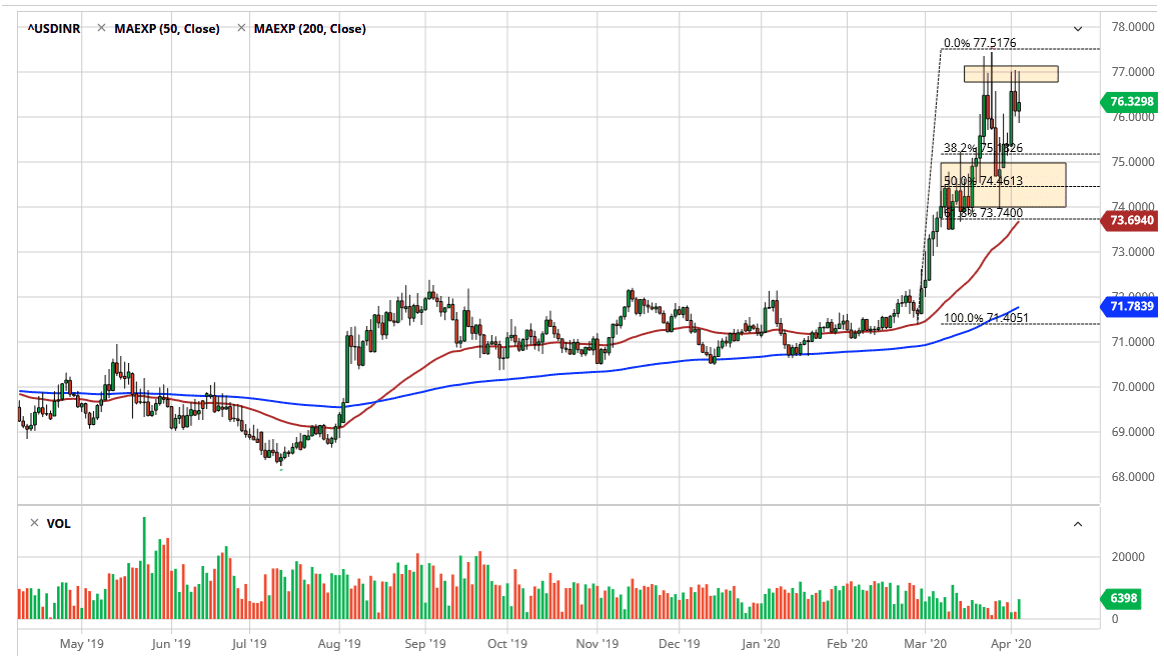

The US dollar rallied a bit during the trading session on Friday, heading towards the ₹77 level yet again, as we did the previous session. With the candlestick that formed, it suggests that the ₹77 level will continue to offer significant resistance, but this doesn’t necessarily mean that the pair won’t be able to break above there. After all, we have seen this market rocket to the upside and there are a lot of things to consider when it comes to the dynamics between the two economies.

The US dollar is of course a safety currency, while the Indian rupee is a major emerging market currencies. Ultimately, this is a chart that shows the emerging market health in general, and at this point I do think that eventually we will break out of the consolidation area that I have marked here, with the ₹77 level on the top been massive resistance, while the area just below the ₹75 level offers a significant amount of support. At this point, it’s very likely that we continue to just bounce back and forth and try to figure out the next move. Ultimately though, it’s very likely that the coronavirus continues to keep the global trade situation very tentative at best, so having said that it should work against EM currencies in general, with the rupee of course not being any different.

That being said, if the market does pull back, the 50 day EMA is starting to race towards the ₹74 level and reach into that consolidation area that I have marked just above there. At this point, it’s only a matter of time before we get some type of either reversal or consolidation but in order for this market to turn around completely, we need to see the Indian lockdown and, and of course global growth start becoming a thing again. At this point it’s difficult to imagine that we are that close to it, so I think we may kill some time in this range, before extending gains even further. For what it’s worth, it’s not until we break down below the 50 day EMA that I would be concerned about the uptrend, but even then, there seems to be a large base closer to the ₹72 level. For the foreseeable future, the US dollar should be favored over owning the Indian rupee as there is so much uncertainty out there and of course the Indian economy is about to take a massive hit based upon the lockdown.