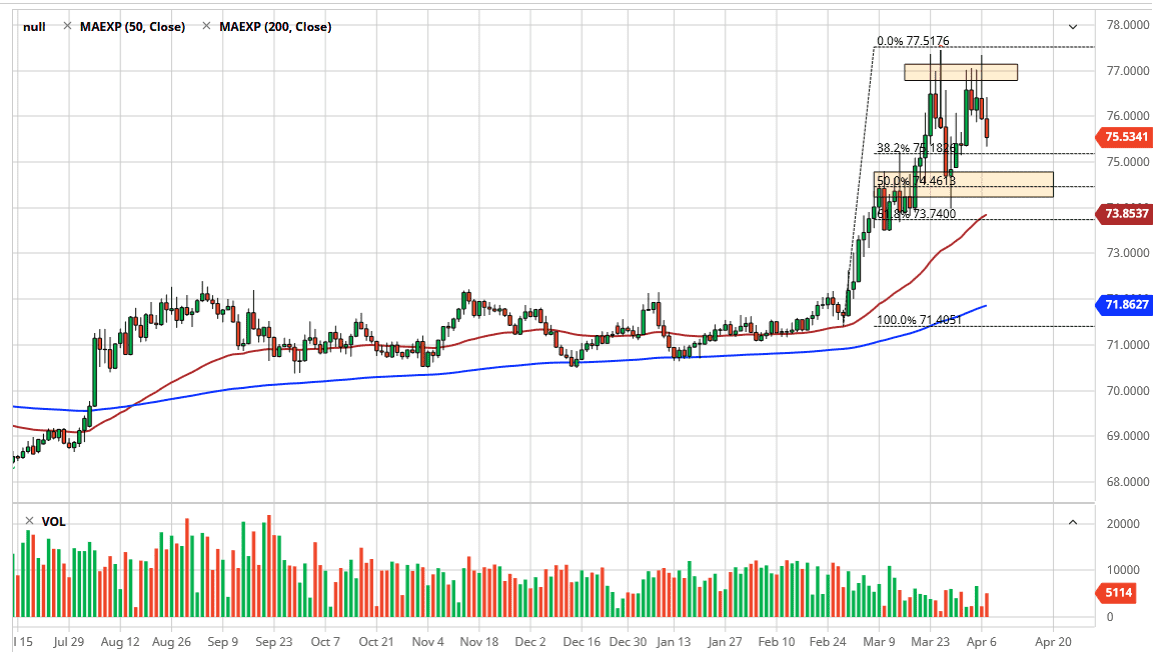

The US dollar initially tried to rally during the trading session on Tuesday but found trouble above the ₹76 level as the market has carved out a range at relatively high levels to decide where we are going next. The ₹75 level has a certain amount of psychological importance built into it, and it’s also an area where we have seen structural support recently. It is because of this that I believe it’s only a matter of time before the buyers come back in, especially if there is some type of “risk off” type of scenario, something that isn’t exactly a real stretch of the imagination at this point.

Looking at the candlestick, it does show signs of weakness, and does suggest that we probably drift a little bit lower. That being said, there is a lot of noise just below so shorting the US dollar at this point would be very difficult. Furthermore, you have to worry about the emerging market aspect of the Indian rupee and the fact that the Indian economy is essentially shut down is going to do the Rupee no favors whatsoever. At this point, it looks as if the market is simply killing time in a range between 75 and 77 in order to figure out where to go next.

From the technical standpoint, the 50 day EMA is starting to reach towards the ₹75 level, so therefore I think it’s only a matter of time before the buyers come in and pick up that bounce. In fact, it’s not unless we get some type of major “risk on” type of scenario that this pair will break down below the 75 handle from a longer-term standpoint. If it does and of course clears the 50 day EMA, then we can talk about a potential move down to the ₹72 handle. However, it’s difficult to imagine a scenario where we get that big of a push higher. At this point, it’s very likely that the market will find plenty of value hunters on this pullback so if you are not in the market right now, it might be more prudent if you are simply going to sit on the sidelines and wait for some type of value underneath. The alternate scenario of course is that the market breaks above the top of the candlestick for the trading session on Tuesday, which would more than likely bring in a short-term move towards the ₹77 handle.