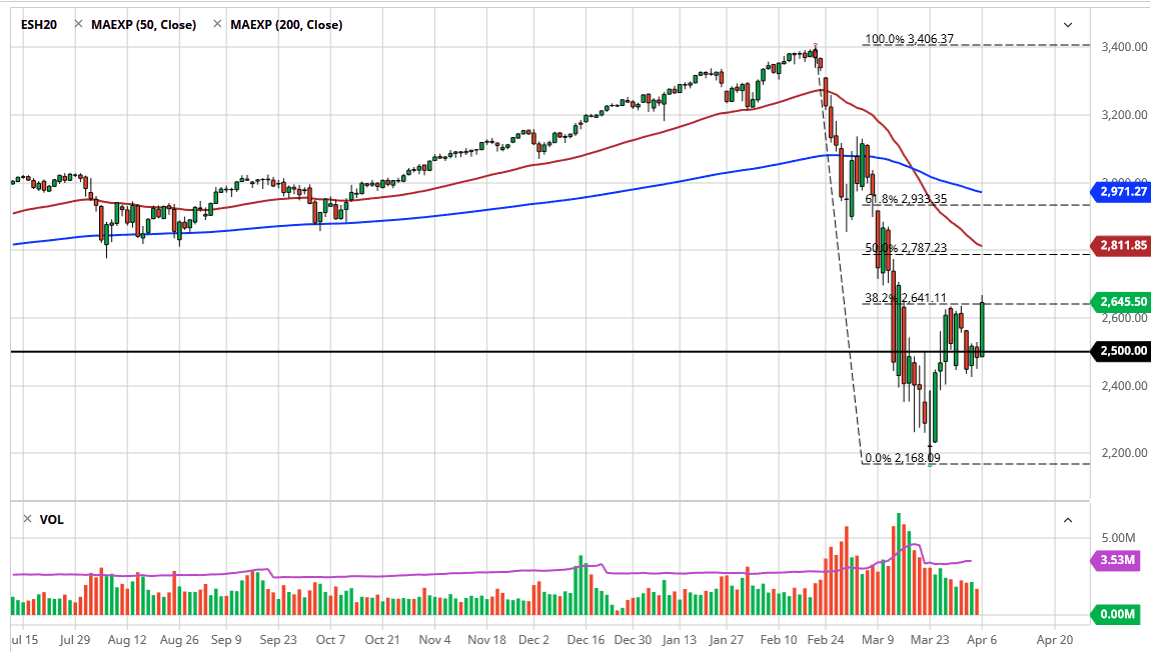

The S&P 500 rallied significantly during the trading session on Monday to kick off the week, breaking above the 2650 level at one point. This is an area that should be significant resistance, but the fact that we are closing right there suggest that it is only a matter of time before we rally again. At this point it’s likely that the market breaking above the top of the range for the Monday session should open up the move to 2750. After that, the market then goes looking towards the 2850 handle.

Before we get there though, we also have to look at the 50 day EMA which is sitting just above the 2800 level which has a certain amount of psychological important. I do believe that the S&P 500 will probably try to continue rallying, because the shape of the candlestick is so strong and of course closed towards the top of the range. It looks as if Wall Street may lead the way, as the market had such a massive move and with complete conviction. With this, we may get a slight pullback, but until we break back down below the 2450 handle, you have to start thinking about the upside at this point, at least for the time being.

Ultimately, the main driver might be the fact that the coronavirus deaths and infection rates are starting to slow down in a few places such as Italy and New York City. Ultimately, this is a market that is also reacting to Janet Yellen, the former Federal Reserve Chairwoman, suggesting that the Federal Reserve may look into coming in and buying specific equities like other central banks around the world will sometimes do. While that may or may not happen, it was just another reason to think that the stock market has rallied.

The remarkable thing is that we have seen so much in the way of volatility, but it does look like we are trying to hold out for a bigger move. The stock market is naturally built to go higher over the longer term, so I think although we have a long way to go, it’s difficult to get all in at this point. If we pull back from here, it’s possible that we make a “higher low” anyway, so it shows that a basing pattern is being worked out. All things being equal though, the 50% Fibonacci retracement of the massive selloff is closer to the 2800 level as well.