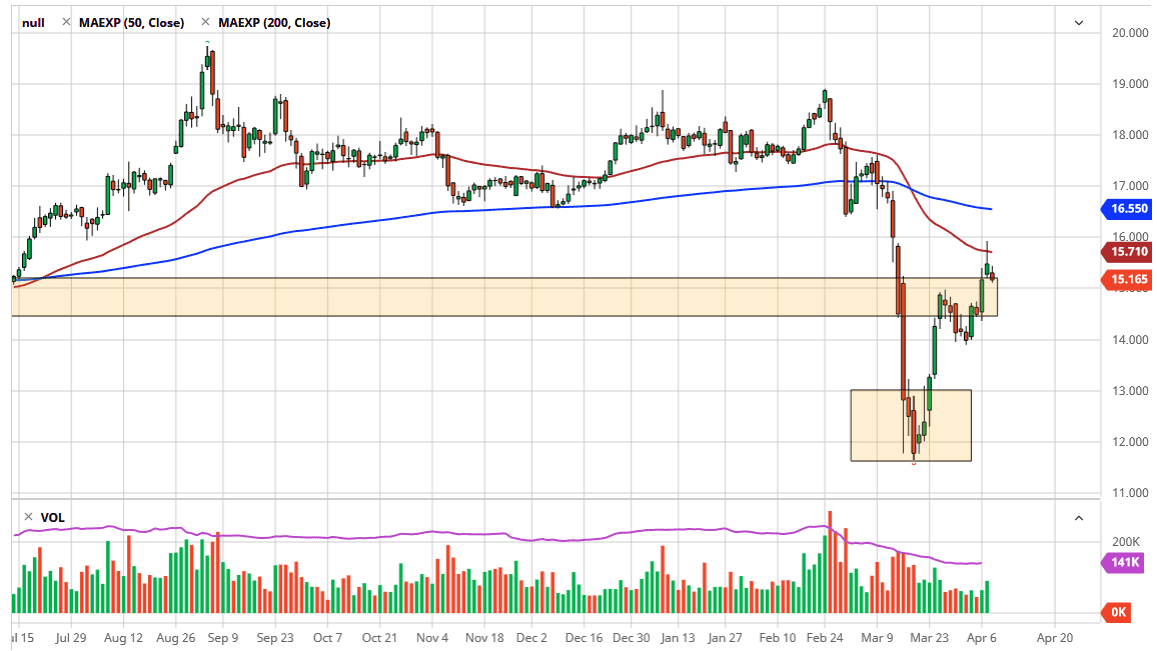

Silver markets did very little during the trading session on Wednesday, as silver may have gotten a little bit ahead of itself. At this point, the silver market had reached as high as the $16 region only pull around and form a shooting star on Tuesday. At this juncture, we had seen the Wednesday session pull back just a bit, showing signs of exhaustion. At this point, I think that the market is likely to pull back a bit further, but if it does it will more than likely offer plenty of value. I don’t necessarily want to sell silver, rather I would like to buy it at lower levels.

The silver markets are a bit different than the gold market in the sense that they also have an industrial component, as silver is used in so many forms of manufacturing, with a particular emphasis on electronics. With that, the silver market does suffer from the global supply chain breaking down and of course demand for all kinds of “things” dropping as well. It is because of this that silver continues to underperform the gold market, although both were a bit sluggish during the day to say the least.

Looking at the candlestick, the range was rather tight, so this tells you that it wasn’t anything along the lines of some type of significant break down. Rather it just simply look like a market that was trying to catch its breath after the volatility that it had seen during the previous session. With that being the case, I think if we can break above the top of the shooting star from the Tuesday session, the market is very likely to continue towards the $17.00 level, possibly even the $18.00 level longer-term. Beyond all of that, you can make an argument for a bullish flag that had recently been broken through, and if that’s the case the move measures all the way towards the $17.50 level at the least. Either way, I don’t have any interest in trying to short the silver market and therefore I like the idea of buying on dips. Central banks around the world liquefying the markets certainly makes an argument for the precious metals side of this trade. As for industrial, that is probably going to continue to struggle as far as demand is concerned going forward, as the global pandemic continues to slow things in general.