Silver markets gapped lower to kick off the week on Monday, and then reached towards the $15.25 level or so. At this point, the market turned around and started finding plenty of buyers based upon the idea of support done at the $15.00 level. I do believe that ultimately the market will continue to see a lot of traders coming in based upon the monetary policy decisions of central banks around the world, not the least of which would be the Federal Reserve.

Silver of course is a precious metal therefore people will look to it in order to protect wealth against fiat currency that is being destroyed at the moment. With the massive amount of monetary policy that we have seen out there, it makes sense that fiat currencies will continue to struggle, and precious metals should get a bit of a boost. However, the silver market unfortunately has the industrial component as well, meaning that it could be pummeled due to a perceived lack of demand, something that I do think is going to be the case.

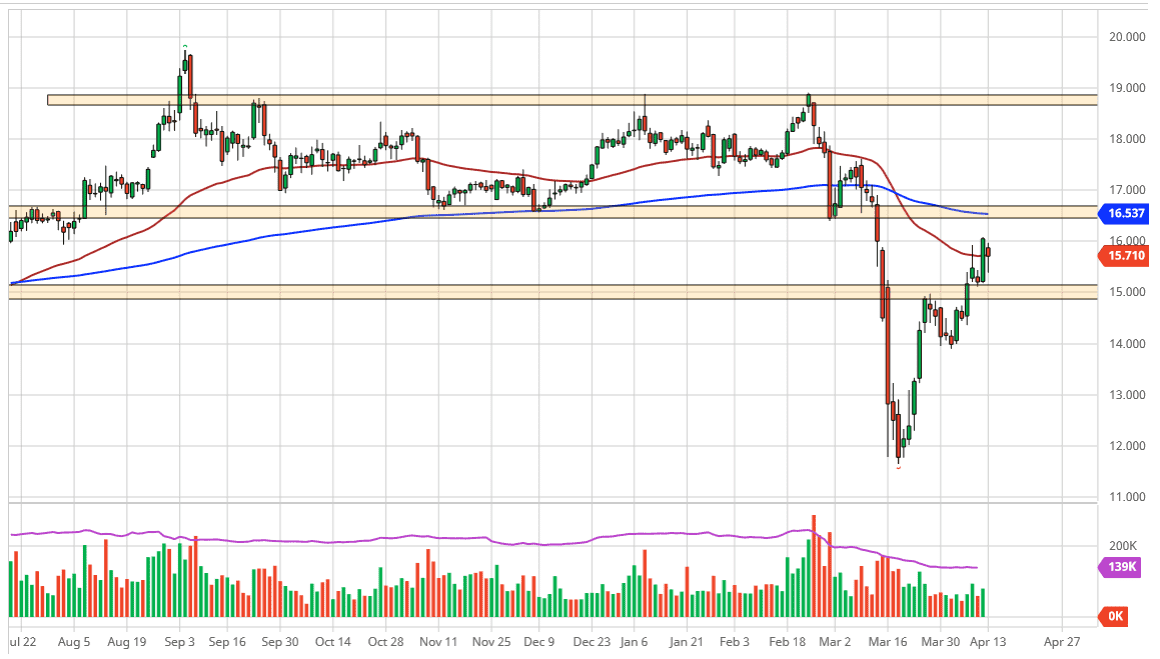

The shape of the candlestick of course is impressive, and the fact that we turned around and found buyers near the 50 day EMA suggests that there are plenty of buyers underneath willing to jump in based upon value. The bullish flag that had formed previously suggested a move towards the $17.50 level, and I think it’s very likely that we go looking towards their given enough time. This doesn’t mean that we get there right away, and it certainly doesn’t mean that we don’t break down between now and then. However, it’s not until we break down below the $14 level that I would be concerned and consider selling this market. I also recognize that the 200 day EMA is sitting at the $16.53 level and should offer a bit of resistance. If we can get above there, then we really start to accelerate to the upside again. I have no interest in shorting silver, at least not until we break down below the aforementioned $14 handle. With that in mind I remain bullish but I also recognize that silver will probably underperform gold, as gold doesn’t have to worry about the industrial component showing a major lack of demand in of course gold tends to be a much more liquid futures contract, thereby showing a bit of a knock on effect in the spot metal markets.