The recent purchases pushed gold prices towards the $1723 resistance, the highest price for the yellow metal in seven and a half years, before settling around the $1713 level in the beginning of Tuesday’s trading. Gold gained support as investors looked to it as a safe haven after the recent losses in stock markets, along with increased expectations for more moves by global central banks and financial policy makers to boost the global economy. With economic sentiment continues to deteriorate globally, more waves of government support are expected from China, India, Europe and the United States.

Gold price gains are the highest since October 11, 2012, according to Dow Jones Market data. The metal also recorded its highest level in seven years on Thursday, even with US stocks recording their biggest weekly advance since 1974 on that same day. The US financial markets were closed on Friday due to the Good Friday holiday.

Gold is often seen as a safe haven asset, moving in reverse with risk assets such as stocks. But analysts said efforts of central banks and financial policy makers have greatly supported the global economy, while the COVID-19 pandemic is causing losses that are expected to provide more support for the yellow metal. Last Thursday, the US Federal Reserve Board approved new loan programs and strengthened existing programs to provide 2.3 trillion dollars to support the economy.

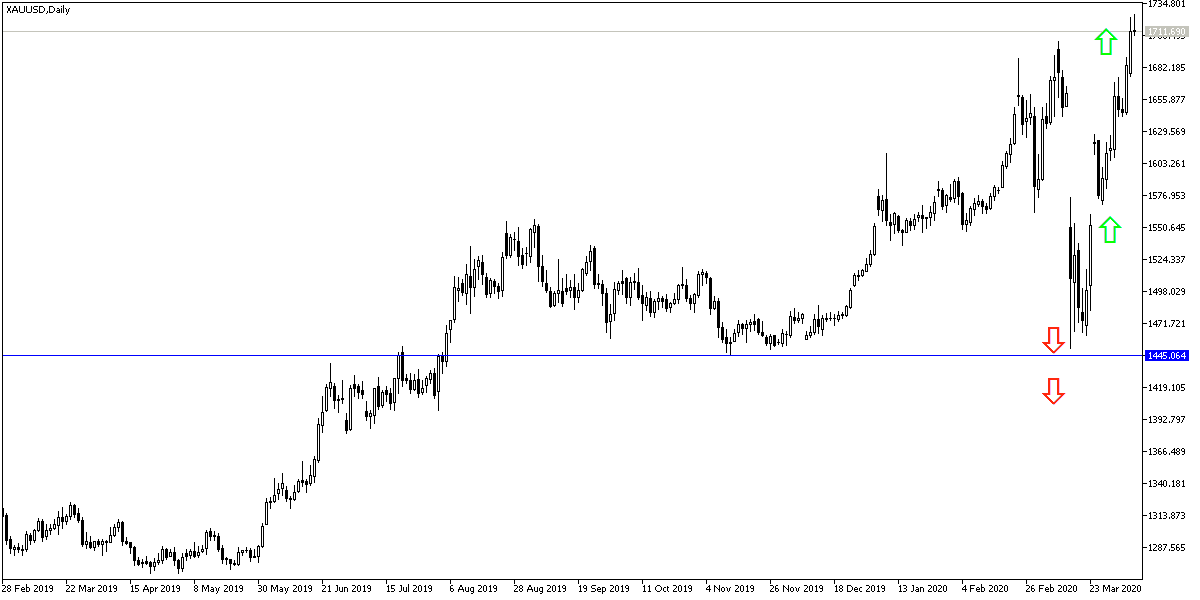

According to technical analysis of gold: We mentioned several times in the technical analyses of gold that buying from every downtrend is the best trading strategy. The recent and strong rebound in the gold price has pushed technical indicators towards strong overbought areas, and therefore profit-taking sales can occur, especially if the strength of the US dollar returns and the global markets grow confidence in containing Coronavirus. The $1,700 psychological resistance is still capping the bulls control of performance. Any sell-offs may push prices towards support levels, and the closest are currently at 1690, 1673 and 1660, respectively.

For the second consecutive day, the economic calendar has no important American economic announcements that affect the dollar, and thus gold. The update of coronavirus infection and death figures will have a strong impact on investor sentiment and financial markets in general.