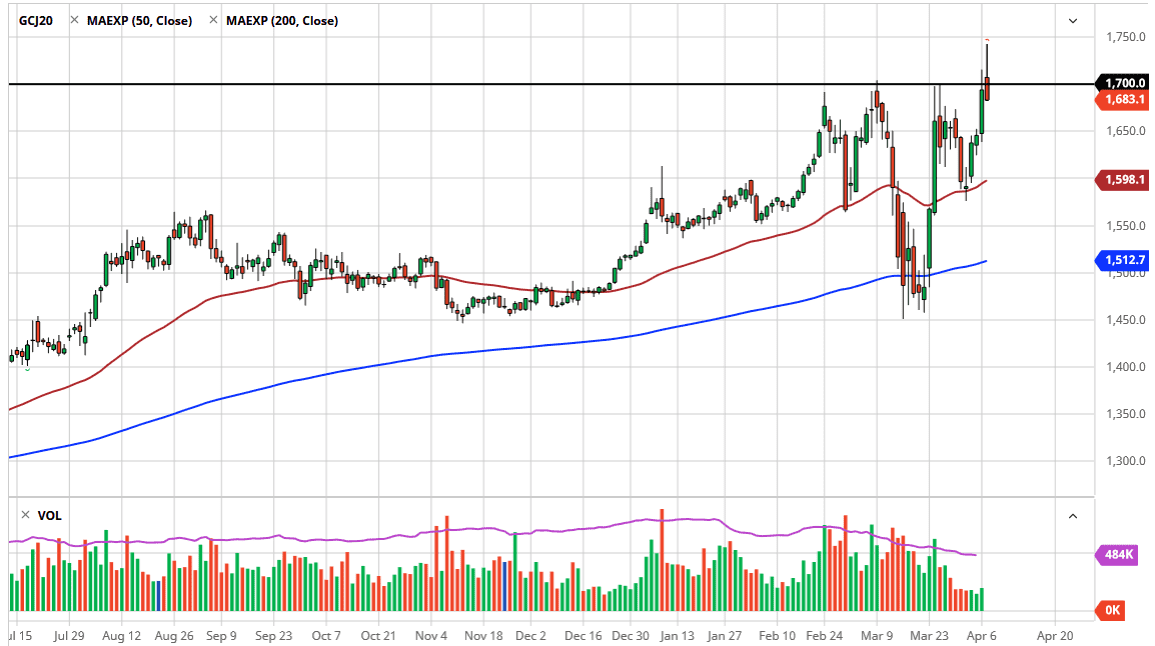

Gold markets initially tried to rally during the trading session on Tuesday and even reached close to the $1750 level. However, the market turned around and fell rather hard during the day, closing at roughly $1680. The shape of the candlestick of course is very bearish as it is a shooting star, and a lot of traders will be looking at that candlestick formation by itself.

That being said, central banks around the world continue to flood the market with cheap money, and that does typically have people looking into gold to protect themselves. After all, devaluation of fiat currency will move counter to the value of gold, so people will often come looking towards gold to protect themselves from those situations. That being said, I don’t necessarily think that this is a major meltdown just waiting to happen, but a pullback makes quite a bit of sense as we have clearly seen a repudiation of gold above the crucial $1700 level.

I suspect that the $1650 level could be supportive, and I certainly think that the $1600 level should be. The 50 day EMA is near the $1600 level, so I do think that it’s only a matter of time before you can find buyers in that area to pick this market. After all, this sets itself up to be a short-term “floor” in the market. This isn’t to say that we can break down below there, but I certainly would expect a lot of support and buyers showing up in that region. The market turning around and breaking above the top of the candlestick during the trading session on Tuesday would be rather impressive though, and that could change the entire attitude of the uptrend. I do believe the uptrend is still very much intact so I much more obliged to be a buyer on dips than anything else. I believe that selling gold at this point is rather reckless and probably a great way to lose money.

Keep in mind that there are a lot of concerns about spot gold right now, and that is having an say in the futures market. There are a lot of concerns about a lack of physical demand due to the coronavirus flight restrictions and the like, but it does seem to be abating a bit as New York and London spot prices are starting to come back within the usual deviations.