For the sixth consecutive day, the GBP/USD pair continues to benefit from the weakness of the USD and optimism about the improvement of the health of British Prime Minister Boris Johnson, who was exposed to symptoms of the Coronavirus. The Pair gains at the beginning of trading this week reached the 1.2536 resistance, its highest in a month, before settling around the 1.2500 level in the beginning of trading on Tuesday. The cable's gains coincided with a broad shift in global sentiment. Besides, Boris Johnson, Prime Minister of Britain, was discharged from the St. Thomas Hospital in London on the weekend after success treatment of a Covid-19 infection that at one point saw his chances of survival at 50-50.

Markets were hit hard last week after news of the deterioration of Johnson's health was announced, and Johnson's case added new impetus to the political and economic uncertainty in the UK, and recent years have shown that the British pound tends to respond poorly to such doubts. Therefore, news that the country's leader has been discharged from hospital to recover at his home is likely to provide more support to the British pound.

The pound's gains are also an extension of the positive momentum that came after the US Federal Reserve increased liquidity lines for global central banks with the aim of ending the global shortage of the dollar. The sudden rise in demand for cash appears to have been a natural response to the collapse of global markets due to the outbreak of the Corunavirus in the first half of March, which put great pressure on the UK financial services industry.

However, by providing direct liquidity to global central banks by creating swap lines, the Fed quickly eased this pressure, which in turn seemed to have sparked a recovery in the GBP. Sterling also tends to rise along with the rise of global stock markets as the currency has a positive relationship with risk appetite, and therefore the broad recovery in global stocks was reflected in the strength of the pound sterling.

This week will be the beginning of the US corporate earnings season, which will highlight the severity of the economic recession caused by the Coronavirus. American banks will start their reporting season as well, and markets will watch with interest the announcement of the number of nonperforming loan accounts they keep on their books, as this will provide good guidance regarding the underlying pressures in the economy. Meanwhile, European countries have begun to consider possible exit strategies from the harsh and persistent closures for several weeks that are paralyzing economic activity, but so far there are still question marks over the possibility of lifting closures.

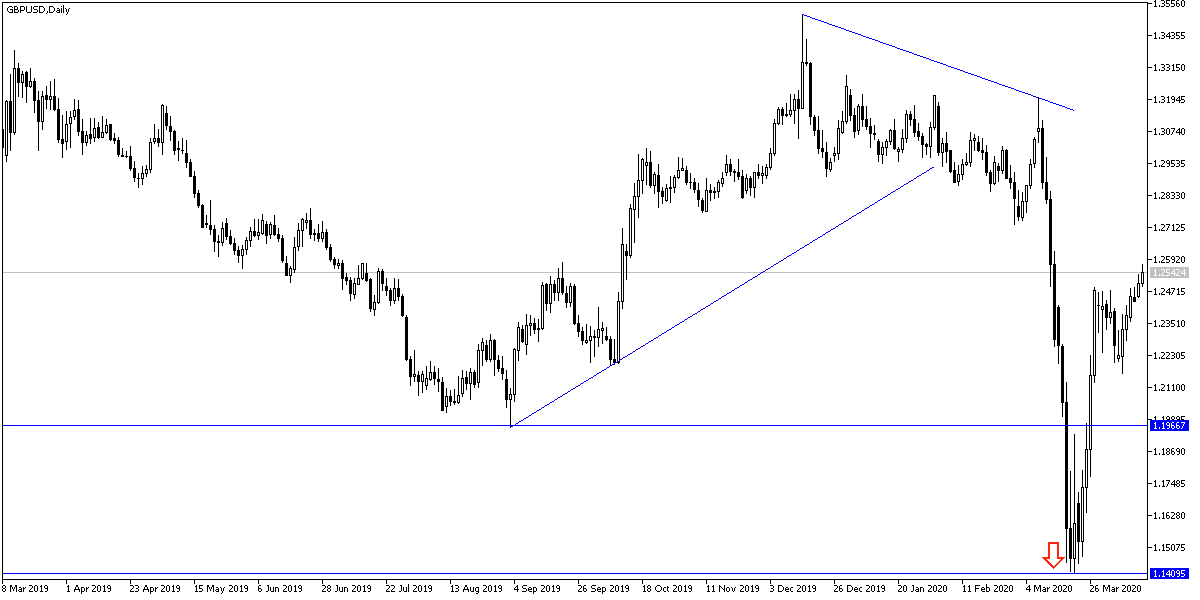

According to the technical analysis of the pair: On the daily chart, the price of the GBP/USD pair is still moving inside the formation of its last bullish channel, and breaching the 1.2500 resistance confirms the strength of the trend reversal. Markets are waiting to test higher resistance levels to ensure the bulls continued control over performance. A return to move below the 1.2300 support is a quick breakdown of the pair's recent positive outlook. Despite the recent performance, I still prefer to sell the pair from every higher level. Britain has surpassed China in terms of Coronavirus infection and death rates.

For the second consecutive day, the economic calendar has no important economic data, whether from Britain or the United States of America.