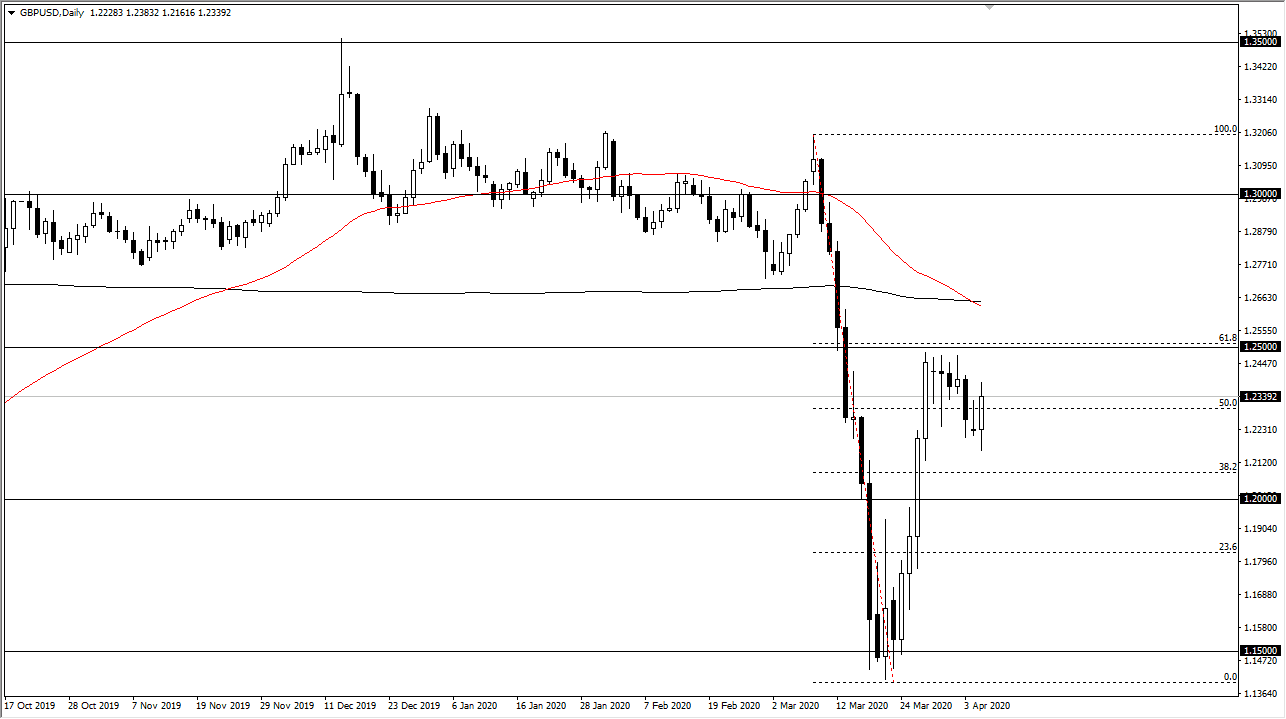

The British pound initially fell during the trading session on Tuesday, but then turned around to show signs of life at the 1.22 handle. At this point, the market has then broken towards the 1.24 handle after that. Ultimately, this is a market that continues to go back and forth and therefore it’s likely that we will see a lot of choppy trading. However, the one thing that’s worth paying attention to is that every time we rally, we can’t quite get as high as we did before. Ultimately, I think that signs of exhaustion will probably come into play and send this market lower.

The obvious level to pay attention to in this pair is the 1.25 handle as it has offered so much in the way of resistance recently. It’s not until we break above there that I think the market can truly take off to the upside and it would need to be something that with the extraordinarily “risk on” driving it. At this point, it looks as if short-term rallies continue to get sold into but obviously it’s not necessarily a market that is ready to break down either. This almost looks a bit like a bullish flag, so that’s something to keep in the back of your mind as well. However, we could be looking at a broadening top as well, which gives us the exact opposite signal.

For those who are looking for long-term signals, the “death cross” has happened, but quite frankly that one tends to be kind of late and lagging. The 61.8% Fibonacci retracement level remains just above the 1.25 handle, so that is something to pay attention to as well. In other words, it’s obvious that this market has a lot of conflicting forces from a technical analysis standpoint just above, so I think it’s going to be difficult to get overly excited about rallies. In fact, I’m looking for reasons to sell until we can get a daily close above the 1.25 handle, but I also recognize that there is a lot of noise in this market. Fundamentally speaking, the US dollar should continue to rally against the British pound but what markets “should do” and what they actually do are quite often two different things and therefore not something that you should be paid attention to. Ultimately, this is a market that I think continues to be noisy to say the least.