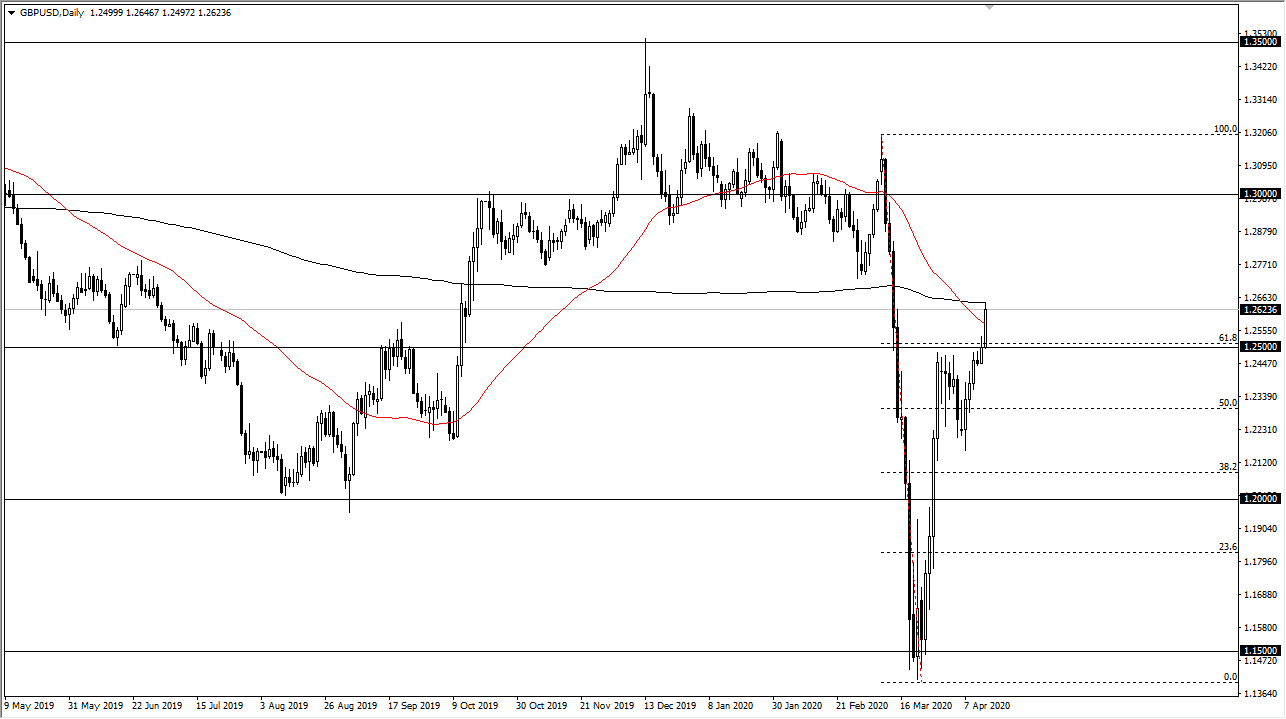

The British pound rallied significantly during the trading session on Tuesday, reaching towards the 200 day EMA which of course is a large, round, psychologically significant figure. At this point, longer-term traders will be looking at this as a potential selling opportunity, so it is worth paying attention to. However, if we break above there on a daily close, it’s very likely that this market continues to go to the upside.

The 1.25 level underneath is significant support, as it was significant resistance previously. At this point, it’s likely that we could get a little bit of a pullback, if for no other reason than to build up enough pressure to finally break above the 200 day EMA. If that happens, then the market is likely to go looking towards 1.2750 level above, and then possibly the 1.30 level after that which of course will bring in a lot of attention. At this point, would be completely retracing the entire move, which as ridiculous as it would look, at this point anything is possible given the way the markets have been behaving.

Keep in mind that the British pound seems to be defying gravity, so it’s difficult to short this market but we are without a doubt overbought at this point. The length of the candle is rather bullish, so if we break above that 200 day EMA it’s very possible that we may continue to send this market even higher. Underneath, if we were to break down below the 1.25 handle, the market is likely to go down to the 1.2250 level. All things being equal, that is an area where there should be a ton of buying pressure. If we were to break down below there it would kill the uptrend.

All things being equal, the British economy is going to come to a standstill, so ultimately the British pound will probably get hammered but at this point it continues to rally based upon the Federal Reserve and it’s flooding of the world with US dollars in general. All things being equal, I do think that we need a pullback to say the least, as things have gotten a bit out of hand. Ultimately, as ridiculous as the move has been, you can’t fight this move very easily at this point. With that, the 200 day EMA and which side of that indicator we close will probably determine where we go next.