Despite the negative results of the US Labor Department report, which confirmed that the American labor market began to suffer from the rapid spread of the Coronavirus, to the point where the US states became the top country on the list of the most affected by the epidemic. In the beginning of this week’s trading, the EUR/USD pair continued its downward correction, as it retreated to the 1.0768 support, before settling around the 1.0835 level at the time of writing. European economic releases are still showing negative results, as a natural reaction to the devastating effects of Corunavirus. The most recent was data from the German statistics agency, Destatis, suggesting that German factory orders fell at a slower pace than expected in February due to strong domestic demand as the initial impact of the coronary virus epidemic was weak.

Factory orders in Germany fell -1.4% on a monthly basis in February after rising by a revised 4.8 % in January. Orders were expected to decrease by -2.5% after initially decreasing by 5.5%. Domestic orders grew 1.7%, while foreign demand fell 3.6% in February compared to the previous month. New orders from the Eurozone decreased by 5%, and requests from other countries decreased by 2.7%.

The German Ministry of Economy said that requests declined in March and April due to the global economic shock caused by coronavirus or Covid-19.

Along the same path, Eurozone investor confidence fell to a record low in April, as the coronavirus spread across the globe, forcing many countries to enforce closings, as evident in a survey data from Sentix, a behavioral research firm.

The investor confidence index decreased by 25.8 points, to reach an all-time low of -42.9. Economists had expected a reading of -30.3. "Without exception, all regions of the world are in deep recession," Sentix said. "Never before has the assessment of the current situation collapsed sharply in all regions of the world within one month," the report added. "A rapid V-shaped recovery is unlikely".

The survey was conducted between April 2 and 4 among 1173 participants, including 268 institutions. The main index remained in negative territory for the second month in a row. The survey's current status index fell to a record low -66 from -14.3 in March. Sentex said the monthly decline of 51.75 points was a record high since the start of data collection in 2003.

Sentix said that the situation is much worse than it was in 2009, and that economic expectations so far underestimate the process of deflation. The recession will go deeper and longer! Sentix added that the Eurozone should prepare itself for a severe economic and social test. On the other hand, the expectations measure rose to -15.8 from -20 in the previous month. The investor confidence index for Germany fell to a reading of -36, its lowest level since March 2009. The current situation index fell to -59, its weakest level since May 2009. The expectations measure rose to -9 from -20.5.

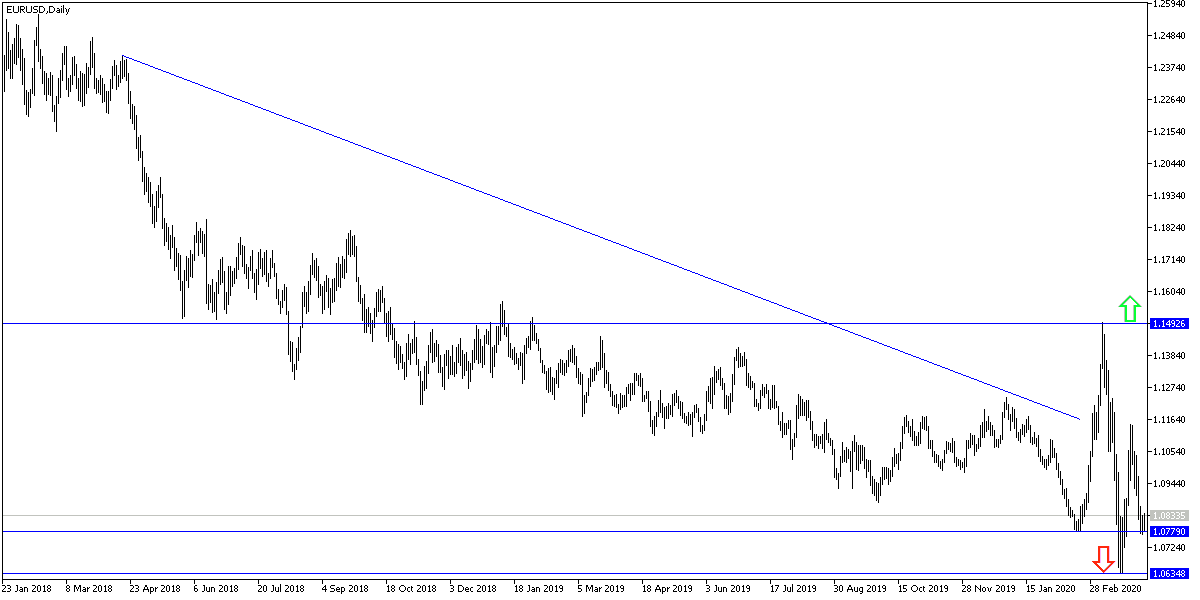

According to technical analysis: Bears are still stronger in controlling the EUR/USD, especially with its stability below the 1.0800 psychological. The general trend is still downward and it is expected that selling will push the pair towards lower support levels reaching 1.0740, 1.0680 and 1.0590, respectively. As I mentioned before, I now stress that there may be an opportunity for an upward correction if the pair manages to reach towards the 1.1000 psychological resistance again.

As for the economic calendar data: the French trade balance and German industrial production will be announced. From the United States of America, job opportunities will be announced.